Overview:

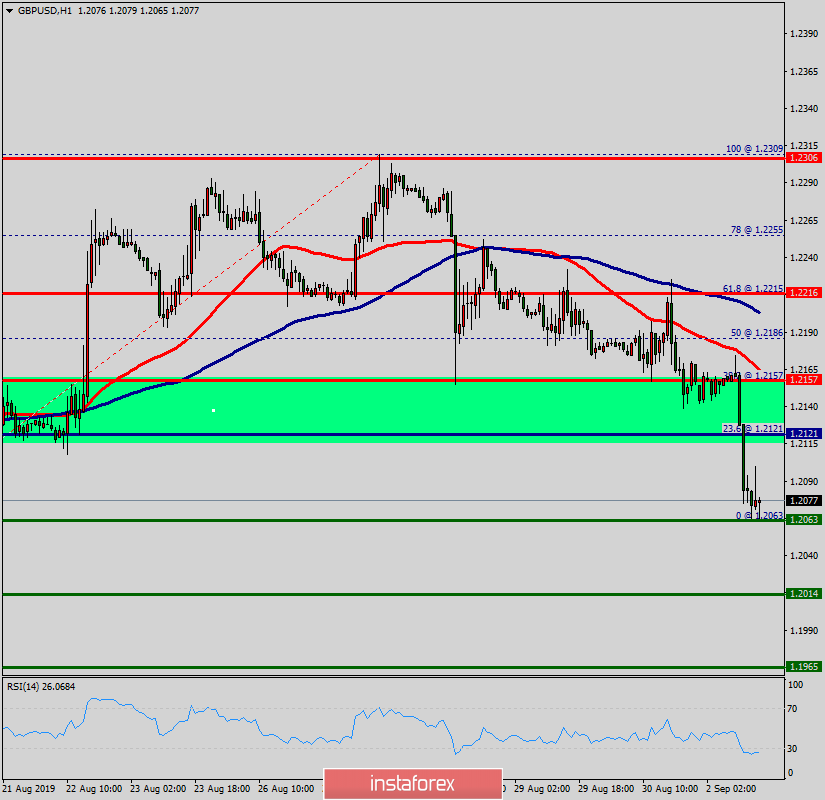

In the 1-hour time frame, the pivot point of GBP/USD pair set at the price of 1.2121.

The pair is trading below its pivot point. It is likely to trade in a lower range as long as it remains below the pivot point.

The bias remains bearish in nearest term testing 1.2063 and 1.2014. Immediate resistance is seen around 1.2121.

A daily closure below 1.2121 allows the pair to make a quick beairhs movement towards the next supports levels of 1.2063 and 1.2014. However, traders should watch for any signs of bullish rejection that occur around 1.2157.

Please notice that this scenario will be invalidated if the price reverses above the wave 2 lower at the level of 1.2157.

A break of that level of 1.2157 will move the pair further upwards to 1.2306 in order to test the double top.

Trading recommnadtions:

- Bearish outlook remains the same, as long as the 100 EMA is pointing to the downside.

- The market will indicate a bearish opportunity below the strong pivot point of 1.2121.

- Sell deals are recommended below the level of 1.2121 with the first target at 1.2063. If the trend breaks the support level of 1.2063, the pair is likely to move downwards continuing the bearish trend development to the level 1.2014.