According to a report by the U.S. Department of Commerce, Americans' personal expenses increased by 0.6% in July 2019 compared in June. This certainly supports the economy that it is suffering from the deteriorating situation in the manufacturing sector and the aggravation of trade conflicts. Economists had forecast growth of only 0.5%.

The recovery in US price growth is also worth noting, which continued to rise due to strong consumer spending. This is a good signal for the Federal Reserve System, which is increasingly leaning toward a policy of low interest rates amid a slowdown in economic growth.

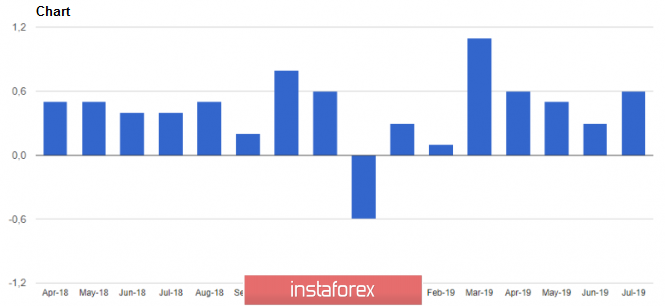

According to the U.S. Department of Commerce, the PCE Private Consumption Price Index in July of this year increased by 0.21% compared to the previous month and increased by 1.38% in July last year. The base index, which does not take into account volatile categories, increased by 0.18% in July compared with June and increased by 1.58% compared to the same period of the previous year. Economists had expected the base index to grow by 0.2% compared to June.

The good news on Chicago PMI Procurement Managers Index also supported the US dollar this afternoon. According to data, the Chicago business barometer in rose to 50.4 points in August 2019, returning to the mark of 50 points, which indicates the restoration of activity. Economists had expected the index to reach 47.5 points.

However, the US household sentiment worsened in August. This was mainly due to rising tensions over the US-China trade war. According to the University of Michigan, the final August consumer sentiment index fell 8.6 points to 89.8 points. Economists had expected the index to reach 92.1 points in August. The most negative factors were import duties.

The American president did not ignore the sharp drop in risky assets on Friday and criticizing the committee once again. Donald Trump tweeted that the euro is falling against the US dollar as crazy, and the Fed is not doing anything. The fall of the euro gives the EU a great advantage in export and production as it makes goods on the world market more affordable.

Trump also pointed out that if the Fed cut rates, it would lead to one of the largest stock market gains in a long time.

As for trade relations, the US president made it clear that only those companies that produce their goods outside the United States will suffer from duties and a new package of which will start in early September.

Looking at the technical picture, the EUR/USD pair continues its bearish trend as many market participants expect the European Central Bank to lower interest rates at its meeting on September 12. The task of the sellers is a new low in the area of 1.0950 and a breakthrough will provide the bears with a new impetus in the areas of 1.0920 and 1.0870.

USD/CAD pair

The Canadian dollar temporarily strengthened against the US dollar after growth in Canadian GDP in the second quarter of this year, but like a number of other world currencies, it lost ground at the end of the day. Export growth was quite high, which offset the drop in company investment and weak household spending. According to the data, Canadian GDP immediately grew by 3.7% in the second quarter of this year, amounting to 2.085 trillion Canadian dollars. Economists expected Canada's economy to grow 3% in the second quarter.