Overview:

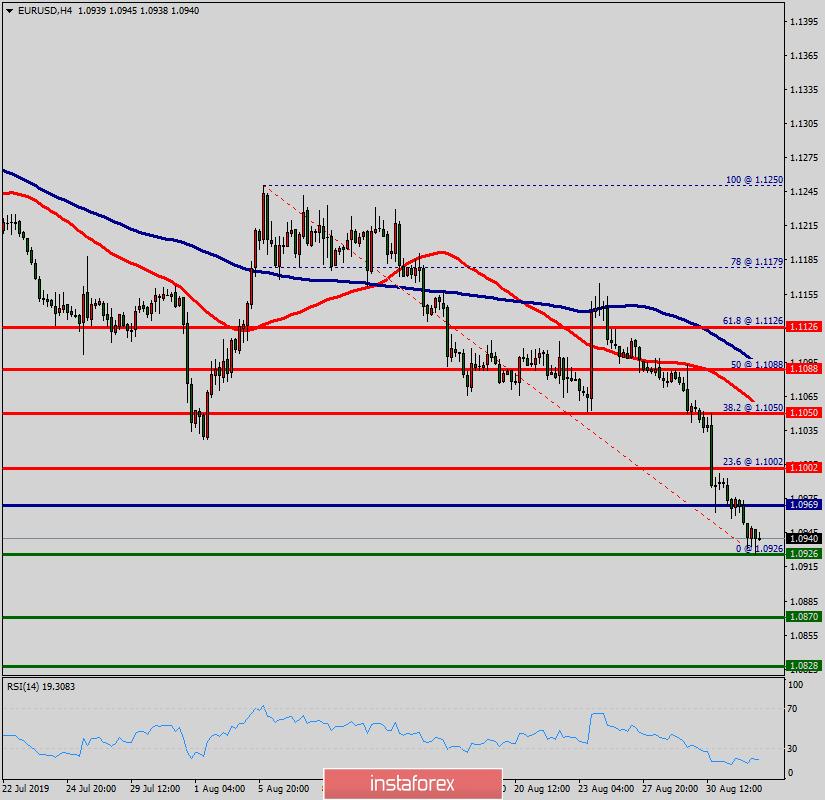

The EUR/USD pair continues to move downwards from the level of 1.1050. Yesterday, the pair dropped from the level of 1.1050 to the bottom around 1.0926.

The first resistance level is seen at 1.1002 followed by 1.1050, while daily support 1 is seen at 1.0870.

The RSI starts signaling a downward trend, as the trend is still showing strength above the moving average (100) and (50). Thus, the market is indicating a bearish opportunity below 1.1002.

The price is in a bearish channel now. Amid the previous events, the pair is still in a downtrend Because the price spot of 1.1002 remains a significant resistance zone.

Therefore, a possibility that the EUR/USD pair will have downside momentum is rather convincing and the structure of a fall does not look corrective.

In order to indicate a bearish opportunity below 1.1002, sell below 1.1002 with the first targets at 1.0870 and 1.0828

However, the stop loss should be located above the level of 1.1050.