The results of the September meeting of the Reserve Bank of Australia had a weak impact on the AUD/USD pair. The regulator continues to gently prepare traders for the next round of interest rate cuts, although this step is largely taken into account in the current quotes. Of course, another reminder that the central bank is ready to follow the path of easing monetary policy exerted great pressure on the Australian dollar – "Aussie" fell to the level of 0.6689, updating the three-week low. But at the start of the European session, the pair returned to its previous positions, as if today's meeting did not exist. Moreover, the AUD/USD bulls even show character, taking the pair to the middle of the 67th figure. But by and large, these price fluctuations are comparable to market noise – the pair is still trading within a wide-range flat in anticipation of powerful information drivers.

After the July meeting of the Reserve Bank of New Zealand, at which the regulator lowered the interest rate by 50 basis points at once, the traders of the AUD/USD pair received a kind of "vaccination" against shocks. Indeed, in the first days after this meeting, there were rumors on the market that the members of the RBA will follow the example of their New Zealand counterparts, resorting to aggressive measures to ease monetary policy. Therefore, when the Australian Central Bank announces its intention to reduce the rate by 25 points, and even then – under certain conditions, the market calmly perceives this information. A similar situation exists today. According to the text of the accompanying statement, the RBA "if necessary" will resort to reducing the interest rate – "to maintain sustainable economic growth."

It is worth noting that in the context of this formulation, key macroeconomic releases will play a particularly important role for the pair in the near future. If data on inflation, the labor market (and especially the level of wages) and the economy as a whole will come out in the "green zone", the probability of a wait-and-see position will grow. Conversely, if the main indicators show a slowdown, the Australian regulator is almost 100 percent likely to resort to a third rate cut for the current year.

That is why tomorrow's data on the growth of Australia's GDP may cause a stronger market reaction to today's price fluctuations. The September meeting of the RBA was, in fact, a passing one, but at the same time the regulator voiced a fairly clear message: "there will be no improvements – we will take measures." So tomorrow's numbers may support the Aussie, or, conversely, send it down to the middle of the 66th figure.

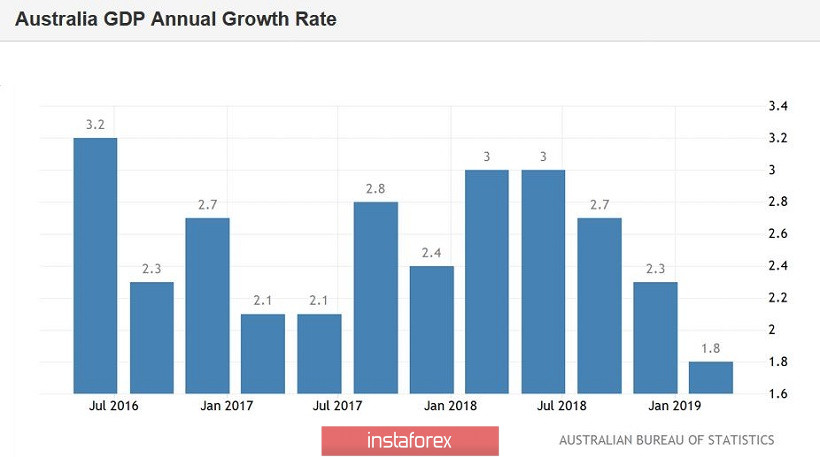

According to preliminary forecasts, the data on the growth of the Australian economy will disappoint investors. Let me remind you that for the past four quarters, GDP has been declining – if in the first quarter of last year, this figure came out at the level of 3.2%, in the first quarter of this year, the indicator grew by only 1.8%. Tomorrow, we will learn the data on the growth of the country's economy for the second quarter of 2019. Experts believe that the key indicator will continue its downward trend, falling to the level of 1.4%. If these forecasts are justified, the Australian will be under strong pressure, because in this case, the Australian economy will beat the long-term anti-record.

Thus, today's price correction should be treated with caution. The Australian is still vulnerable and tomorrow's data could easily send the AUD/USD pair to weekly lows. From the external fundamental background, one should not wait for support. Recent rumors about the prospects for talks between the US and China are grim. At the moment, the parties cannot even agree and organize another meeting, not to mention the resolution of more complex issues. Donald Trump's indicative optimism is not substantiated by anything: Beijing and Washington are still on opposite sides of the barricades, and the latest mutual tariff "strikes" eloquently confirms this fact. In other words, "Aussie" may receive temporary support from statistics tomorrow (if only the GDP growth rate will be better than the forecast values), but it is unlikely that this fact will be able to reverse the southern trend. This means that after the completion of the (possible) correction of AUD/USD, it is advisable to consider short positions for the pair, with the main price target of 0.6620.

From the technical point of view, the pair is under significant pressure, and on all "higher" timeframes. On H4, D1, W1, and MN, the pair is between the middle and lower lines of the Bollinger Bands indicator, which also indicates the priority of the southern movement. The pair shows a bright bearish trend, which is confirmed by the main trend indicators – Bollinger Bands and Ichimoku. Thus, the Ichimoku indicator on the daily chart formed its strongest bearish signal "Parade of Lines", in which all the lines of the indicator are above the price chart, thereby demonstrating the pressure on the pair.

In turn, the lines of the Bollinger Bands indicator show a narrowed channel – this is also a strong signal for the southern direction. Additional confirmation of the bearish scenario is the oversold MACD and Stochastic oscillators. To determine the main goal of the southern movement, let's move to the monthly timeframe: here we focus on the bottom line of the Bollinger Bands – the price is 0.6620.