The Brent and WTI markets are designed in such a way that each army of opponents has its own titanium behind it. The Bears rely on the United States with its accelerated production growth and Donald Trump arguing that lower prices are good for the American consumer. The bulls are for Saudi Arabia, which requires $80 per barrel of North Korean for a balanced budget. There is no black or white in the oil market, similar in life. here are others. Which direction the largest consumers - China and another titan, Russia - moves to depends on which opponent will control the situation.

While in terms of production, the oil market seemed balanced most of August (US supplies were blocked by the OPEC production cut agreement), a nearly 6% drop in prices was due to lower global demand. Since September 1, China and the US have increased trade duties on imports, which could slow down the Chinese economy by 0.8 pp in 2020. Oxford Economics estimates that economic growth will fall to 5.7% in the fourth quarter and remain so throughout the next year. The problems of the largest oil consumer make Brent and WTI bulls retreat.

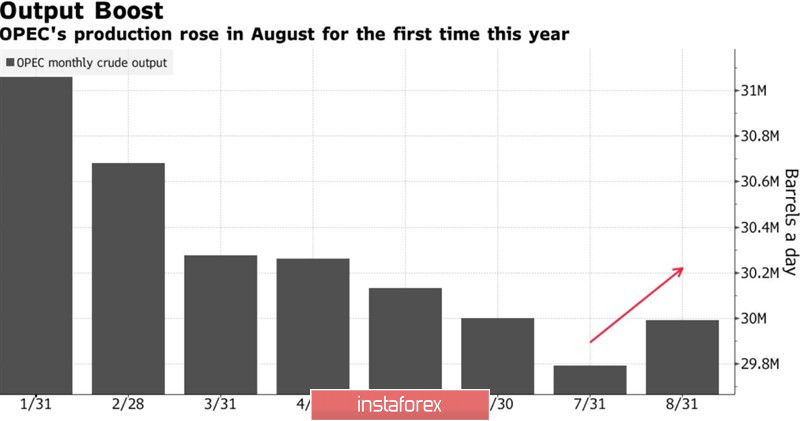

The situation is beginning to look awful given the first increase in OPEC production in August. Bloomberg experts estimate the figure to be 29.99million b/s. While Saudi Arabia is cutting production, other countries including Iran, Nigeria, and Russia are stepping up. In particular, the Russian Federation downloaded 11,294 million b/s at the end of the summer, which is the highest number since March.

OPEC Oil Production Dynamics

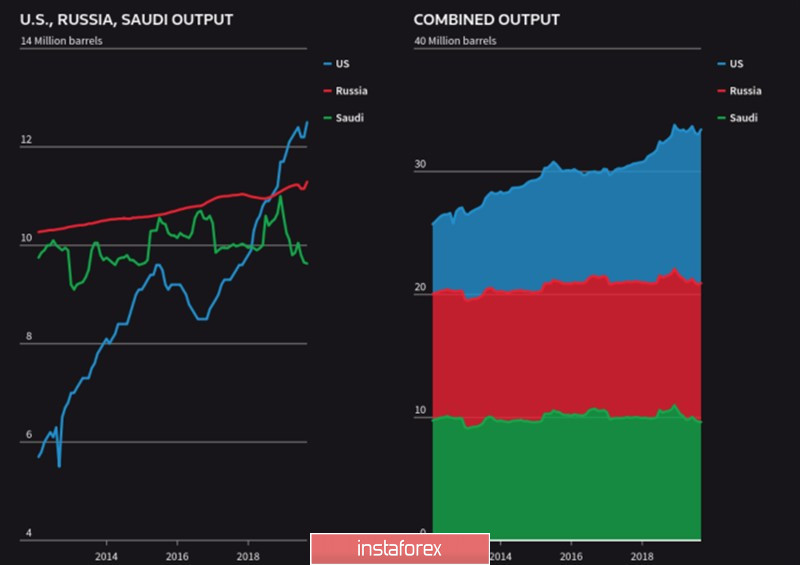

Dynamics of oil production by the largest producers.

Thus, both Beijing and Moscow do not support the efforts of Riyadh and the weakness of titanium, which stands behind the buyers that lead to the fact that the market is controlled by "bears". According to the consensus forecast of the Wall Street Journal experts, Saudi Arabia's GDP will grow by 1.4% in 2019, and at the end of last year, their figure was + 2.2%. Capital Economics so far say that the economy of OPEC's largest member will expand by a modest 0.3% under the influence of low prices for black gold.

Pressure on oil is also exerted by the growth of the USD index. Brent and WTI are traded in dollars, hence, the strengthening of the American currency is always considered a "bearish" factor for both grades. Strong US statistics, confidence in their victory in the trade war with China, as well as precarious positions in the European economy pushes the USD index to the north. The proponents of the US dollar are not embarrassed by the Fed's desire to loosen monetary policy, or by Donald Trump's verbal interventions, which have long criticized the Fed's monetary policy and too strong US currency.

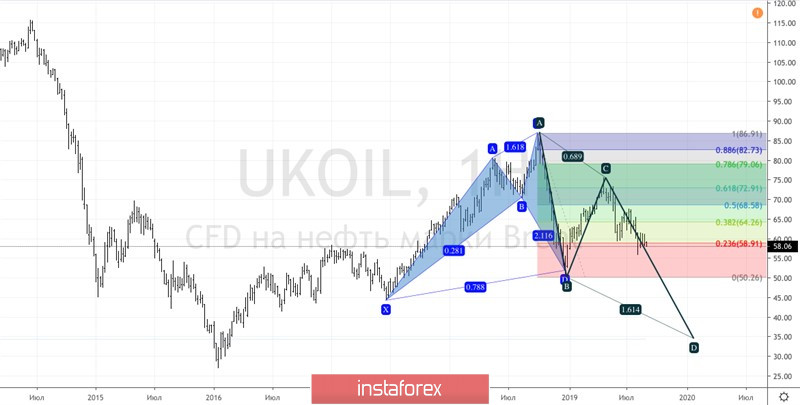

Technically, if the Brent bears manage to hold $58.9 per barrel (23.6% of the CD wave of the "Shark" blue pattern) and rewrite the December low, activating the AB = CD model will increase the risks of achieving its target by 161.8%. It corresponds around USD 34.5.

Brent daily chart