EURUSD has increased a little in the morning, but remains under selling pressure as long as it is trapped below the 1.1111 level. Technically, the pair could drop further and it could reach fresh new lows if the US Dollar Index will advance further in the upcoming period.

It remains to see what will happen because if the dollar index drops again, EUR/USD will increase and maybe it will rebound towards the 1.1200 psychological level.

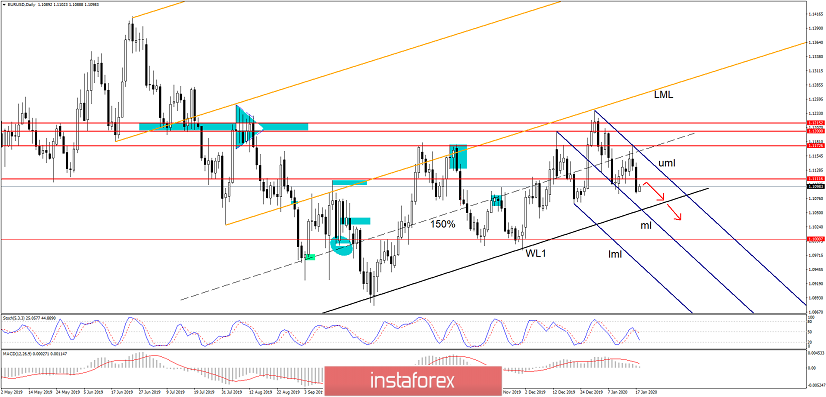

EUR/USD is trading within an ascending channel on the daily chart, it has increased between the lower median line (LML) and the first warning line (WL1). So, only a valid breakdown from this ascending channel will open the door for a larger drop in the upcoming period.

You can see that the pair has failed to retest the lower median line (LML) signalling overbought conditions and a potential corrective movement, at least till the warning line (WL1). The false breakout above the 1.1200 - 1.1215 and the bearish engulfing has signaled that the upside movement could be completed.

The outlook is bearish in the short term as long as the price stays below the 1.1111 level (support turned into resistance) and as long as the pair is traded inside the descending pitchfork (dark blue), below the upper median line (uml). EUR/USD was rejected by the upper median line (uml) and now is somehow expected to drop towards the median line (ml) again. An important downside movement could be invalidated only by a false breakdown of the warning line (WL1) and by a valid breakout of the upper median line (uml) of the descending pitchfork, if the price escapes from the pitchfork's body.

Trading Recommendation

Maybe it would be better if you wait for a valid breakdown of the first warning line (WL1), ascending channel's support, before you go short on this pair, even if it is under bearish pressure after the bearish engulfing and after the retest / rejection from the upper median line (uml) of the descending pitchfork.

However, a retest of the 1.1111 level and maybe a false breakout above this resistance could give you a good chance to go short as well, but only if the price continues to stay below the upper median line (uml). If you want to sell it from right below the 1.1111 level, you should consider putting a Stop Loss right above the former high from 1.1172. The downside targets could be at 1.1000 and at the 1.0879 lower low.