Building on the strength of the American economy, Donald Trump continues to remake the world. He managed to conclude new trade agreements with Mexico, Canada, Japan and China and intends to take on the EU. At the same time, the successes or failures of the American President become a catalyst for changes in the USD/JPY quotes. Escalating conflicts with China and Iran led to an increase in demand for safe-haven assets. On the contrary, the stabilization of the situation in the Middle East and the ceasefire in the US-China trade war put serious pressure on the yen.

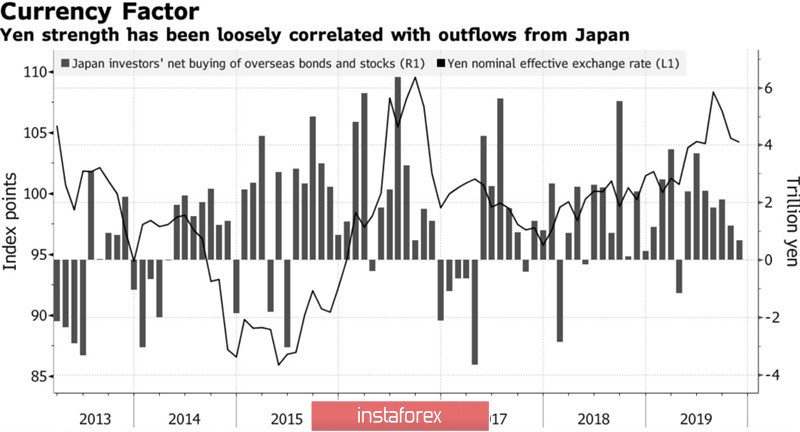

JP Morgan notes that in 2019, the USD/JPY pair was trading in the narrowest range since 1980. However, we cannot say that it was a question of permanent consolidation. Downward trends were replaced by upward trends and vice versa. The same is true in January: the strong start of the yen due to the conflict in the Middle East was replaced by its serious weakening against the dollar against the background of the White House's reluctance to start a war and the signing of a trade agreement by Washington and Beijing. As a result, global risk appetite increased, and Japanese investors rushed to buy foreign assets. Interestingly, the stronger the yen, the more they want to increase the share of foreign securities in their portfolios. So, in 2019, their net purchases exceeded £20 trillion, including due to the fall in USD/JPY quotes.

Dynamics of USD/JPY and purchases of foreign securities by Japanese investors

In the week of January 24, the yen and the euro are claimed to be the most interesting currency. Meetings of the Bank of Japan and the ECB, the release of data on German and European business activity, the world economic forum in Davos, where there is a chance to hear Donald Trump's comments about the harm of a strong dollar, as well as the US Senate's consideration of the impeachment case, attract investors' interest in these monetary units.

And the European Central Bank and its colleagues in Tokyo are increasingly talking about the harm of negative rates. According to 24 of 41 Reuters experts, such a policy will not help either the economy or prices. 28 of 42 economists forecast BOJ monetary restriction in 2021 or later. At the next meeting, the regulator is likely to raise forecasts for economic growth thanks to the $120 billion fiscal stimuli, which should be seen as a "bullish" factor for the yen.

As for the ECB, Christine Lagarde's intention to be closer to the people may raise one important question. According to Europeans, the prices of food and other goods are growing by leaps and bounds, official statistics show the opposite. Perhaps it's time to change the CPI calculation base? Any manifestations of "hawkish" rhetoric will become a catalyst for the strengthening of the euro, as, indeed, the positive from the business activity of Germany and the eurozone.

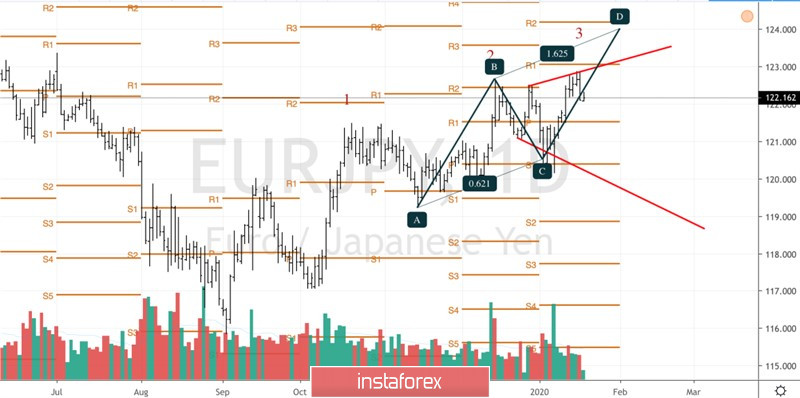

Technically, a combination of two reversal patterns - "Three Indians" and "Expanding Wedge" - can be formed on the daily EUR/JPY chart. At the same time, the drop in quotes below support by 121.5 (the Pivot level) will allow us to talk about the transition of the initiative into the hands of "bears". On the contrary, updating the January maximum will increase the risks of implementing the target by 161.8% on the AB=CD model.

EUR/JPY, the daily chart