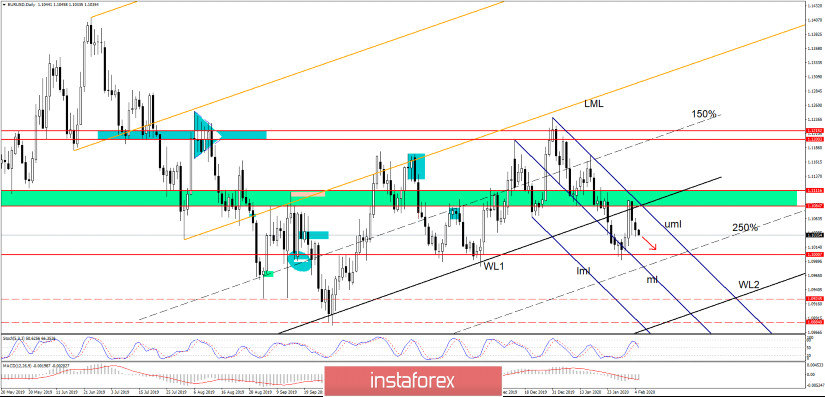

EUR/USD is trading in the red after the false breakout above the 1.1084 static resistance and above the first warning line (WL1) of the previous ascending pitchfork. The price has failed to reach the upper median line (uml) of the descending pitchfork signaling selling pressure, the next downside target will be at the 1.1000 psychological level.

The USD is very strong again as the Dollar Index has managed to rebound from 97.38 and now is trading right above the 98.00 psychological level. EUR/USD is expected to reach new lows if the USDX jumps above the 98.18 previous high.

EUR/USD has come back only to retest the broken warning line (WL1), ascending channel's support, and now it seems determined to reach at least the 1.1 critical support. The outlook is bearish as long as the quote is trapped within the descending pitchfork's body, below the upper median line (uml).

The price is somehow expected to be attracted by the 250% Fibonacci line as well, EUR/USD has failed to reach this potential dynamic support at the first attempt. I believe that a valid breakdown below the 250% line and below the 1.1 psychological level will signal a drop towards 1.0924 and towards the second warning line (WL1).

We could have another leg higher only if the price is rejected from the 1.1 level and from the 250% dynamic support. A Bullish Engulfing or a Pin Bar followed by a valid breakout above the upper median line (uml) could give birth to an important upside movement.

- Fundamental Analysis

The ADP Non-Farm Employment Change is expected around 157K, much below the 202K in the previous reading period, while the ISM Non-Manufacturing PMI could increase from 55.0 to 55.1 points. ECB President Lagarde's speech could bring some volatility as well today, so you should keep an eye on the economic calendar because the fundamentals will drive EUR/USD in the short term.

EUR/USD should drop further if the US data comes better than expected, while some poor metrics could send the pair higher again.

- Trading Tips

Maybe it would be better to wait for a valid breakdown below the 1.1 level to be sure that EUR/USD will resume the downside movement because a false breakdown, a reversal pattern, will invalidate a larger drop and it could bring a buying opportunity. If you want to open a short position below the 1.1000 level, you should place a Stop Loss above the 1.1095 high.

A long opportunity could be confirmed only after a rejection from the 1.1 and after a valid breakout above the upper median line (uml).