Britain withdrew from the EU. Brexit took place, but it seems that everything is just the beginning. London and Brussels have to solve a lot of economic problems and contradictions, which will have a negative impact on the exchange rates of the pound and the single currency for a long time.

The pathetic statements of B. Johnson, the Prime Minister of the UK so far, that the country will manage without the EU and that it will follow its standards, only increase the tension between "foggy Albion" and continental Europe. The first problems have already begun to appear in the field of fisheries, as this is connected with the territorial waters of the EU and Britain. On this wave, fishermen have already begun to lose profits.

The hype around Britain's "farewell" finally ended, and, as they say, harsh everyday life began. Given the complexity of the upcoming trade contradictions, we believe that the pound will be under strong pressure due to the uncertainty of the outcome of negotiations on mutual trade between the European Union and Britain, the economy of the latter may receive blow after blow, which will affect the monetary policy of the Bank of England, which may be forced not only do not keep the current level of interest rates, but even move to lower them to stimulate the national economy in the face of uncertain prospects for transition rioda.

We also expect that this uncertainty will adversely affect the exchange rate of the single currency, which is still not in its best shape amid weak economic growth in the eurozone and regular threats from D. Trump about the introduction of increased duties on European car exports to the States.

Given the general background, we believe that the euro and pound will consolidate at best over wide ranges around current price levels.

But back to the main topic from the beginning of the new year - the Chinese coronavirus. On Tuesday, the tension in the markets eased, as it becomes clear that the risks of a pandemic are reduced, because the Chinese authorities are able to keep this attack under control. In addition, the Central Bank of China will pour significant financial resources into supporting the national economy. It also seems that the Fed will not stand aside, which continues the hidden program of QE and the ECB. On this wave on Tuesday, demand for risky assets sharply increased, which was reflected in the rise of stock indices to Europe, North America and Asia. However, defensive assets, on the contrary, were under pressure. Gold quotes have declined sharply as well as the yen which has also fallen against the dollar. On the other hand, yields on US Treasury bonds have risen sharply.

It's too early, of course, to say that a turning point has occurred in the market sentiment, but we can expect continued growth in stock indices and a weakening demand for defensive assets, that is, if investors no longer see apocalyptic headlines related to coronavirus in the news feeds.

Forecast of the day:

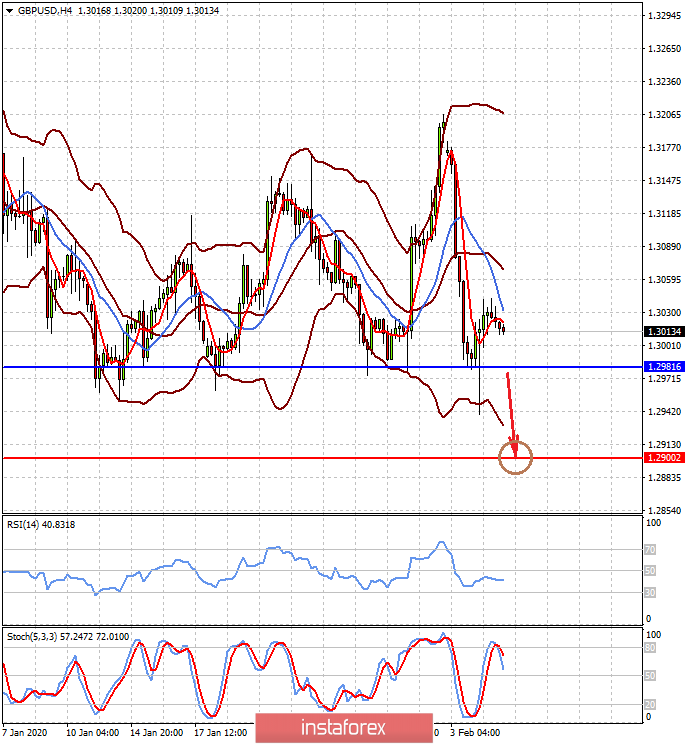

GBP/USD is trading in the range 1.2900-1.3225. We believe that the pair can continue to decline to the level of 1.2900 if it breaks through the level of 1.2980.

Gold is trading below the level of 1562.25. Maintaining positive market sentiment may trigger a new wave of price reductions. In this case, it will turn around and rush to the level of 1539.00, if it does not rise above the level of 1562.25.