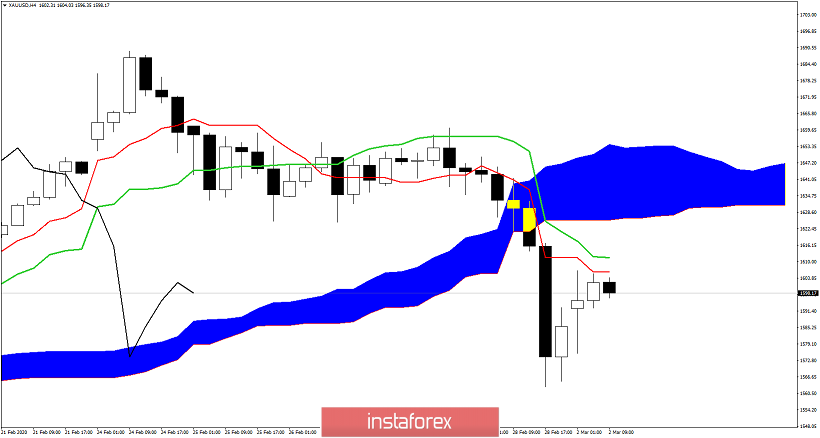

Gold price has reversed strongly to the upside from our target area of $1,600-$1,620 after bottoming at our second target of $1,560. Price is still below cloud resistance and has still a lot of obstacles to overcome in order to resume the uptrend.

Gold price remains inside its longer-term bullish channel. Price has pulled back towards the previous consolidation area and is showing reversal signs. This could be just a short-term bounce and we might see another sell off towards the lower channel boundary. After this correction in Gold price and bounce was justified. Rejection at $1,610-25 resistance area would increase chances of another leg lower towards $1,530. Holding above $1,580-60 is key for the resumption of the up trend.