Economic calendar (Universal time)

Among the significant events of the economic calendar today, we can note:

8:55 index of business activity in the manufacturing sector in Germany;

9:30 index of business activity in the manufacturing sector of the UK;

15:00 index of business activity in the US manufacturing sector.

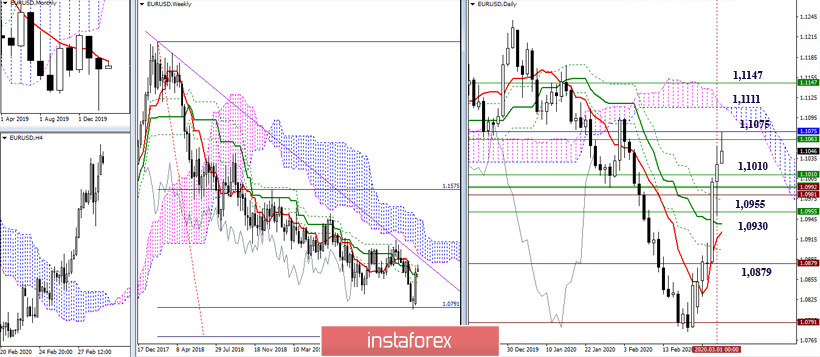

EUR / USD

Players to upgrade managed to prove themselves and closed February with great optimism. Throughout the past week, the bulls were busy trying to leave the emerging full-fledged restoration of the monthly downward trend under a big question. They succeeded. Apparently, the players on the decline in the current situation may be limited to fulfilling the weekly goal of breaking the Ichimoku cloud for a long time according to the first target (1.0791). Even if the upward players take a break in the near future, the opponent is unlikely to quickly change the alignment of forces and expectations. As a result, March has great chances to maintain bullish sentiment and the implementation of new upward prospects. Now, the upward prospects and objectives are the elimination of the weekly dead cross (final line 1.1064), consolidation over the monthly short-term trend (1.1075), a breakdown of the daily cloud (Senkou Span B 1.1111) and the formation of an upward target, as well as testing the strength of the weekly cloud Ichimoku (currently it is the area 1.1147 - 1.1370). To restore the players' positions for lowering, the main difficulty now is a fairly wide support zone, combining the levels of the weekly and daily crosses of Ichimoku, as well as historical levels. In this direction, support 1.1010 - 1,0980 - 1.0955 - 1.0930 - 1.0899 can be noted. Under the current conditions, it will be possible to return to the consideration of bearish opportunities only after a reliable return of the pair at 1.0879 (historical level).

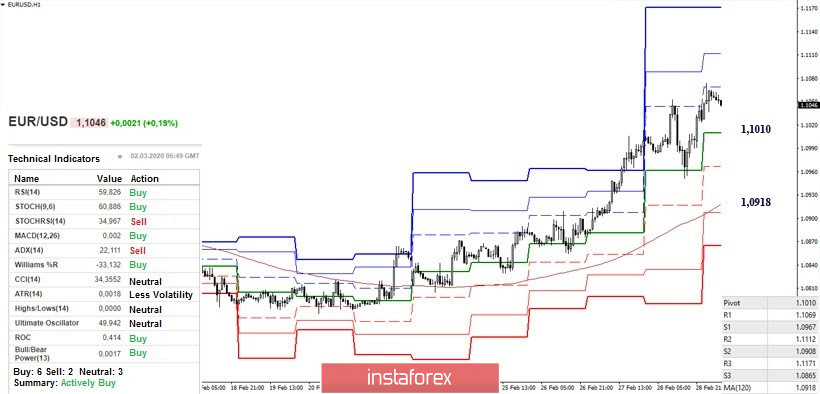

At the moment, the advantage in the lower halves remains on the side of the players to increase, who were able to update the maximum of last week after the opening of trading and test the first resistance of the classic Pivot levels (1.1069), then the resistance is located at 1.1112 (R2) and 1.1171 (R3). The origin and development of a downward correction can lead to a couple of important support in the near future - the central Pivot level of the day (1.1010). The loss of the level will allow us to talk about a full downward correction. In this case, the main reference point for H1 will be the weekly long-term trend (1.0918). Today, the nearest support can be noted at 1.0967 (S1).

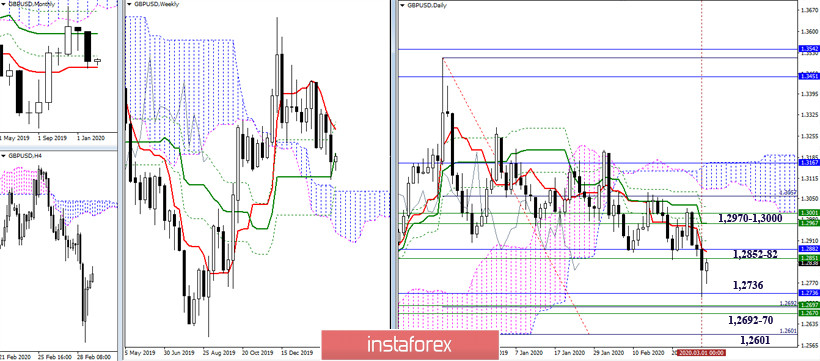

GBP / USD

Last week, the players to decline managed to leave the zone of uncertainty, which developed for a long time within the weekly Tenkan and Fibo Kijun. The weekly result was the execution of a downward correction to support the medium-term trend (1.2736), strengthened by the monthly level (1.2736). Meeting with the support led to the development of lights out. The closest reference points of the current rise is now the accumulation of levels in the region of 1.2851-82 (daily Tenkan + weekly Kijun + monthly Fibo Kijun). Further, resistance will be significant, concentrated in the region of 1.2970 - 1.3000 (final levels of the daily dead cross + weekly Tenkan + Fibo Kijun). Consolidation above will form a full rebound from the weekly medium-term trend and will return the pair to the zone of the last consolidation which will allow to re-examine prospects and plans for strengthening bullish sentiment. At the same time, developing under the indicated resistances will allow you to implement a daily upward correction and begin to implement the decline again. The most secured and significant support zone is now concentrated at 1.2736 (monthly Tenkan) - 1.2692-70 (weekly Senkou Span B + Fibo Kijun + the first target of the daily target for breakdown of the cloud) - 1.2601 (100% daily performance goals).

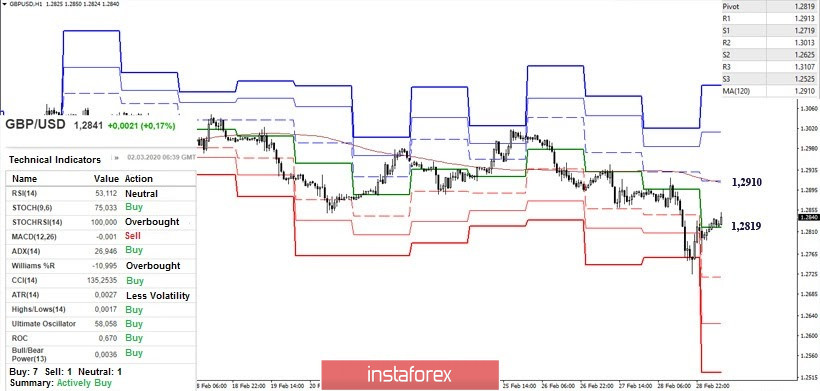

An upward correction on H1, which was outlined after a meeting with strong support for the higher halves, has already managed to cause the players to gain support from most of the analyzed technical indicators and are trying to gain a foothold above the central Pivot level of the day (1.2819). The next important bullish point is now located at 1.2910 (weekly long-term trend). Now, consolidation above can change the current balance of forces and open up new prospects for players to increase. The completion of the upward correction will return the pair to the minimum of the last week (1.2725), strengthened now by the support of the classic Pivot levels S (1.2719). Further, a downward trend may be restored (1.2625 - 1.2525).

Ichimoku Kinko Hyo (9.26.52), Pivot Points (classic), Moving Average (120)