GBP/USD has rallied on the short term as the USD was punished by the USDX's massive drop, but the pair remains under some bearish pressure as long as it is trading below the near-term resistance levels.

The pair is trading at 1.3039 level, much below 1.3199 yesterday's high. It could ddecline significantly again if it closes the gap up. The USD has managed to appreciate a little as the US dollar index has bounced back from a major dynamic support.

- GBP/USD False Breakout Signals Potential Drop

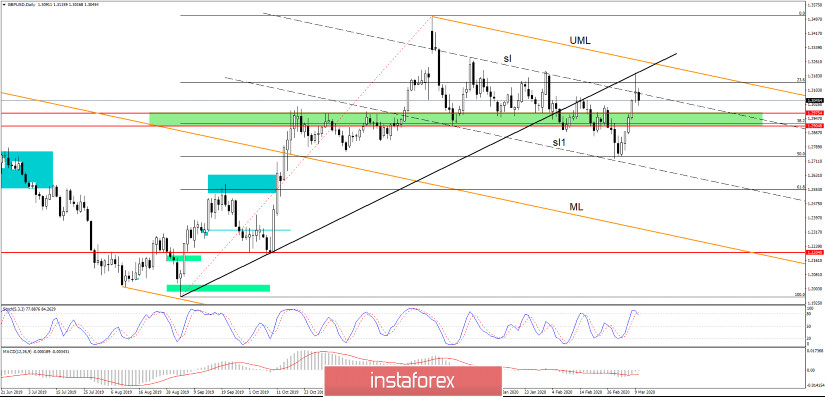

The GBP/USD pair's bounce was natural after the price was rejected by the 50% Fibonacci line and after the bullish engulfing was confirmed. I've said in my previous analysis on GBP/USD that we may have a bullish momentum towards the inside sliding line (sl) after the failure to reach and retest sl1.

GBP/USD is trapped between the inside sliding lines (sl, sl1). A rejection from the channel's upside line could signal another bearish movement. You can see that the price has registered only a false breakout above the upside line and above the 23.6% retracement level, it has retested the uptrend line and it could drop again if it closes yesterday's gap.

- TRADING RECOMMENDATION

It is premature to go short again only after a false breakout above the sliding parallel line (sl), we need a confirmation that the price will drop again. If GBP/USD is rejected by the sliding line (sl), the first target is at the 50% retracement level, while the second target remains at the downside line (sl1).

Technically, the uptrend line retest has validated the breakout and could signal that the pair might have a larger correction in the upcoming period. This scenario will take shape only if the price stays below the 23.6%, below the upper median line (UML) and most important below the sliding line (sl).

A further increase towards fresh new highs will be confirmed after a valid breakout above the upper median line (UML) of the descending pitchfork.