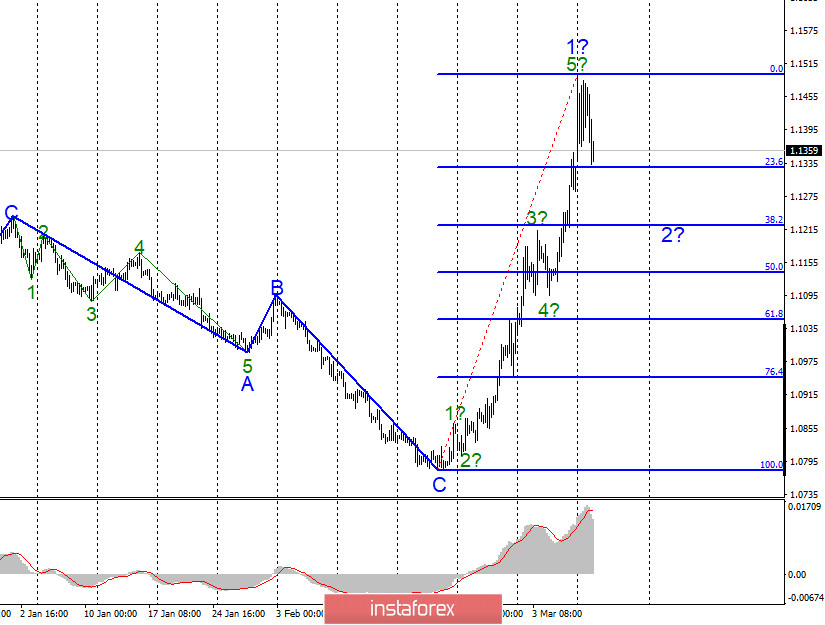

EUR/USD

On March 9, the EUR/USD pair skyrocketed by 170 pips taking into account an early gap. This surge is a vivid example of what is going on in the market. Usually, the euro trades in a daily range of 40-60 pips. However, at the moment, the price movement reaches 100 pips on a daily basis. Today, the pair has already lost around 100 pips suggesting that wave 1 of a new upward trend will be completed and wave 2 will start forming. In this case, the price is likely to continue falling with targets near Fibonacci levels of 38.2% and 50.0%.

Fundamental component:

The EUR/USD pair did not react to the news on March 9. The market was in a state of shock all day. The euro and the pound were rising. However, oil prices collapsed by 30%. The markets were panicking. At the same time, the industrial production in Germany improved for the first time in a while. Though, the markets did not pay attention to the news. Meanwhile, US President Donald Trump announced his intention to lower payroll tax in order to minimize the negative impact of the coronavirus. It is hard to tell whether this move will have a positive effect on the US economy. Moreover, it is only a proposal. Trump is expected to address the Congress and the Senate in the near future in order to consider the possibility of such fiscal easing. Anyway, pressure on the US dollar has decreased today. There are two possible reasons for that. That happened either because Trump proposed to lower payroll tax or because traders did not want to buy the euro any more. However, the coronavirus problem remains. It means that we can expect a new wave of panic in the markets. Eurozone's 4Q GDP data is set for release today. At the moment, the markets clearly do not need more stimulus for active trading.

General conclusion:

The euro-dollar pair supposedly continues the formation of a new upward trend. Based on the current wave count, wave 1 is completed. Thus, it is better to wait for wave 2 to build up and open buy deals after the formation of wave 3. At the same time, wave 3 is likely to be weaker compared to wave 1 and the entire trend, which started on February 20, can make a three-wave pattern.

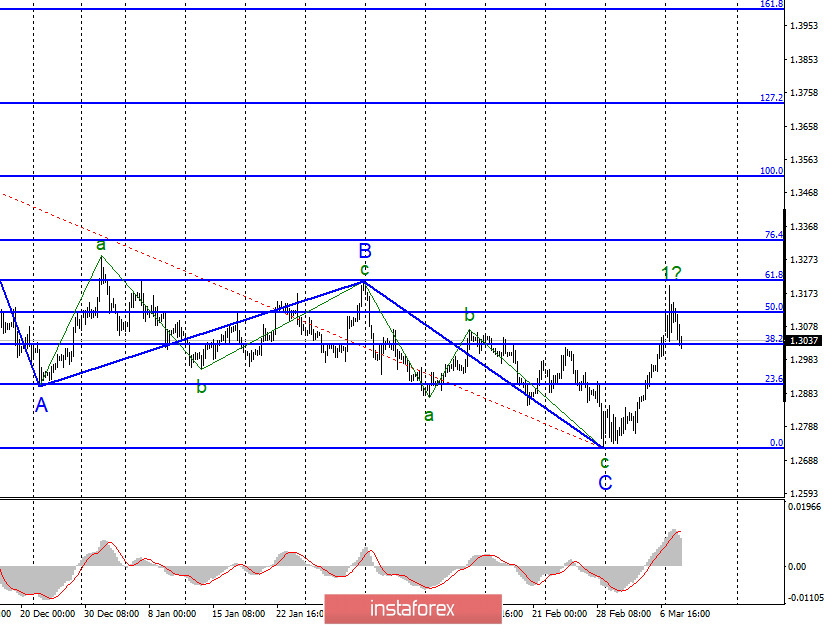

GBP/USD

The GBP/USD pair surged by around 50 pips on March 9. However, the pair pulled back from its early highs yesterday and continued falling today. Thus, we can expect wave 1 of the upward trend to complete formation. In such a case, the price is likely to continue dropping as part of wave 2. At the same time, it is important to remember that the wave pattern can become even more complex at any moment.

Fundamental component:

There was no news for the GBP/USD pair on Monday. Nevertheless, pressure on the dollar has decreased. Thus, the pound-dollar pair is likely to form correctional wave 2. This week's most important news from the UK and the US will be released tomorrow. At the moment, the market is trying to recover after Black Monday.

General conclusion:

The pound-dollar pair has made the current wave even more complicated. Thus, it is better to start trading now, as the situation in the markets is very unstable and shocking. After wave 2 is formed, you can consider buying the pair with targets located near Fibonacci levels of 1.3330 and 1.3513, or 76.4% and 100.0%, on the expectation of wave 3.