Traditionally, oil and dollar has an inverse relationship. When oil becomes expensive, the dollar becomes cheaper, and vice versa. However, Russia's unexpected move to withdraw from the agreement with OPEC in reducing production not only led to the collapse of oil prices, but also to the sudden weakening of the dollar against other major currencies. This clearly demonstrates the dependence of American oil companies on the cost of oil, as after all, they prefer to work on the spot market, concluding contracts for delivery at current prices. This is in contrast with Russia and Saudi Arabia, who sign long-term contracts that specify both prices and volumes in advance, regardless of how oil prices fluctuate. In other words, American companies have a much smaller margin of safety, which means that a sharp drop in oil prices will primarily hit them, just like the blow that happened recently to the United States. Thus, if this decline in oil prices prolongs, then we should expect a new wave of bankruptcies in American oil companies, inevitably leading to a decrease in oil production in the United States, even though the oil balance will not change much globally. Simply put, the supply of oil in the dry balance will be exactly the same, but the share of American oil companies will decrease.

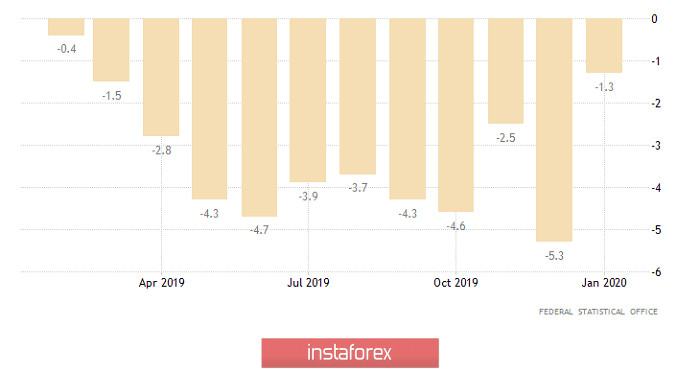

To be honest, the reversal in oil prices is not the only reason why the dollar is strengthening. The current macroeconomic situation also influenced it, as yesterday, data on industrial production in Germany was published. Although it showed some improvements, it still continued to show a decline from -5.3% to -1.3%, which lasted for 15 consecutive months. Meanwhile, European bond yields continue to go down as well, as the yield on 3-month bonds in France fell from -0.627% to -0.668%, and the yield on 6-month bonds fell from -0.628% to -0.672%. The yield on 12-month bonds, on the other hand, increased from -0.642% to -0.716%. Nevertheless, this just indicates that the market is waiting for the European Central Bank to reduce its interest rates.

Industrial production (Germany):

The yield of American debt securities is also going down. The yield on 3-month bills fell from 1.155% to 0.390%, and the yield on 6-month bills fell from 1.01% to 0.40%. Nevertheless, the rates of American securities are at least with a plus sign, not like in Europe's, which is a minus.

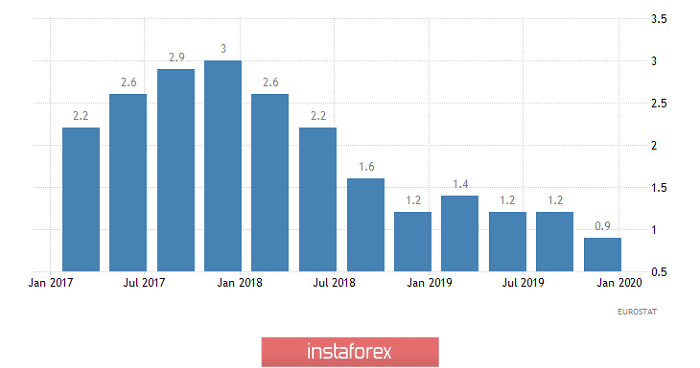

Anyhow, production in the United States will decline, due to the fact that American oil companies are much more dependent on the price of black gold. Meanwhile, everything is unchanged in Europe, especially since the latest estimate of the Eurozone's GDP for the fourth quarter is published today, which should finally confirm the fact that the economic growth rate has slowed from 1.2% to 0.9%, and that the recession is getting closer. In addition, just like in Germany, industrial production in Italy is expected to continue its decline, although it should slow down a bit from -4.3% to -3.2%.

The growth rate of GDP (Europe):

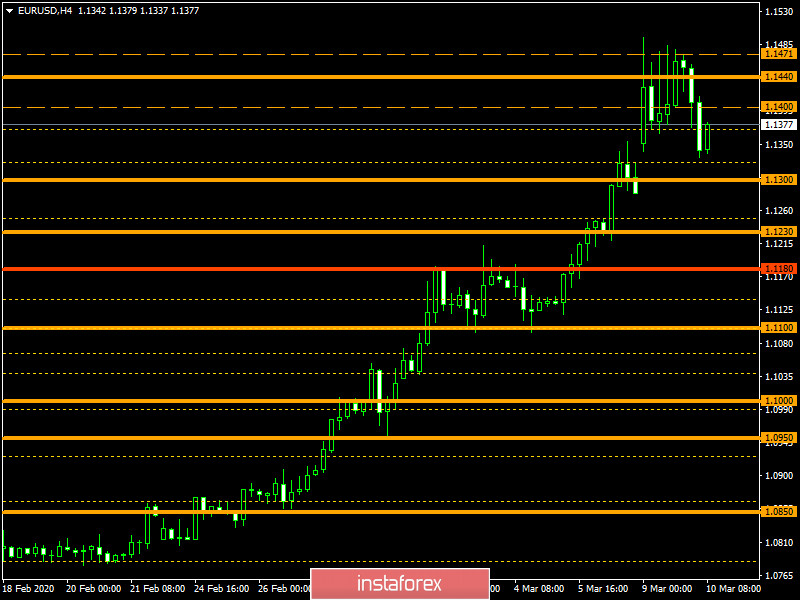

During its recovery process, the EUR/USD pair managed to return to the area of 1.1340, where it slowed down. The recovery process may likely continue towards the level of 1.1300.

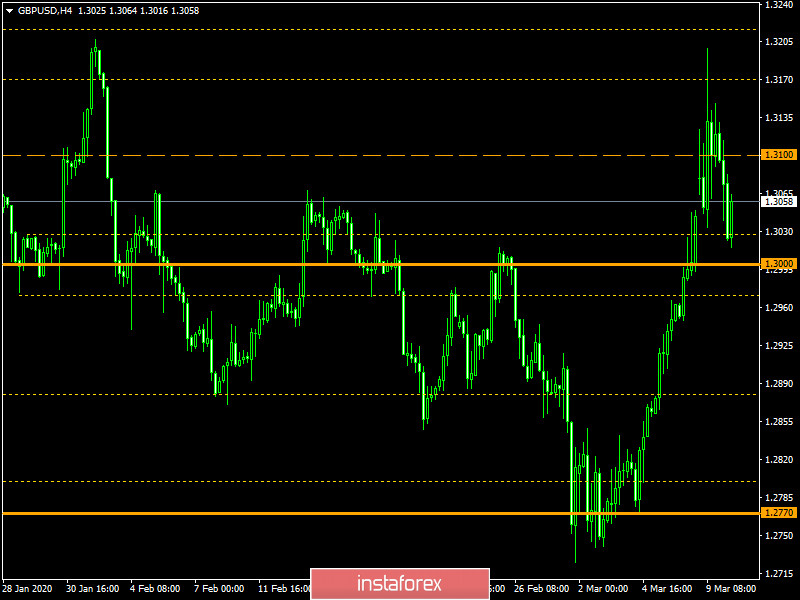

The GBP/USD pair is recovering. The quote has already managed to work out more than 150 points from the peak, and is now relatively close to the control level of 1.3000, where there is a slowdown. If the price fixes below 1.3000, the downward movement will continue, forming a recovery relative to the entire corrective course of the past week.