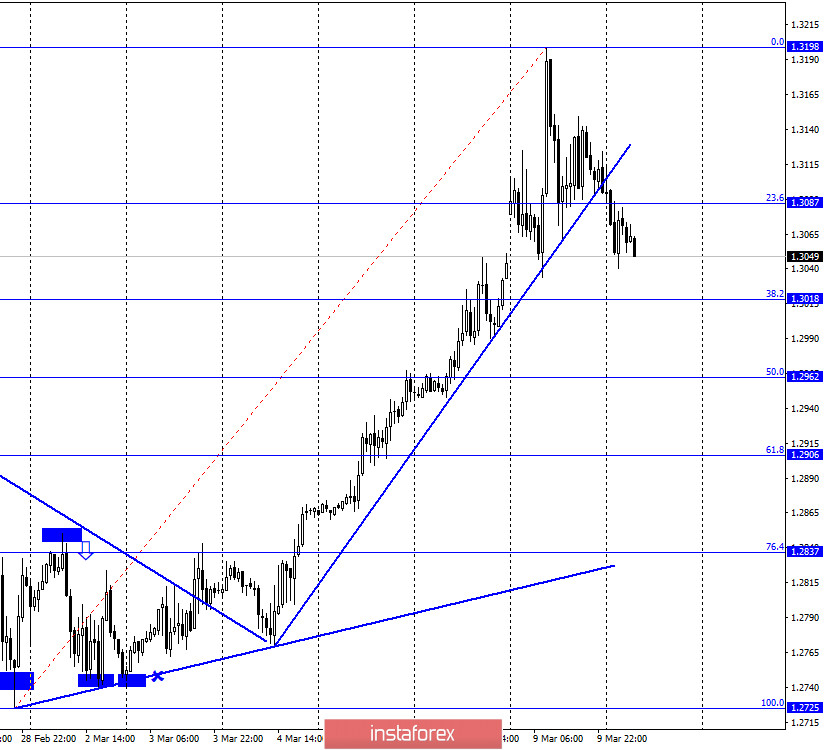

GBP/USD – 1H.

Hello, traders! According to the hourly chart, the quotes of the GBP/USD pair performed a reversal in favor of the US currency and anchored under the upward trend line. Thus, a sales signal is received. A new Fibonacci grid is built that allows you to count on the fall of quotes in the direction of the corrective levels of 38.2% (1.3018), 50.0% (1.2962) and 61.8% (1.2906). At the same time, the absolutely unstable state of the market can at any time turn into a new uncontrolled growth of the British. Thus, when opening any trades, traders should be aware of high risks.

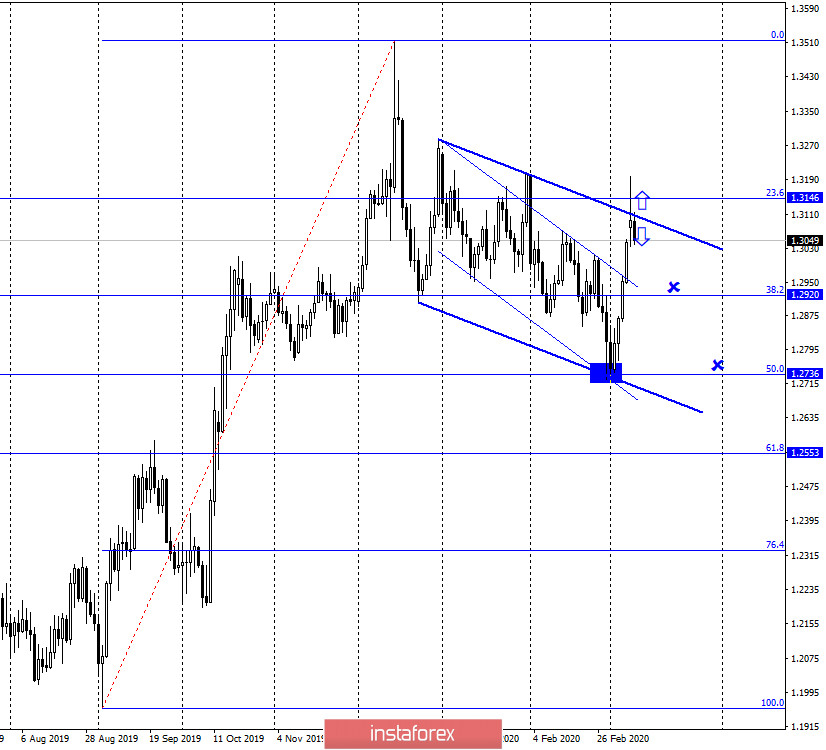

GBP/USD – 4H.

As seen on the 4-hour chart, the GBP/USD pair performed a reversal in favor of the US dollar and fell to the corrective level of 61.8% (1.3023). The rebound of quotes from this level will work in favor of the British and the resumption of growth in the direction of the corrective levels of 76.4% (1.3094) and 100.0% (1.3207). Closing quotes below this level will increase the likelihood of further falls in the direction of the target levels defined on the hourly chart. A reversal around the level of 100.0% (1.3207) speaks in favor of ending the upward trend. This level is the peak level from January 31. Today, the divergence is not observed in any indicator.

GBP/USD – Daily.

As seen on the daily chart, the graphic picture remains the most interesting. First, yesterday we received a fairly strong sales signal in the form of a rebound from the upper line of the downward trend corridor. Thus, traders were able to sell the pound/dollar pair and expect a fall in the direction of the corrective levels of 38.2% (1.2920) and 50.0% (1.2736). Closing quotes over the descending corridor will work in favor of the British, cancel all trading ideas for sales and significantly increase the probability of further growth of the pair's quotes.

Overview of fundamentals:

On Monday, March 9, there were no reports or news worthy of traders' attention.

The economic calendar for the US and the UK:

On March 10, traders will not have to pay attention to economic reports again, as there are no plans for any in the UK and the US.

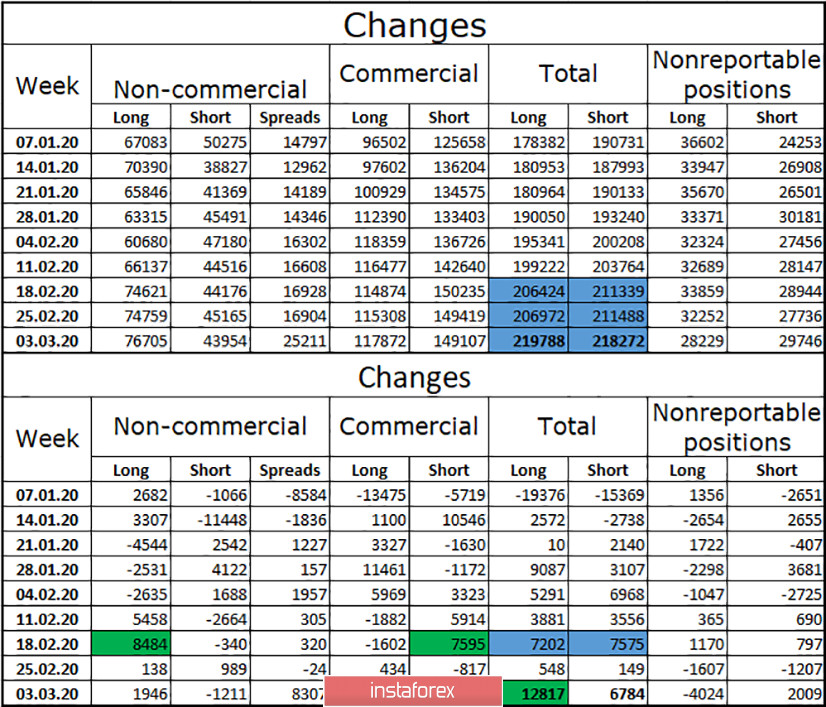

COT survey (Commitments of traders):

The new COT report for the week of March 3 showed the same lack of changes between the total volumes of short positions and long positions. Thus, nothing has changed in the week before March 3. But events that started happening after March 3 are not displayed in the report. The markets are now in a state of panic, so the total numbers of all contracts for all groups of major players may already differ from the reported ones by very impressive values. Thus, the COT report in these conditions will not help to determine the further movement of quotes of the pound/dollar pair.

Forecast for GBP/USD and recommendations for traders:

I believe that in the current conditions, opening any deals is associated with high risks, since the market remains in a state of panic and can move in any direction with renewed vigor. However, there are also two sales signals. On the hourly chart, it is weak with targets of 1.3018, 1.2962 and 1.2906. On the daily chart – it is stronger with targets of 1.2920 and 1.2736.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, and companies that buy currency not for speculative profit, but for current operations or export-import operations.

"Non-reportable position" - small traders who do not have a significant impact on the price.