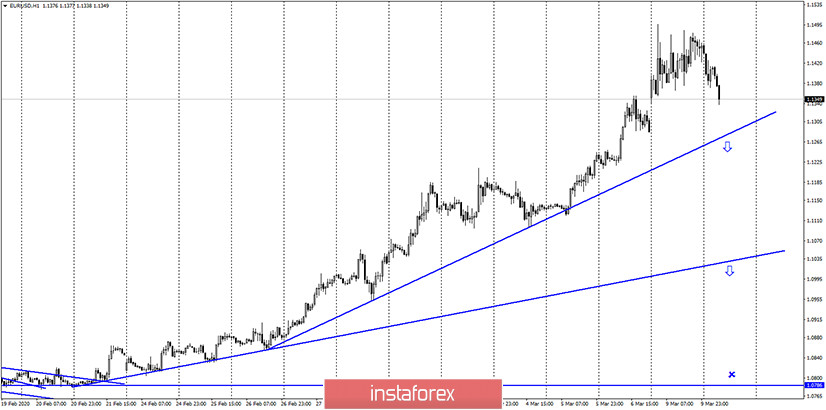

EUR/USD – 1H.

Hello, traders! The EUR/USD pair as a whole continues to be in the upward trend. The second upward trend line, which has a higher degree of inclination, continues to characterize the mood of most traders as "bullish". At the moment, the pair's quotes performed a reversal on the hourly chart in favor of the US currency and began the process of falling in the direction of the second trend line. A rebound of the pair from this line will work in favor of the euro and the resumption of growth of quotes. Closing below it will give a long-awaited signal for sales and allow traders to expect a fall in the direction of the first trend line.

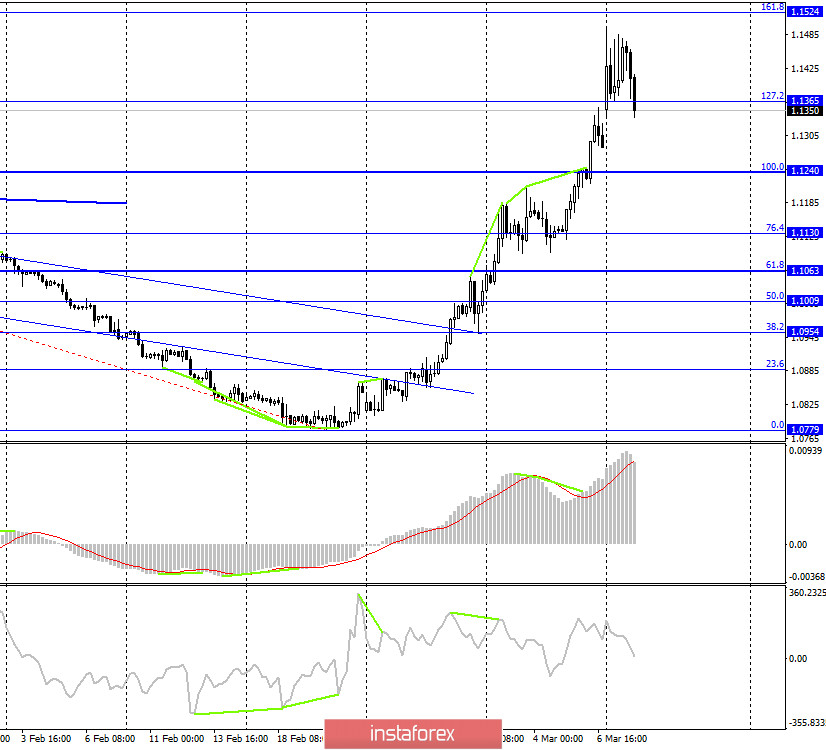

EUR/USD – 4H.

As seen on the 4-hour chart, the quotes of the euro/dollar pair also performed a reversal in favor of the US currency with consolidation under the Fibo level of 127.2% (1.1365). I am not sure that the upward trend can be considered complete on this chart since the pullback is very small so far. Nevertheless, traders can now expect a slight drop in the direction of the corrective level of 100.0% (1.1240). There are no pending divergences on March 10 in any indicator.

EUR/USD – Daily.

As seen on the daily chart, the euro/dollar pair may finally start falling after a rapid rise to the level of 1.1496. I assumed that it had already started and built a Fibonacci grid that predicts a drop in quotes in the direction of the Fibo levels of 38.2% (1.1221) and 50.0% (1.1137). Nevertheless, such strong growth in quotes, which was observed in recent days, and the state in which the market is now, may well turn into new growth in the quotes of the euro. Thus, the trading idea with a fall in the area of 1.1137-1.1221 is just a hypothesis.

EUR/USD – Weekly.

The weekly chart indicates that the potential for growth for the European currency remains and is limited to the level of 1.1600 (approximately) or the upper line of the tapering triangle. So far, bull traders have decided to take a pause (it is not known for how long), so about 100 points of the pair did not reach the target level. The goal remains relevant.

Overview of fundamentals:

On March 9, the calendar included the only report – in Germany, industrial production for January. There were other reports in Germany, but they were extremely weak. German production rose by 3.0% m/m and declined by 1.3% y/y, better than traders' expectations. However, now the market is in a panic and it is clearly not economic reports that drive traders.

News calendar for the US and the EU:

EU - change in GDP (10:00 UTC+00).

Today, the only report of the day is GDP in the EU for the fourth quarter. However, I can draw the same conclusion today as I did yesterday. It is unlikely that this potentially very important report will be seriously considered by traders who remain in a state of panic, judging by the strength of the movements.

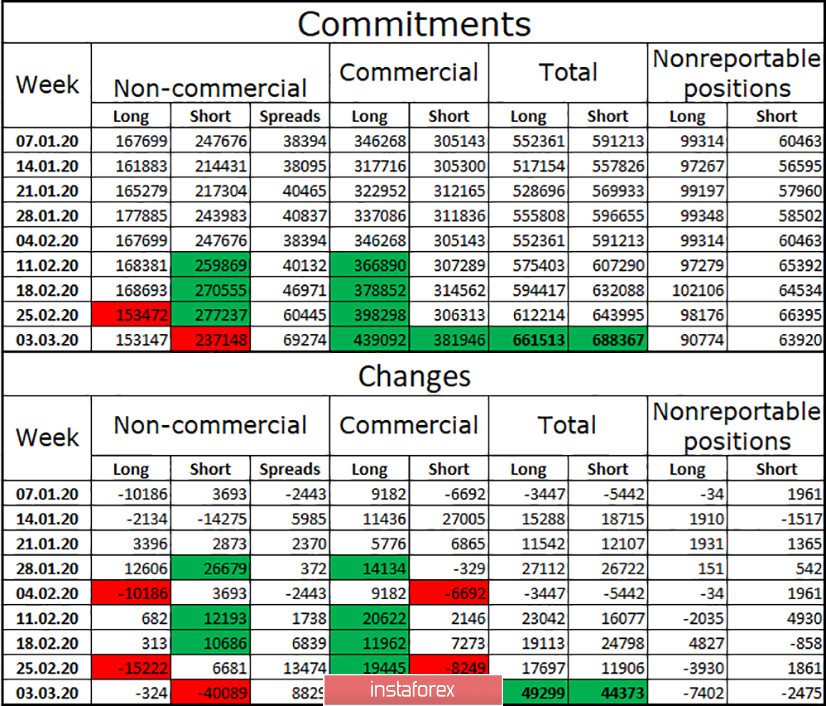

COT survey (Commitments of traders):

A new report by Commitments of traders for the week of March 3 showed, first, a sharp reduction in the number of Short positions among the "Non-commercial" group. Second, a sharp increase in both Long and Short positions among the "Commercial" group. Third, the total number of both Long and Short positions has increased significantly. Market activity is growing, the total number of purchases from major players is increasing, and hedgers are now insured against the future growth of the euro currency and its fall. The "Changes" part of the table shows even better that the number of sales contracts among speculators has decreased by 40,000. But the number of Short among hedgers has increased by 80,000. Thus, I conclude that the high activity of traders of all calibers will remain for the time being.

Forecast for EUR/USD and recommendations for traders:

The overall picture of the EUR/USD pair remains unchanged. Purchases, from my point of view, are still dangerous, although the growth of quotes is very strong. So it is up to traders to decide whether they want to risk and buy the euro, perhaps at the very end of the move? At the same time, any sales remain counter-trend, so they are also dangerous. So I think the best option now is to stay out of the market. Traders can now expect a pullback to the area of 1.1137–1.1221, but there is no signal for sales yet.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, and companies that buy currency not for speculative profit, but for current operations or export-import operations.

"Non-reportable position" - small traders who do not have a significant impact on the price.