GBP/USD extends it's sell-off after the Bank of England decided to cut the Official Bank Rate by 0.50% in yesterday's meeting. The MPC members voted unanimously for this decision. The Coronavirus epidemic could cause serious economic damage, that's why the BoE has reduced the Bank Rate and has launched the new Term Funding Scheme, trying to fight the COVID-19 effects.

The pair has decreased aggressively in the last two sessions, it has invalidated a potential drop and now is almost to confirm a larger drop. The price is trading in the red, it has changed little today, but the overall bias is bearish after GBP/USD closed the Monday's gap up.

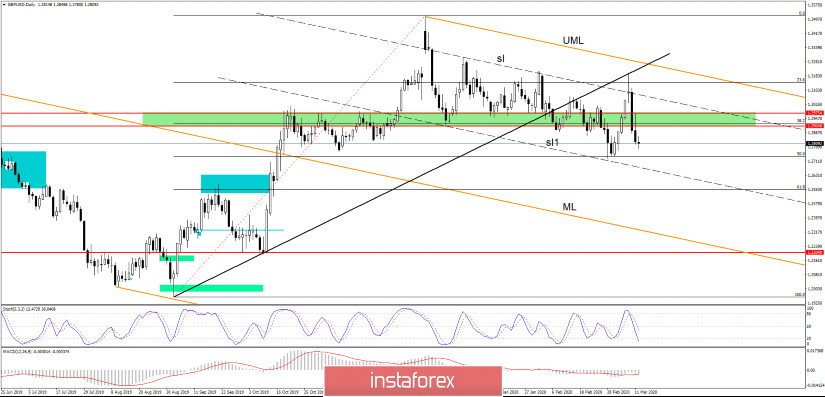

- GBP/USD Within A Down Channel

I've said on Monday that the descending channel is still intact after the false breakout above the inside sliding line (sl) and above the 23.6% retracement level. GBP/USD has retested the uptrend line and now it could register a significant drop after the failure to reach and retest the upper median line (UML) of the descending pitchfork.

The pair has come back below 1.2900 psychological level rapidly, signaling a high selling pressure. The USD has taken the lead and it could drive the pair towards fresh new lows if the US Dollar Index will have enough bullish energy to climb higher.

The next downside target remains at the 50% retracement level, while the second one is seen at the second inside sliding parallel line (sl1), the downside line. GBP/USD could resume the downside movement between the sliding lines (sl, sl1), only a valid breakdown below the second sliding line (sl1) will confirm a sharp drop towards the median line (ML) of the orange descending pitchfork.

- TRADING TIPS

The uptrend line retest has signaled a potential larger downside movement, so a valid breakdown below the 50% retracement level, another lower low, will validate a further drop. The outlook is bearish as long as the price is traded within the down channel pattern, a downside breakout will announce a drop towards the median line (ML) of the descending pitchfork.

The median line (ML) acts as a magnet, it could attract the price after the failure to reach and retest the UML in the attempt. A larger drop could be invalidated by another false breakdown below the 50% retracement level. If GBP/USD will consolidate above the 50% (1.2735), a breakout to the upside is favored.

You should keep in mind one thing, the outlook is bearish as long as the price is traded below the 1.2904 - 1.2975, below the 38.2% retracement level and below the sliding line (sl) of the descending pitchfork, minor rebounds could give is a great chance to go short on this pair.