Yesterday, British Finance Minister Rishi Sunak announced a full package of fiscal support measures worth £30 billion. However, because of the super large expenditures, the pound did not like it very much, as it requires maintaining a soft monetary policy for quite a long time.

Yesterday, the Bank of England reduced the key interest rate from 0.75% to 0.25%. It also announced measures to combat the effects of the coronavirus, introducing a funding program designed to support lending to small businesses affected by the epidemic.

Nevertheless, during his speech, Rishi Sunak said that despite the spread of the coronavirus, UK's economy is strong, and public sector finances are in good condition.

Measures from the new aid program include: additional costs for the health system (£500 million), coverage of the cost of sick pay for companies with fewer than 250 employees, and a £2 billion budget allocated as part of the plan to help the companies affected by the coronavirus. Tax incentives will also be provided for small businesses in the areas of recreation, entertainment and retail.

As I noted above, the full package of fiscal support measures amount to £30 billion.

The Finance Minister's statement also gave a forecast for UK's GDP growth for 2020. While the previous forecast was at 1.4%, it is now expected to be 1.1%. In 2021, the economy is expected to show a growth of 1.8%, and in 2022, 1.5%. This rise will be achieved through the measures outlined above. Meanwhile, the budget deficit for 2019-2020 is expected to be 2.1% of the GDP, and in 2022-2023, 2.4%.

Note that this emergency stimulus package does not provide for the resumption of quantitative easing. Nonetheless, many experts expect that during the BoE's meeting on March 26, the regulator will resume its quantitative easing program. Although there are no specific figures yet, these expectations will most likely have a negative impact on the pound as well.

As for the technical picture of GBP/USD, the rush of yesterday's support at 1.2840 further aggravates the position of the pound, so the bears will take advantage of this moment to try to break below the level of 1.2780. This will lead to an update of local lows in the area of 1.2740 and 1.2670. On the other hand, in the case of an upward correction, the pound's growth will be limited to the levels of 1.2870 and 1.2910.

EUR/USD

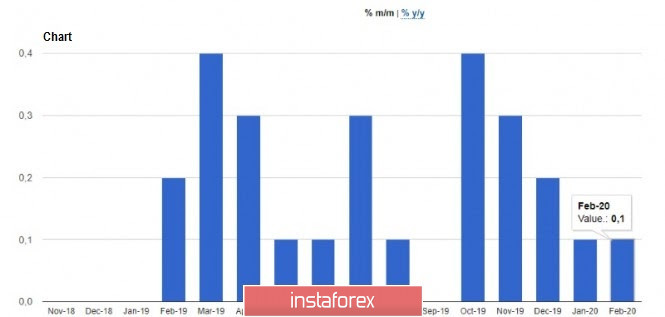

Yesterday's report on the minimum growth of consumer prices in the United States did not have much impact on the dollar. According to the US Department of Labor, the consumer price index (CPI) in February increased by 0.1% compared to the previous month, while the base index, not taking into account volatile categories, rose by 0.2%. The decline in the index was mainly due to the decline of energy prices, while food prices rose by 0.4%. Meanwhile, if compared with the same period of the previous year, the CPI increased by 2.3%, while the basic index increased by 2.4%.

These data do not reflect yet the changes in prices after the spread of the coronavirus, and it does not take into account the serious drop in energy prices seen this March.

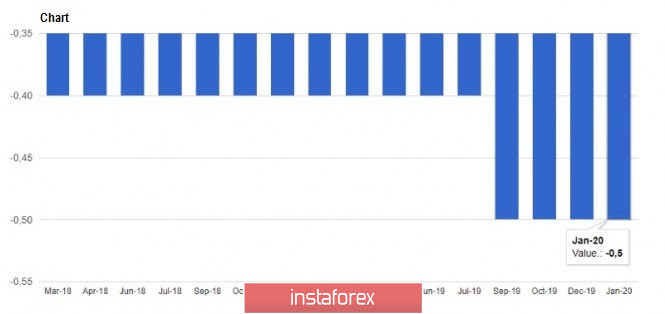

The ECB will meet today to announce a package of measures aimed at mitigating the impact of the spread of the coronavirus on the economy. Most likely, deposit rates will be reduced by 10 basis points, resulting to -0.60%, and monthly net asset purchases will rise from £20 billion to £40 billion.

As for the current technical picture of EUR/USD, the pair's bulls need to pass the resistance level of 1.1330, in order to return the trading instrument to the highs of 1.1380 and 1.1460. However, if the pressure on the pair persists after the ECB's decision, then large support levels will be seen in the area of 1.1180 and 1.1100.