EUR/USD has decreased a little for a short time as the USD was boosted by the USDX's rally. The US dollar index further growth will send the pair deeper. You should know that the price maintains a bullish outlook despite the minor drop, a larger upside movement was confirmed after EUR/USD registered a valid breakout above the 1.1200 - 1.1215 area. The current drop could be temporary, the price could jump higher if the ECB decides to keep the Interest Rate on hold at 0.00%. Unfortunately, a rate cut is unlikely to make a positive impact on the eurozone's economy because the previous measures have failed to boost the economy. The FED, BOC, and BoE have decided to reduce the interest rate to combat the coronavirus fallout, now the time is ripe for the ECB to take action.

The Main Refinancing Rate stands at a historical low, 0.00%, while the Deposit Facility Rate is already in the negative territory. So, the ECB needs to do more than just reduce rates. The ECB Press Conference could bring high volatility and could shake markets, you should be ready for aggressive movements on EUR/USD.

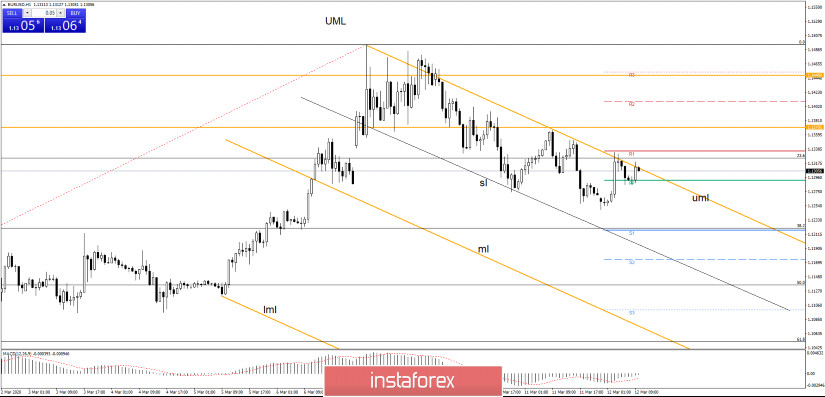

EUR/USD has come back to retest the upper median line (uml) of the descending pitchfork. A rejection or a false breakout could send the price down towards the 1.1248 previous low. The price is trading above the PP (1.1291) level, but the bias is still bearish as long as the pair is trading within the descending pitchfork's body. The USD could drive the price down towards the S1 (1.1217), 38.2% retracement level and towards the 1.1215-1.1200 major support area.

EUR/USD is trapped between the upper median line (uml) and the inside sliding line (sl), the price has moved away from the downside line (sl), but only a valid breakout above the upper median line (uml), from this down channel, and above the 23.6% retracement level will confirm another bullish movement.

Technically, EUR/USD is still bullish as long as is it stays above the 1.1215 - 1.1200 area, but a valid breakdown below this area will signal a sharp drop. MACD indicates a bullish divergence on the H1 chart, but as I've just said, only a valid breakout above the upper median line (uml) will confirm that the correction is finished.

- TRADING TIPS

We could consider going long if the price escapes from the minor down channel after a valid breakout above the upper median line (uml) and above the 23.6% retracement level, the first upside target is seen at 1.1448.

However, you should know that another lower low, a drop below the 1.1248 will validate a drop at least till the 38.2% and towards the 1.1215 - 1.1200 area. The inside sliding line (sl) represents strong dynamic support.

The fundamentals will drive the price today, some unexpected measures could drive the price down, while the lack of action will push EUR/USD way higher. A false breakdown with a great separation below the 1.1215 - 1.1200 area or a bullish engulfing right on this obstacle could announce a bullish momentum as well.

Only a valid breakdown to the downside will open the door for a larger drop post ECB, maybe it will be better to stay away during the ECB announcements and wait for a clear signal and direction.