EUR/USD – 1H.

Hello, traders! On March 11, the EUR/USD pair still made a consolidation under the second upward trend line. Thus, the continuation of the upward trend is currently in doubt, and the pair's quotes, which performed a reversal in favor of the US currency, began the process of falling in the direction of the first upward trend line. Thus, the approximate target level is 1.1100, which is located at a distance of almost 200 points from the current pair rate. An attractive target!

EUR/USD – 4H.

According to the 4-hour chart, the pair's quotes of the euro/dollar, after rebounding from the corrective level of 127.2% (1.1365), performed a reversal in favor of the US currency and resumed the process of falling towards the corrective level of 100.0% (1.1240). The bullish divergence of the CCI indicator worked in favor of the European currency and some growth in quotes. However, there is a feeling that the fall in quotes will resume in the near future. It would be good if it was accompanied by the formation of sales signals. So far, there is only one signal – on the hourly chart. Closing the pair's exchange rate under the Fibo level of 100.0% (1.1240) will increase the probability of a further fall in the direction of the next corrective level of 76.4% (1.1130).

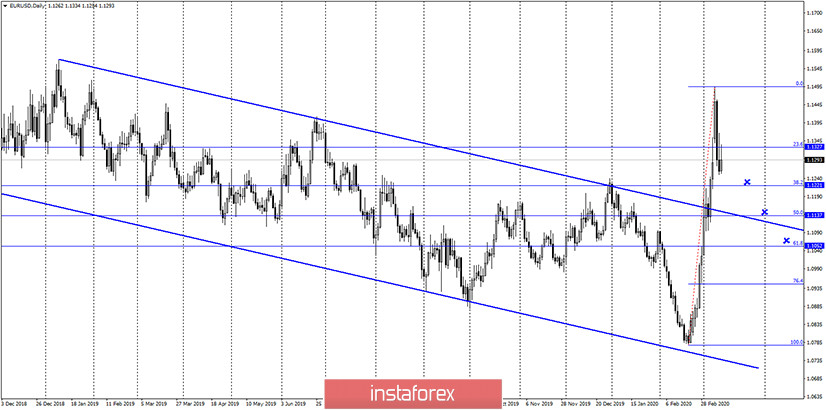

EUR/USD – Daily.

As seen on the daily chart, the euro/dollar pair, after a rapid growth to the level of 1.1496, finally began to fall in quotes. The new grid of Fibonacci correction levels allows traders to expect a fall in the direction of 38.2% (1.1221) and 50.0% (1.1137). At the same time, passions around the coronavirus are "boiling". Every day there are news and reports that can cause a new panic in the market. Traders continue to be in a restless mood. The upward trend can be resumed at any time. Thus, the trading idea with a fall in the area of 1.1137-1.1221 looks good, but it remains just a hypothesis.

EUR/USD – Weekly.

The weekly chart indicates that the potential for growth in the EU currency remains and is limited to the level of 1.1600 (approximately) or the upper line of the tapering triangle. So far, bull traders have decided to take a pause (it is unknown for how long), so the goal remains relevant, but its development may be delayed for some time.

Overview of fundamentals:

On March 11, the calendar included a single report – the change in US inflation in February. And this report was quite strong. Inflation in America exceeded the expectations of traders and amounted to 2.3%, although compared to January, it still fell slightly. Nevertheless, the decline in quotes had an informational background.

News calendar for the United States and the European Union:

EU - change in industrial production (10:00 UTC+00).

EU - publication of the ECB's decision on the main interest and deposit rates (12:45 UTC+00).

EU - ECB's press conference (13:30 UTC+00).

An important report on industrial production will be released in the European Union today. Traders are waiting for another reduction in volumes. Also today, there will be a summing up of the ECB meeting and a press conference by Christine Lagarde. The ECB is expected to ease monetary policy, lower the rate and/or expand the QE program.

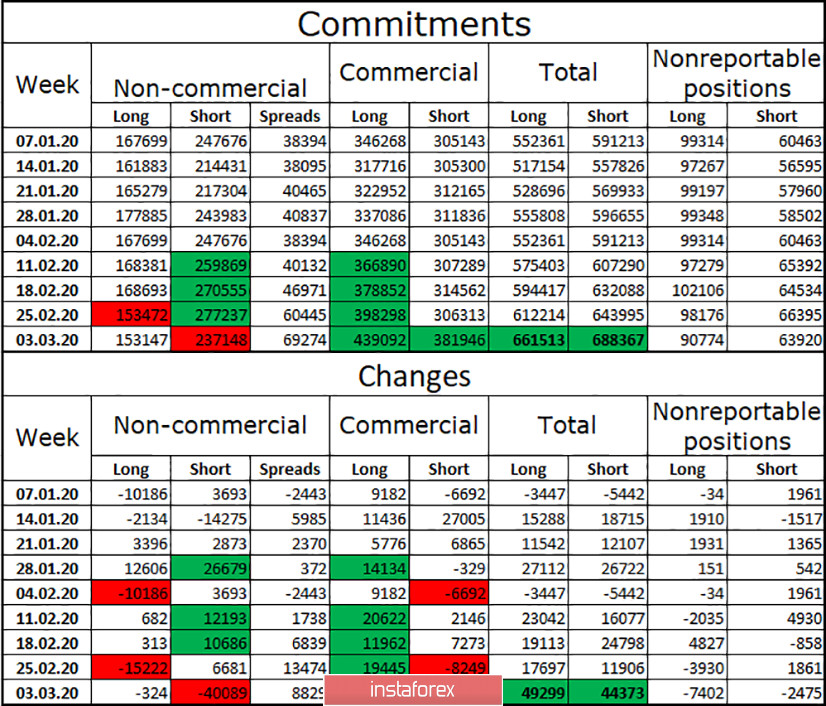

COT report (Commitments of Traders):

The latest Commitments of Traders report for the week of March 3 showed a sharp decrease in the number of Short positions among the "Non-commercial" group, a sharp increase in both Long and Short positions among the "Commercial" group, and a noticeable increase in the total number of both Long and Short positions. Market activity is growing, and we can see this in the general volatility even now, after the report. The total number of purchases from major players is increasing, and hedgers are now insured against future growth of the euro currency and its fall. The "Changes" part of the table shows even better that the number of contracts for sale among speculators has decreased by 40,000. But the number of Short positions among hedgers increased by 80,000. Thus, I conclude that the high activity of traders of all calibers remains.

Forecast for EUR/USD and recommendations for traders:

The EUR/USD pair is currently characterized by a high amplitude of movements and high activity of traders. The upward trend can be resumed at any time. However, the sell signal on the hourly chart allows you to sell the euro currency with a target of about 1.1100. However, to maintain this signal, it is also necessary to close the pair's quotes under the Fibo level of 100.0% (1.1240) on the 4-hour chart. This is almost a prerequisite for today. All the news from the European Union can just work against the European currency.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency not for speculative profit, but to ensure current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.