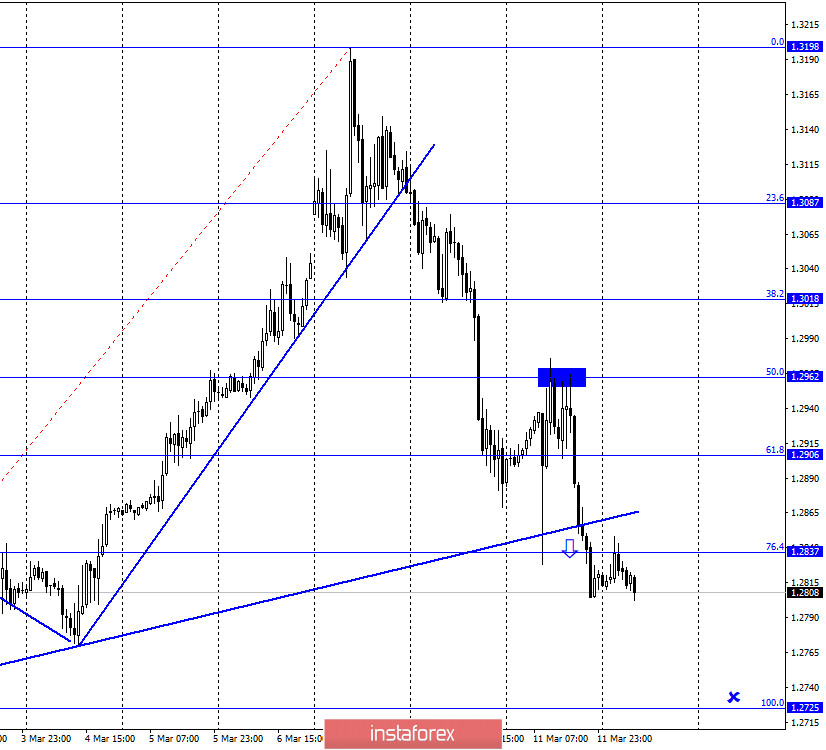

GBP/USD – 1H.

Hello, traders! According to the hourly chart, the quotes of the GBP/USD pair performed a rebound from the corrective level of 50.0% (1.2962) and a reversal in favor of the US currency with a new fall to the ascending trend line. Then the pair easily closed under the trend line, and at the same time under the Fibo level of 76.4% (1.2837). Thus, the fall in the pair's quotes can be continued on March 12 in the direction of the next corrective level of 100.0% (1.2725).

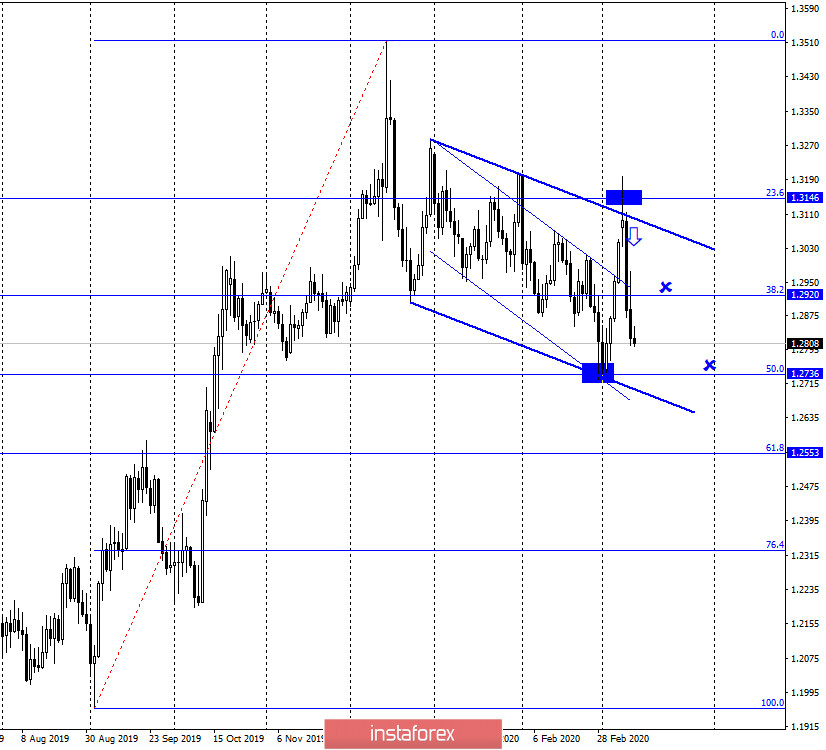

GBP/USD – 4H.

As seen on the 4-hour chart, the GBP/USD pair also rebounded from an important level – the Fibo level of 50.0% and with a reversal in favor of the US dollar, resumed the process of falling in the direction of the corrective level of 0.0% (1.2725), which completely coincides with the target level of the hourly chart. Today, the divergence is not observed in any indicator. Unfortunately, the sales signal on the 4-hour chart is quite weak. Nevertheless, it is more likely now that the fall in prices will continue.

GBP/USD – Daily.

As seen on the daily chart, the graphic picture remains the most interesting. After the rebound of quotes from the corrective level of 23.6% (1.3146), as well as the upper line of the downward trend corridor, the pair continues the process of falling in the direction of the second target level – the Fibo level of 50.0% (1.2736). The first target of 1.2920 is fulfilled. There are no more than 50 points left before the second one. The pair remains inside the downward trend corridor, which continues to define the current mood of traders as "bearish". In just 8 days, the quotes performed a strong growth and an equally strong fall. Thus, I believe that panic continues to be present in the market, which can lead to new strong movements. Well, if they are inside the trend corridor, it will greatly facilitate the forecasting process.

Overview of fundamentals:

On Wednesday, March 11, there were a large number of important economic reports on the calendar. However, the day began not even with them, but with the fact that the Bank of England at an emergency meeting decided to reduce the rate by 50 bps. This decision caused the further fall of the British dollar. All subsequent reports only finished off the pound. Industrial production in Britain decreased by 2.9%, and the GDP level was 0% in January. A little later, it became known about strong inflation indicators in America. Thus, all the news of the last day was in favor of the US currency.

The economic calendar for the US and the UK:

On March 12, important economic reports and events are not included in the calendar of the UK and the US.

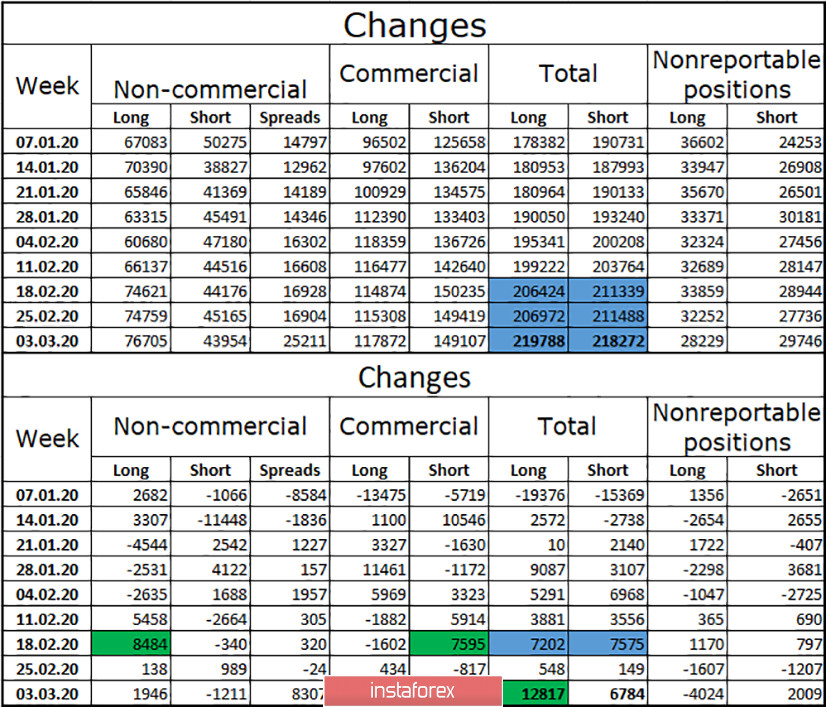

COT report (Commitments of Traders):

The new COT report for the week of March 3 showed the same lack of changes between the total volumes of Short positions and Long positions. Thus, nothing has changed compared to the previous report. Markets now remain in a state of panic, so the overall numbers of all contracts for all groups of major players may already be very different from those presented in the report. Nevertheless, the almost complete equality of Short and Long positions suggests that neither bears nor bulls currently have an advantage. Since the activity of traders is currently extremely high, I expect alternating periods of strong growth and strong fall. The new COT report on Friday may show a mix of balance in the direction of bears or bulls, which will allow us to draw new conclusions on the mood of most major players.

Forecast for GBP/USD and recommendations to traders:

I believe that in the current conditions, opening any transactions is associated with high risks, since the market remains in a state of panic and can move in any direction with new force. However, there is a strong sell signal on the daily chart with targets of 1.2920 and 1.2736, the first of which has already been worked out. The trend line on the hourly chart did not stand, so the chances of a fall to 1.2725-1.2736 are high.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency not for speculative profit, but to ensure current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.