Gold is trading at $1,512, but it has signaled a potential rebound after the sharp drop. The price maintains a bullish outlook on the medium to the long term as long as it is traded above the $1,484 static support.

The yellow metal has slumped aggressively amid the broad-based strength of USD. The USDX has climbed as much as 99.84 level in yesterday's session, but it has opened with a gap down today, a potential drop will force the USD to decrease. In this context, gold could regain footing again.

Gold could increase also because the global risk is growing fast as the coronavirus is spreading aggressively, making new victims and economic damages. We still need confirmation before going long because the price is still trading in the red and approaches the $1,484 downside obstacle again.

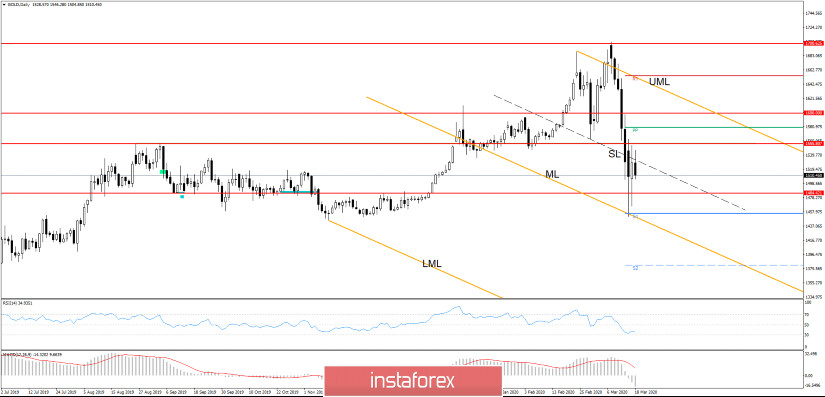

Gold continues to stay below the inside sliding line (SL) of the descending pitchfork, signaling bearish pressure, despite the false breakouts below the $1,484 static support. I said in yesterday's analysis that another false breakdown with a great separation below the near-term support levels, or a reversal pattern could validate a bullish momentum.

Technically, the major false breakdown below $1484, S1 ($1,455) and below the median line (ML) has signaled a potential upside movement towards the upper median line (UML). Personally, I would like to see consolidation and a valid breakout above the inside sliding parallel line (SL) as a bullish sign.

- TRADING RECOMMENDATIONS

Gold is still trading under bearish pressure as long as it remains below the inside sliding line (SL) of the descending pitchfork, you can see that the price wasn't able to close above it in the last attempts.

The failure to approach and reach the median line (ML), or to close and stabilize below the $1,484 will signal a bullish movement, the next targets are seen at $1,555, $1,600 and at the upper median line (UML). You should know that a larger upside movement will be confirmed only by a valid breakout above the UML.

I believe that a broader corrective phase will be validated if the price drops and if it closes below the S1 ($1,455) or if it makes another lower low.