It's not the coronavirus itself that is scary, which is far from even the usual flu, which annually takes away more than half a million invaluable human lives. A terrible panic, which is arranged by mass propaganda and misinformation. Twenty-four hours a day, seven days a week, you can only hear about coronavirus. People already have the feeling that there is nothing else in the world and there is nothing but a terrible and horrible virus. Therefore, are all kinds of figures who consider themselves titans of thought and bearers of secret knowledge, suffering only from inferiority complexes, because their opinions are not interesting to anyone, worsens the situation, shouting every second that it's still worse, and hiding the truth from us. People's minds are not made of iron, and their nerves give out. People do not understand what is happening, and demand from the authorities to save a terrible fate. The authorities of all countries of the world under the pressure of public psychoses, powered by mass agitation and disinformation, are forced to take at least some measures. As a result, people conclude that it is the coronavirus that is taken seriously by states, and they are starting to panic even more. Masses of people sweep away everything from store shelves, which creates an even greater impression of a complete disaster, and the panic only intensifies.Therefore, States are forced to introduce more and more strict security measures, since people brought to hysteria can do such troubles that doesn't seem enough. And this scares people even more, and the panic only intensifies. And against this interesting background, the capital flight from all over the world to the United States is taking place in a remarkable way. Of course, we can say that investors are also afraid of all kinds of risks, and the like, which results in closing all their positions. But then why is the dollar so expensive and the yield on American debt securities reduced? All this is more reminiscent of global profit taking, after several years of steady growth in various stock indices. Sooner or later, this was about to happen. Investors had to start taking profits, others would run after them, and like a snowball all indices and other assets would go down. This is a typical scenario for any financial crisis. But this time, two things are frightening. First, this is information support, which brings people to panic, and it would not only get worse; moreover, on a social level. The second is that such recessions begin to occur with enviable regularity, and their frequency only increases. Back in the last century, such things happened no more than once every ten years and even less often. But now, this happens about once every five years. And of course, everything that happens once again shows the total dependence of the global financial system on American investment funds and banks. Well, the coronavirus itself was only the trigger, which launched all these wonderful processes.If it hadn't been there, there would have been another reason. Moreover, the coronavirus itself is already actively blamed for all the economic problems that began much earlier. And it is these same economic issues and are the true cause of the global capital flight.

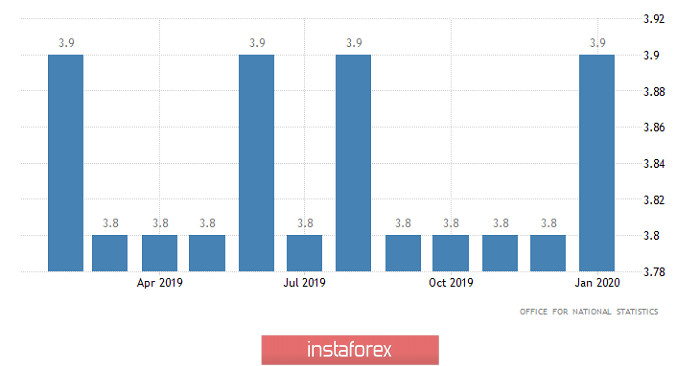

At the same time, we must admit that even without any coronavirus there, the dollar has reasons for growth, even if not the same as we observe. For example, the UK unemployment rate rose from 3.8% to 3.9%, although it was supposed to drop to 3.7%. Moreover, average wage growth slowed from 3.2% to 3.1%. That is, unemployment is growing, and salaries are falling. Another thing is that this situation may be temporary and random in nature, since the number of applications for unemployment benefits increased not by 24.0 thousand, but by 17.3 thousand. In addition, employment increased by 184 thousand, instead of the forecasted 150 thousand. In other words, there is every reason to believe that the situation will improve. However, the general panic mood, as well as the main indicators of the labor market, did their dirty work.

Unemployment Rate (UK):

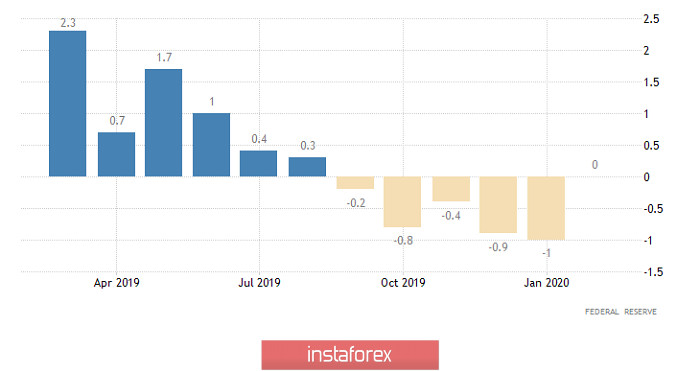

But American macroeconomic statistics was clearly more positive. The most important thing is probably that the five-month decline in industrial production has stopped. However, no growth has been recorded, but at least there is no need to speak of a decline. But initially, they expected that the recession would continue, although by 0.3%. In addition, retail sales data were much better than forecasts, the growth rate of which was to slow down from 4.4% to 2.7%. But first, upward up to 5.0%, reviewed the previous results, and then reported that the growth rate slowed down to only 4.3%. JOLTS data on open vacancies was also published, the number of which increased from 6,552 thousand to 6,963 thousand. So yes, there are all economic reasons for the growth of the dollar. Well, the information panic did the rest.

Industrial Production (United States):

Do not forget about macroeconomic statistics. Another thing is that only negative data will increase, while positive results can go almost unnoticed. And of course, we are talking only about data that applies to everyone except the United States. With US macroeconomic data, everything will be diametrically different. That is, positive data will be perceived with much greater enthusiasm, but negative data will most likely be ignored. Thus, unfortunately for the single European currency, data on inflation will be published today in the Old World, which should show its decline from 1.4% to 1.2%. However, we need to recall recent data on the largest countries in the euro area, which coincided with forecasts only in Germany and France. But they turned out to be worse than forecasts in Italy and Spain. So there is every reason to believe that inflation will slow down a bit more. For example, up to 1.1%. And this will hit the single European currency even more. And what can I say, when even the trade balance of Europe can plunge into despair, since its surplus should amount to 2.8 billion euros in January which looks ridiculous against the background of the December surplus of 23.1 billion euros. By the way, if in December, Italy's trade surplus amounted to 5.0 billion euros, then in January it should amount to only 1.0 billion euros. I note that all this is caused by the panic with coronavirus in the Old World.

Inflation (Europe):

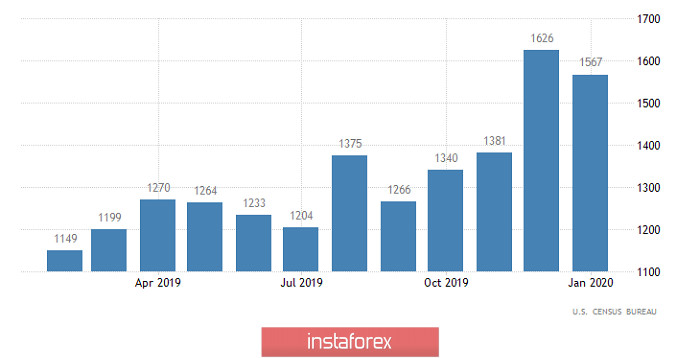

As mentioned above, negative macroeconomic statistics for the United States, in the current environment, will be largely ignored by the market. This is exactly what we can see today, since the number of issued building permits should decrease by 3.4% from 1 550 thousand to 1 498 thousand. At the same time, the number of started construction projects may be reduced by 4.6% from 1 567 thousand to 1 495 thousand. But this unpleasant fact will make few people stop, and the dollar will continue its confident winning pace.

New Home Construction (United States):

The short-term benchmark for the single European currency is the level of 1.0875.

The pound is likely to move to the level of 1.1925.