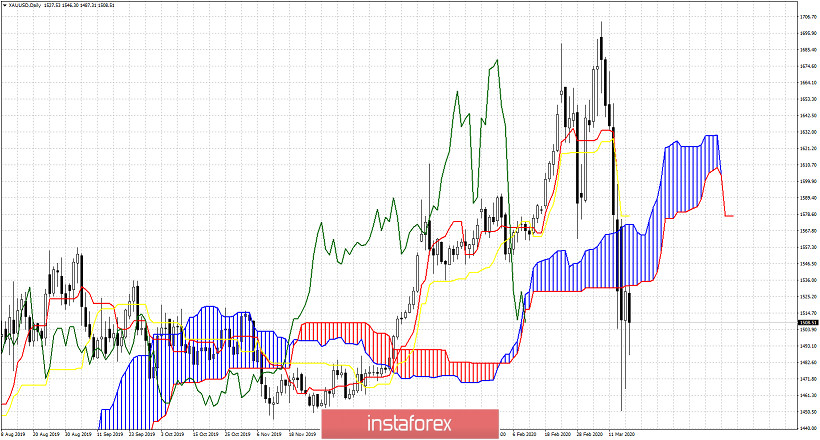

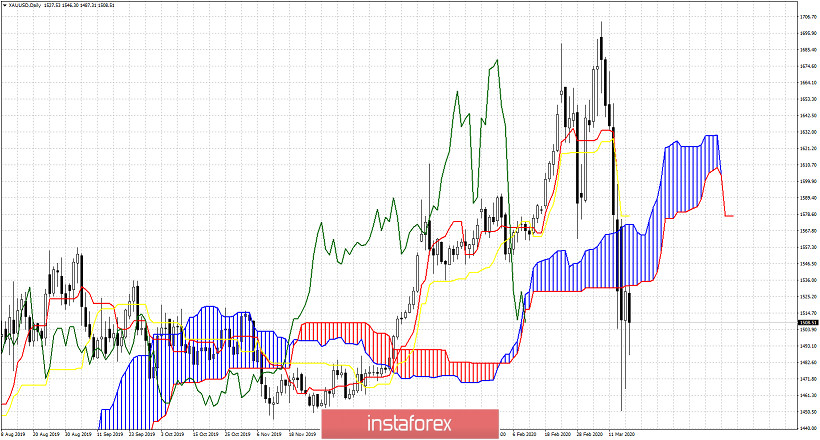

Gold price has broken below key cloud support and despite the bounce, price got rejected and shows more signs of weakness. Gold bulls have a lot of work to do in order to turn this around. Trend remains bearish.

Gold price is below the Daily Kumo. The Chikou span is about to break below the Kumo. The tenkan-sen is about to provide us with a sell signal as it crosses below the kijun-sen. Resistance is found at $1,532 and as long as price is below this level, we expect to see new lows soon. Next resistance is at $1,575. This is major resistance that could decide the trend of the coming weeks. So far we have two Daily candlesticks with long lower tails. This implies buying interest. A daily close below $1,500 will put added pressure to those buying below $1,500 that so far supported Gold. A daily close below $1,500 will most probably bring Gold price to $1,450 again if not lower.

Red lines - bullish channel (broken)

Green rectangle - support area

Gold price is at the green rectangle which is horizontal support area. I expect price to continue lower towards the 50% Fibonacci retracement before a bigger bounce comes. The Daily RSI has still not reached oversold levels. Trend remains bearish and I believe it is wise for traders to protect their short positions and not think about bullish scenarios yet.