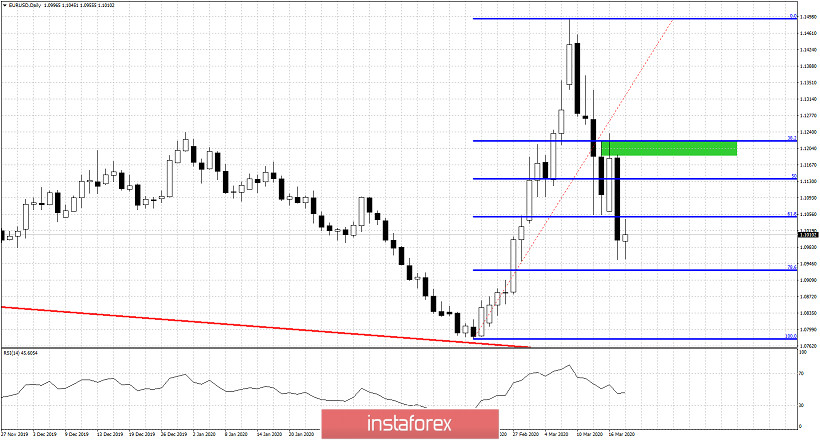

EURUSD has broken through important Fibonacci level support and is showing more signs of weakness. There are no bullish signs of a reversal. Trend remains bearish as long as price is below 1.12

EURUSD is making lower lows and lower highs. After breaking below 1.1055, the chances for a major higher low and the resumption of the uptrend have decreased. Breaking below the 61.8% Fibonacci retracement is not a good sign for bulls. The Daily RSI is far from oversold. Major short-term resistance remains at 1.12-1.1225 and only a break above it could bring bulls back in control of the trend. On a weekly basis nothing is lost yet for bulls. A weekly close above 1.1060 and as close as better to 1.11 would be a positive sign. The longer price stays below 1.1055 the worse it will get.