Overview:

The EUR/USD pair continues Its down amid coronavirus crisis.

The strength of the dollar nowadays, supported by concerns about the effect of coronavirus.

The U.S. dollar rose against most of currencies since coronavirus crisis.

Last week, the euro weakened after the European Central Bank declared more positive news to fight the effect of the coronavirus but did not lower interest rates.

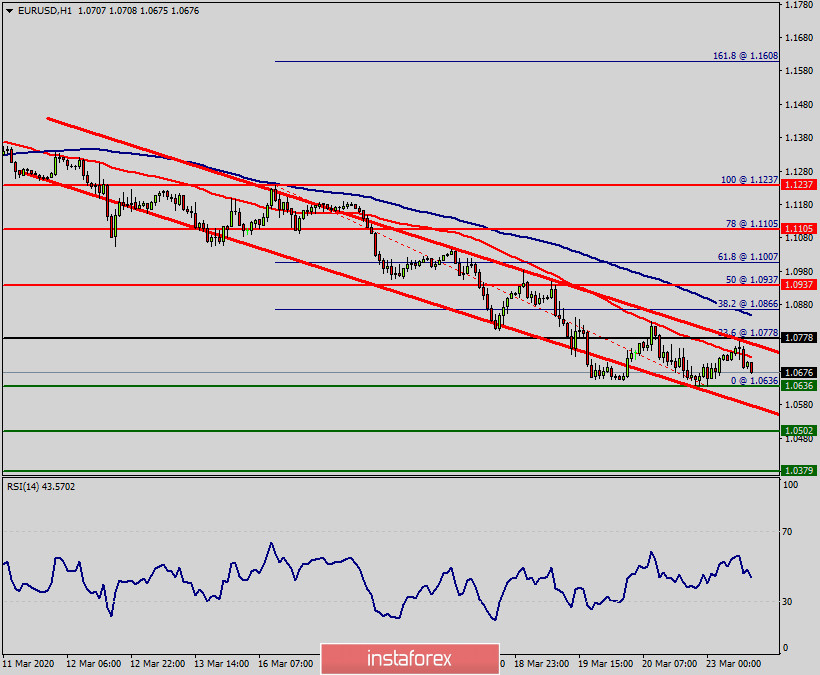

Technically, the EUR/USD pair dropped sharply from the level of 1.0937 towards 1.0636. Now, the price is set at 1.0685.

On the H1 chart, the resistance of EUR/USD pair is seen at the level of 1.0778 and 1.0937.

It should be noted that volatility is very high for that the EUR/USD pair is still moving between 1.0778 and 1.0502 in coming hours.

Moreover, the price spot of 1.0778 remains a significant resistance zone. Therefore, there is a possibility that the EUR/USD pair will move downside and the structure of a fall does not look corrective.

So, sell below 1.0778 with the first target at 1.0636 to test last week's bottom. In overall, we still prefer the bearish scenario as long as the price is below the level of 1.0778. Furthermore, if the eur/USD pair is able to break out the bottom at 1.0636, the market will decline further to 1.0502.

However, it would also be sage to consider where to place a stop loss; this should be set above the second resistance of 1.0937.