Hello, traders!

Despite the fact that the Bank of England lowered the main interest rate to 0.1% and increased the volume of the QE program to 645 billion pounds, the UK may face a recession according to many experts.

It is all the fault of the COVID-19 outbreak, which threatens to lead to a significant decline in economic growth in the United Kingdom. According to some forecasts, British GDP may fall by 2.6% if Boris Johnson's cabinet fails to take adequate measures to combat the coronavirus.

However, according to one well-known major bank, the American economy also remains very vulnerable to the consequences of the pandemic, and the drop in economic activity in the United States of America may be 24%. An impressive figure that is more than twice the post-war figure.

Before proceeding to technical analysis, I would like to draw your attention to the fact that a large amount of macroeconomic data from the UK and the US is expected to be published this week. Today is an exception. In the economic calendar, you can only see the index of economic activity from the Federal Reserve of Chicago, which will be published at 13:30 (London time).

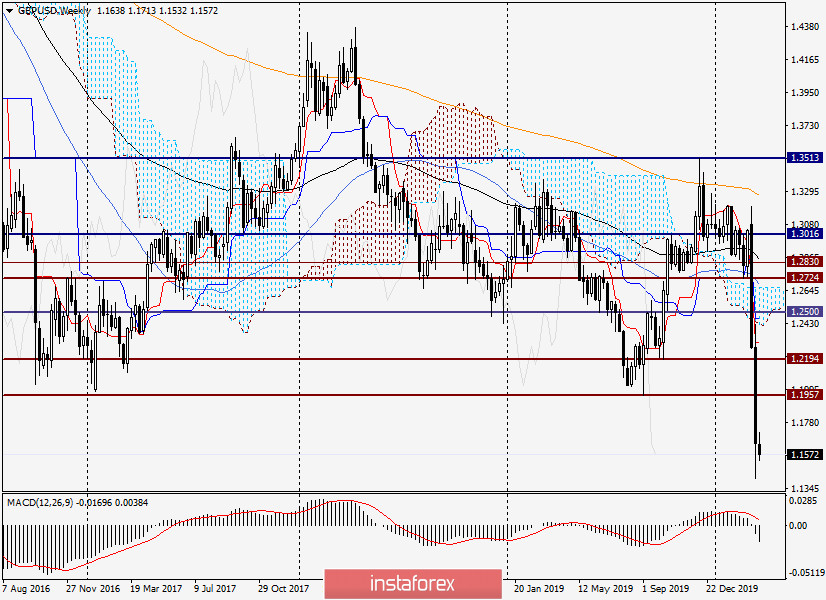

Weekly

Following the results of trading last week, a second huge bearish candle appeared in a row with a very low closing price at 1.1640. At the same time, support for 1.1957 was broken. Given the strength of the downward dynamics and the closing price, there is no doubt that the breakout of 1.1957 is true.

What's next? It seems that the British currency has passed through a free fall, the boundaries of which are not possible to determine now. The situation can change only if the bulls on the pound manage to return the quote above 1.1957 and finish the week above this level.

Taking into account that the US dollar is currently the undisputed favorite in the foreign exchange market, this task is very difficult. If the assumption of a further fall in sterling is correct, we will look for points for selling GBP/USD in smaller time intervals.

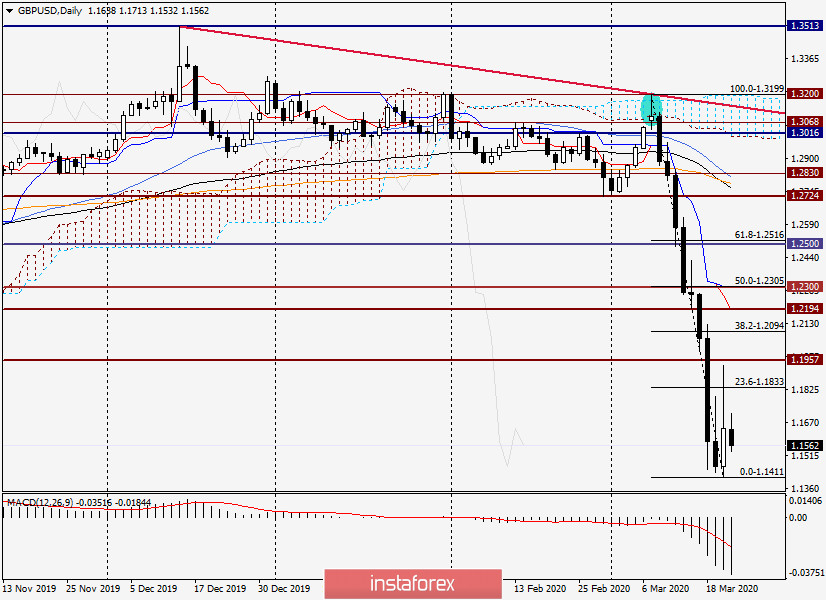

Daily

Last Friday, the pair rolled back slightly above 23.6 Fibo from the fall of 1.3199-1.1411, but fell short of the broken support level of 1.1957. In my opinion, this moment was very good for opening sales, but it is already in the past.

We can assume that the pound/dollar will once again try to adjust to the area of 1.1830 and give an opportunity to open short positions. If the pair manages to rise above Friday's highs of 1.1933 and close the session above this level, there will be a probability of a deeper corrective pullback, the goals of which will be the psychological level of 1.1000, and above the level of 1.2094 and possibly 1.2194.

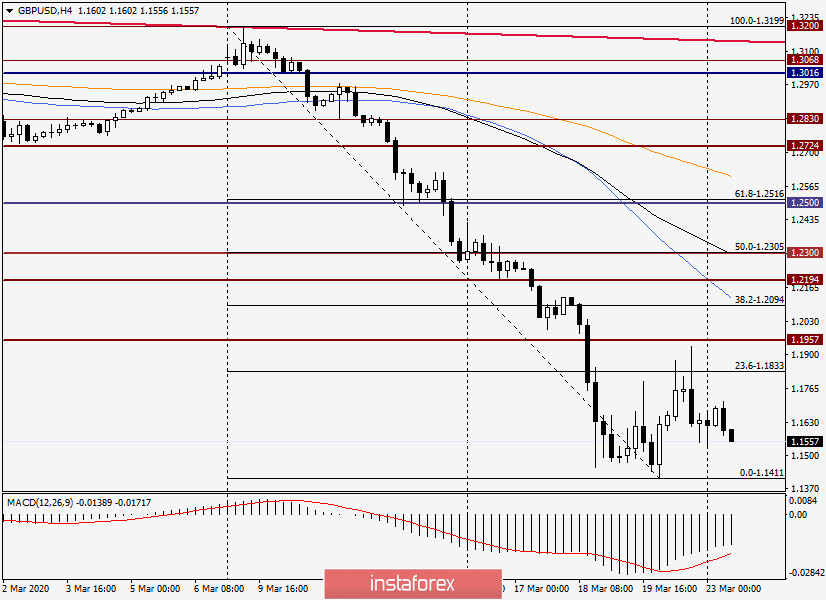

H4

On the 4-hour chart, the pair is trading in a relatively narrow sideways range. Although, given the strong volatility of trading, it can only be called narrow.

I usually suggest opening positions on the trend, and after corrective rollbacks. Despite strong bearish pressure, there is always the possibility of a rate correction, so it is risky to open short positions near the current lows.

I dare to assume that in the event of a rise in the price zone of 1.1700-1.1770 and the appearance of bearish candle signals there, there will be grounds for opening sales for GBP/USD. You should look for more attractive prices for opening short positions in the area of 1.1830-1.1900.

Alternatively, for those who trade on the breakdown, you can try to sell at the census of the minimum values on March 20 - 1.1411. In my opinion, this is quite risky, but it's up to you.

Good luck!