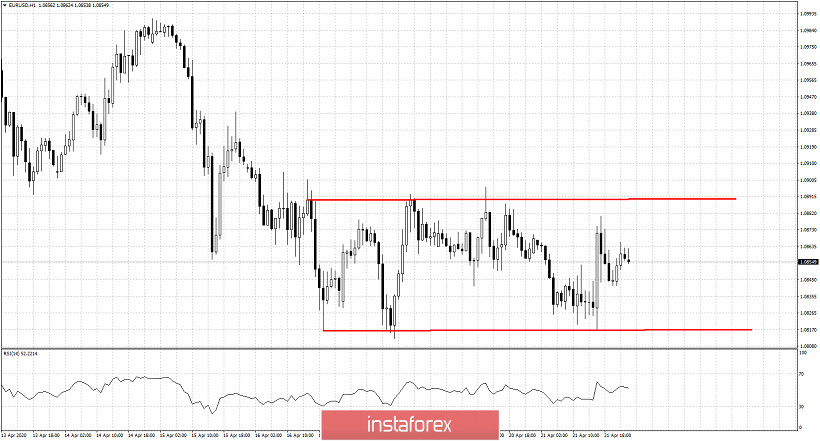

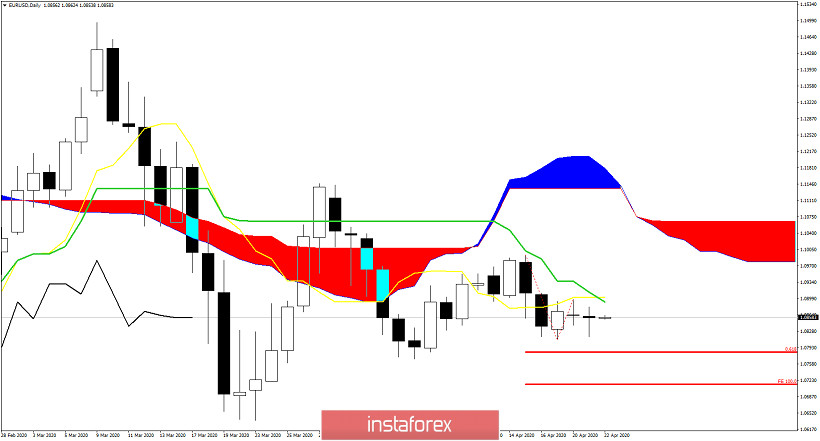

EURUSD has made no real progress over the last few sessions. Price has been trading mostly sideways between 1.08 and 1.09. As our previous analysis has shown, most signs we are given from charts and indicators are bearish.

Red lines - trading range

EURUSD has tested 1.08 area 4 times and the 1.09 level 3 times so far since April 16th. Failure to hold above 1.08 I believe will put 1.06 in danger, with increased chances of breaking below it. On the other hand a move above 1.09 will give some hopes to bulls and it will be very interesting to see if price can continue higher.

At 1.09 we have also both the tenkan-sen and kijun-sen indicators, confirming this is important short-term resistance. However I continue to believe that as long as price is below 1.10 we should remain on the bearish camp, expecting a move towards 1.06.