EUR/USD is traded at 1.0739 level and it seems unstoppable in the short term. It has ignored the near-term support levels and now accelerates the sell-off. The eurozone's poor economic data has weakened the euro. I said yesterday that the outlook is bearish and that the price could drop further if the data comes in worse than expected.

The Dollar remains strong as the USDX has resumed the upside movement, the index is somehow expected to register an important bullish movement in the upcoming period, so EUR/USD could drop towards fresh new lows. The euro depreciates versus the major currencies after the eurozone's Manufacturing and Service sectors have fallen deep into contraction territory as a COVID-19 effect. Surprisingly, the US Flash Manufacturing PMI has come in better than expected, at 36.9, beating the 35.1 estimates.

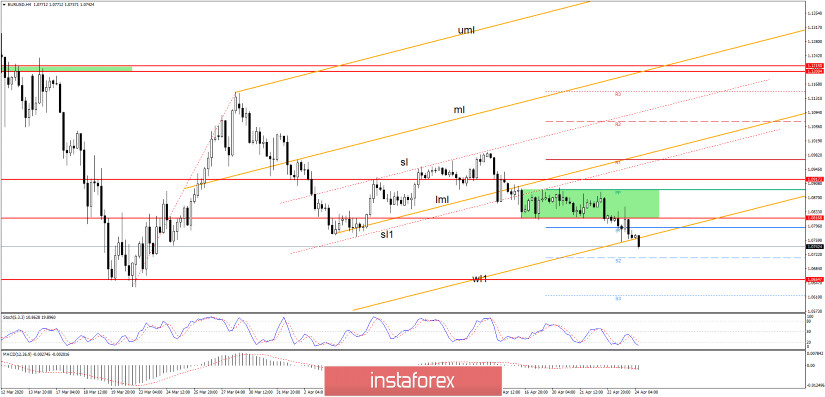

The USD continues to increase after the mixed US data, EUR/USD has stabilized below the 1.0816 signaling a further drop. It has ignored the weekly S1 (1.0791) level and now is trading below the first warning line (wl1) of the orange ascending pitchfork.

The next downside target is seen at the S2 (1.0712) level, but you should be careful because the price could come back to test and retest the broken warning line (wl1) before it drops deeper.

The outlook is bearish on EUR/USD, a major decrease could be confirmed after a valid breakdown below the 1.0654 static support. I've said yesterday that you can use the S2 (1.0712) and the S3 (1.0612) level as potential downside targets in the short term, a valid breakdown below the 1.0654 could signal a drop on the medium to the long term.

- TRADING TIPS

EUR/USD is bearish as the USDX is bullish, the pair is into a long-term downtrend, a valid breakdown below the 1.0654 static support, another lower low, will validate a further drop. Technically, the current drop is natural after the price has escaped from the minor sideways movement between the PP (1.0891) and the 1.0816.

We may have a selling opportunity if the price will come back to test and retest the warning line (wl) and the S1 (1.0791) level. A larger drop could be invalidated only if the price makes a false breakdown with a great separation below the 1.0654 level, a reversal pattern on this level will announce a bullish movement.