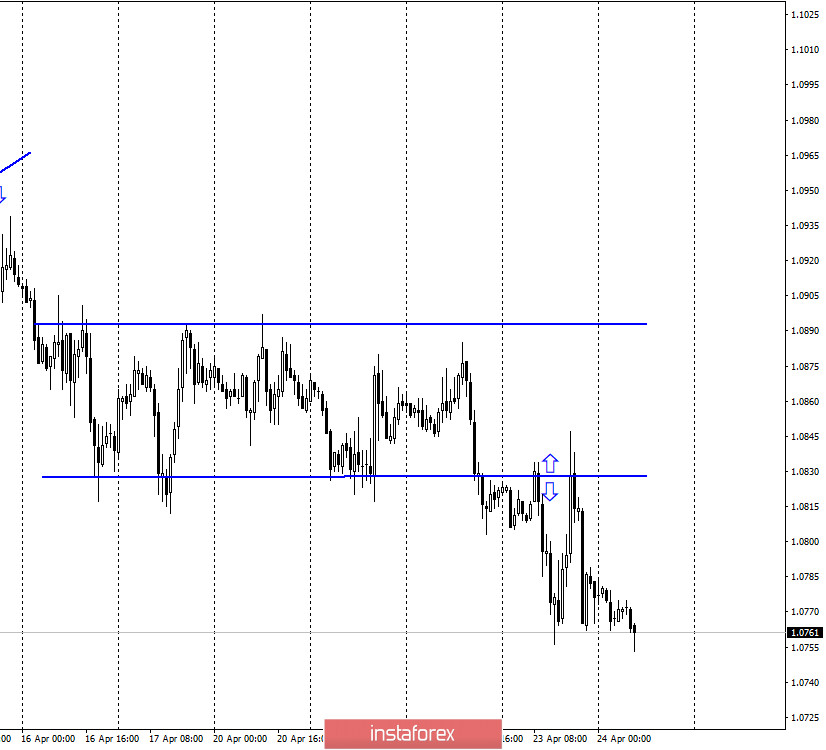

EUR/USD – 1H.

Hello, dear traders! On April 23, the EUR/USD pair grew and returned to the lower border of the side trend corridor. Then, the price pulled back from this level and started falling again. Thus, the lower border of the side corridor once again played in favor of bear traders. There are no new graphical patterns on the current chart. However, they may appear any time soon. From all the news released yesterday, I can single out the failed negotiations between the EU countries. The parties have not managed to agree on new measures that could help support the economy, or on the exact size of the aid. The new relief package is expected to amount to 1.6-2.2 trillion euros. Consequently, a decision on these vital issues is delayed. The most important thing is not to be late with the decision. The euro dropped amid the failed negotiation results of the summit. However, today, the greenback is likely to experience turbulence as news from the US is expected during the day.

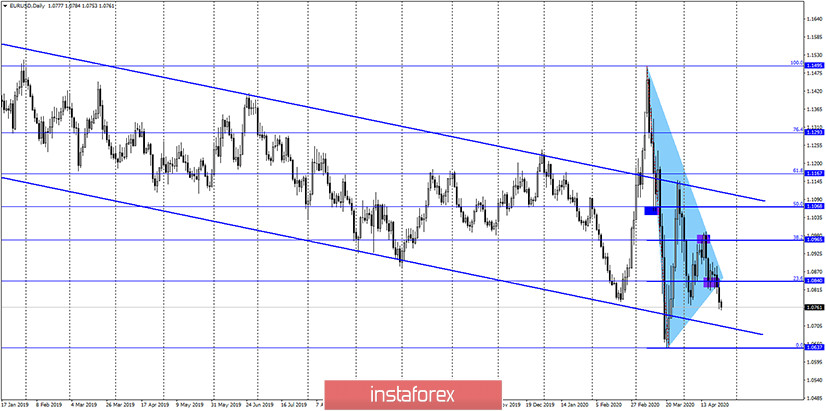

EUR/USD – 4H.

According to the 4-hour chart, the quotes rebounded from the correction level of 1.0840 (23,6%) and pulled back falling in the direction of the correction level of 1.0638 ( 0.0%). Bearish sentiment in the market prevails as the downward movement continues. Today, no divergences are expected near any of the indicators. Consequently, if the information background does not does not intervene, the euro-dollar pair is likely to continue sinking. I think it is better to buy the euro if the quotes consolidate above the downward trend line. In this case, the market sentiment is likely to change for the bearish.

EUR/USD – Daily.

According to the daily chart, the EUR/USD pair consolidated below Fibonacci retracement level of 1.0840 (23.6%), as well as delow the tapering triangle. Consequently, there are two sell signals at once on this chart. This fact significantly increases the chances of the pair falling in the direction of the correction level of 1.0637 (0.0%).

EUR/USD – Weekly.

On the weekly chart we can see that the EUR/USD pair continues to trade near the bottom line of the tapering triangle. A rebound of quotes from this line still allows us to expect growth of the pair in the long term in the direction of the level of 1.1600 (the upper line of the triangle). If the price closes below the triangle, the pair is likely to fall. In this case a new long-term downward movement is possible.

News overview:

On April 23, a series of business activity reports - composite services and manufacturing PMIs - was released in the European Union at once. All the indicators showed the strongest drop of business activity compared to the previous month - March. Data from the United States was weak as well. Thus, the US business activity was extremely low. Moreover, the number of initial applications for unemployment benefits increased by another 4 million.

Macroeconomic calendar for USA and EU:

On April 24, new orders for US durable goods are set for release. They are expected to decline by 6-12%.

Overall, no important news from the eurozone is expected on April 24.

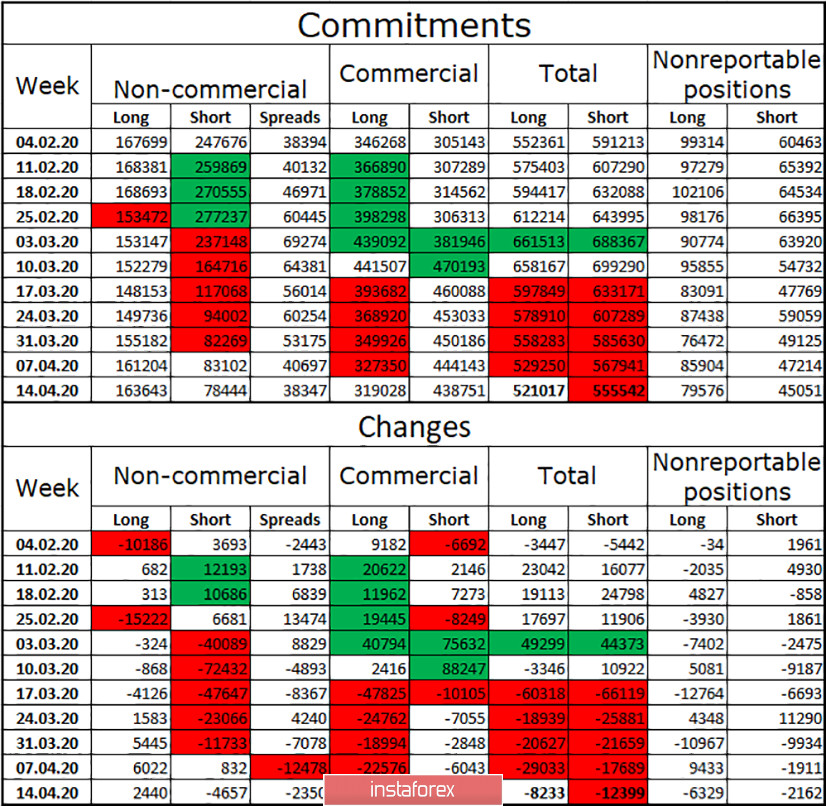

Commitments of traders report:

The latest Commitments of traders report showed no major changes in the mood of hedgers and speculators. Large market players were closing their long and short contracts. The number of long deals decreased by 12,399 while short positions fell by 8,233. Only the Non-commercial group, that is speculators, recorded an increase in long contracts. However, these speculators have been actively closing short contracts over recent months. They do not expect the greenback to strengthen. Overall, major players preferred to close their short positions. Over the past week, the number of short contracts has decreased in absolute terms. Consequently, the possibility of a fall in the euro is reduced. The euro-dollar pair has not been showing a high tendency to drop over this week. Thus, large market players are likely to continue to reduce the number of short positions. A new Commitments of traders report will be released later today.

Forecast on EUR/USD and recommendations for traders:

It is better to sell the euro with a target at 1.0638. There are four signals on three charts indicating that sell deals are preferable at the moment. Apart from that, do not forget about using Stop Loss orders. It is better to buy the euro after the quotes consolidate above the downward trend lina on the 4-hour chart with targets at 1.0964 and 1.1065.

Terms:

Non-commercial are major market players: banks, hedge funds, investment funds, private and large investors.

Commercial are commercial enterprises, firms, banks, corporations, companies that buy currency not for speculative profit, but for ensuring current activities or export-import operations.

Non-reportable positions are small traders who do not have a significant impact on the price.