USD/JPY is trading in the green according to the H4 chart, but the pressure is still high as the pair is located below some strong upside obstacles. The pair has signaled an oversold situation in the short term, a USDX's further increase could bring a reversal soon.

The dollar has taken the lead as the US economic data has come in mixed lately, even if the COVID-19 crisis continues. I believe that today's US data will be crucial for the USD, some poor numbers will send the USDX down and will force the dollar to depreciate versus its rivals.

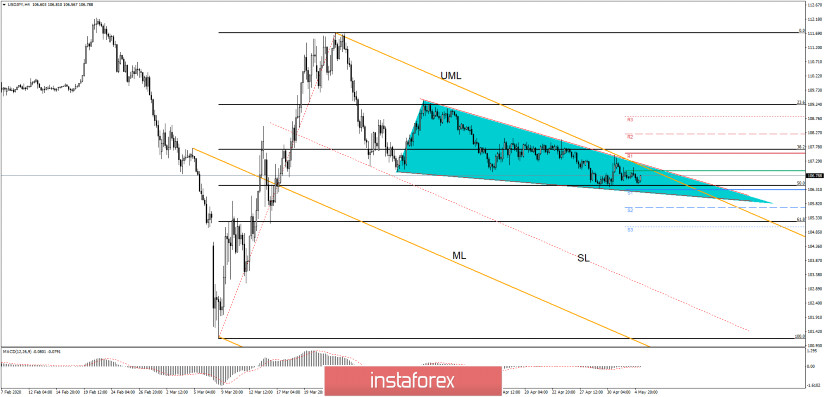

The pair has found strong support at the 50% retracement level and now it tries to approach the upper median line (UML) of the orange descending pitchfork. USD/JPY has developed a Falling Wedge pattern as well, but we need confirmation before we buy this pair.

USD/JPY has failed to approach and reach the median line (ML) of the orange descending pitchfork, so a valid breakout above the upper median line (UML) could signal an increase towards the 111.71 high. MACD is showing bullish divergence on the H4 chart, but we need a clear signal to consider going long.

- TRADING TIPS

USD/JPY was into a corrective phase after the last leg higher, it has decreased as much as 106.35, and now has developed a Falling Wedge pattern. It has found support at the 50% retracement level after it has moved away from the inside sliding line (SL) of the descending pitchfork.

So, we'll have a buying opportunity if the price will make a valid breakout from the Falling Wedge pattern, above the upper median line (UML), and if it closes and stabilizes above the R1 (107.55) and above the 38.2% Fibonacci level. The major upside target is seen at the 111.71 high, such an increase could appear after a valid breakout through the near-term obstacles and after the failure to approach and reach the median line (ML).

USD/JPY is under pressure as long as it stays below the upper median line (UML), a rejection or a false breakout will send the rate way lower. A further decrease will be confirmed after a valid breakdown below the S1 (106.29) and below the chart pattern's support. In this situation, you can use S2 (105.69), S3 (105.02), and the 61.8% level as potential targets.