Overview:

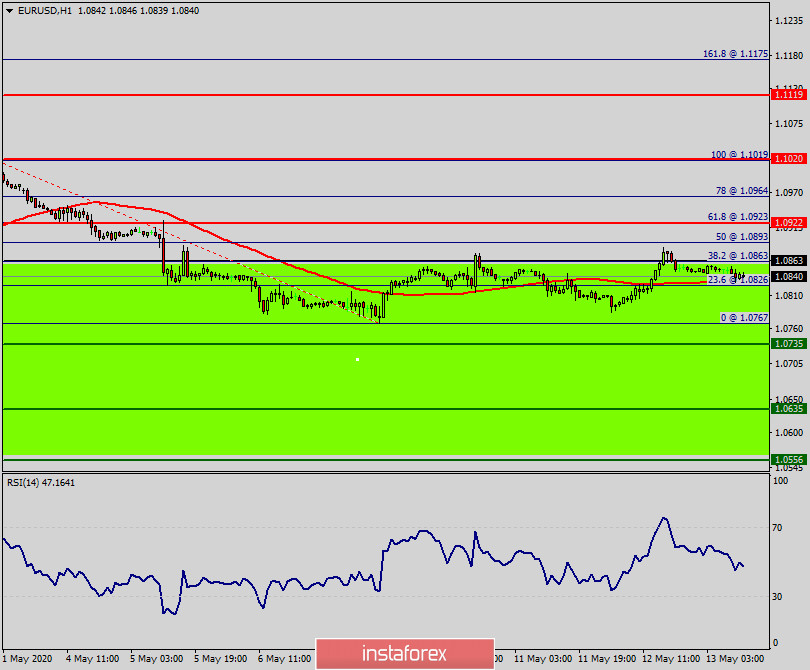

The EUR/USD pair faced resistance at the level of 1.1020, while minor resistance is seen at 1.0922 (coincides with the ratio of 61.8% Fibonacci retracement).

Support is found at the levels of 1.0735 and 1.0635. Pivot point has already been set at the level of 1.0863.

Equally important, the EUR/USD pair is still moving around the key level at 1.0863, which represents a daily pivot in the H1 time frame at the moment.

Yesterday, the EUR/USD pair continued moving upwards from the level of 1.0767 to the top around the 1.0863 level.

In consequence, the EUR/USD pair broke resistance, which turned into strong support at the level of 1.0767. The level of 1.0767 is expected to act as the major support today.

We expect the EUR/USD pair to continue moving in the bullish trend towards the target levels of 1.0922 and 1.1020.

On the downtrend: If the pair fails to pass through the level of 1.0863 (pivot), the market will indicate a bearish opportunity below the level of 1.0863. So, the market will decline further to 1.0767 to return to the daily support in order to form the double bottom. Moreover, a breakout of that target will move the pair further downwards to 1.0735.

But in overall, we still prefer the bullish scenario as long as the trend is above the area of 1.0767.