Economic calendar (Universal time)

The main statistics for the UK today are already announced. Most of the indicators are in the positive zone, but there is also some negativity. Thus far, the attention of the economic calendar is focused on waiting for data from overseas: the index of the cent of producers at 12:30 and data on crude oil reserves at 14:30.

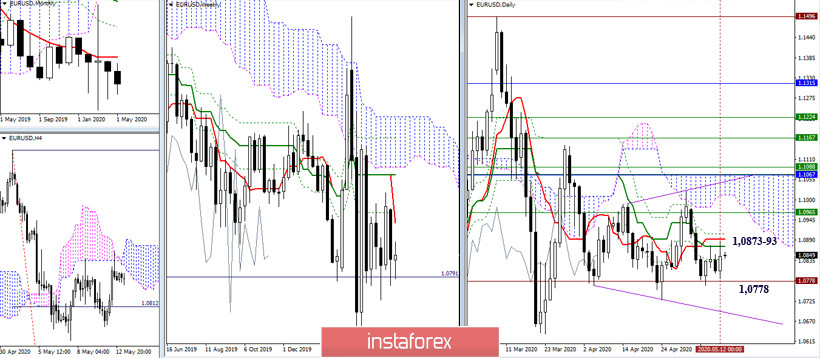

EUR / USD

The players to decline failed to break through the support of the historical level of 1.0778 once again. Yesterday, the pair returned under the resistance of the daily cross (Kijun 1.0873 + Tenkan 1.0893), thereby continuing consolidation within the boundaries of the indicated landmarks. The breakdown of borders can make a difference. In this case, the attention of players to increase will shift to the resistance of 1.0965 (weekly Fibo Kijun) and 1.1067 - 88 (accumulation of levels of different halves), and for players to decrease, the minimum extrema 1.0727 - 1.0636 and the trend will become relevant lines.

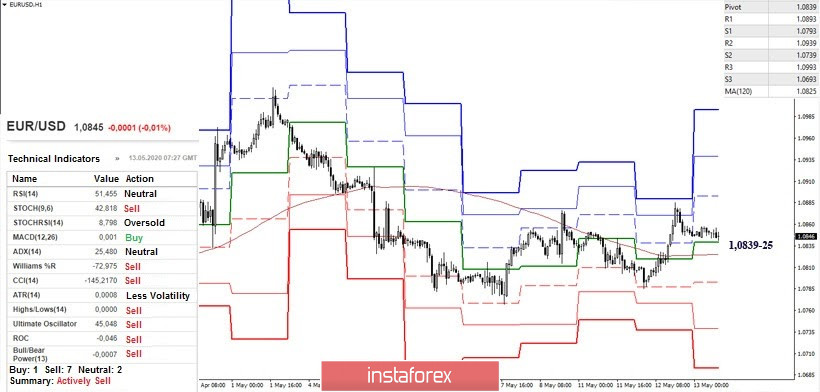

The tactics of constant attacks brought results. The key resistance was eventually broken. As a result, the players to rise are using a certain advantage of forces today, using significant H1 levels as support. While 1.0839 - 25 (central Pivot level + weekly long-term trend) supports bullish interests, there are still prospects for a new test of the resistance of the higher halves (1.0873-93), with subsequent strengthening of the players to increase. Within the day, the upward reference points in the form of classic Pivot levels are located today at 1.0893 - 1.0939 - 1.0993. If the players on the rise in the near future will lose support 1.0839 - 25, then in this case, the bears will most likely make an attempt again to break through the level of 1.0778. By doing so, new opportunities will open. Support for the classic pivot levels of 1.0739 (S2) and 1.0693 (S3) will join the prospects for the higher halves.

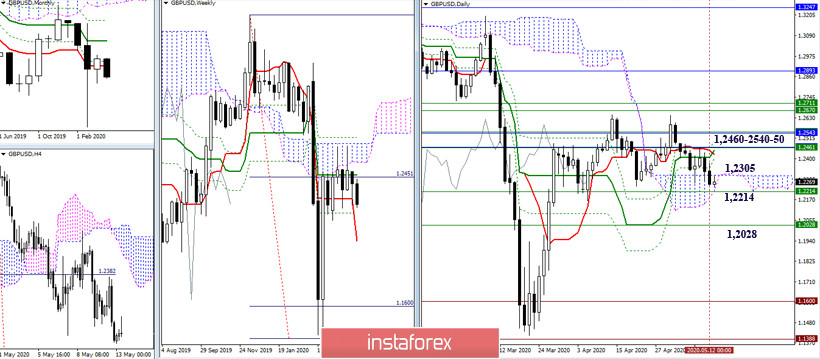

GBP / USD

Yesterday, the pound closed the working day in the daily cloud. After that, the main task for players on the downside is to exit the cloud, with a consolidation in the bearish zone relative to it. The lower border of the daily cloud is now strengthened by the weekly Fibo Kijun (1.2214). The cloud in this place is quite narrow, so the failure of the bears and the rebound from the encountered supports can quickly return some of the advantages of the opponent.

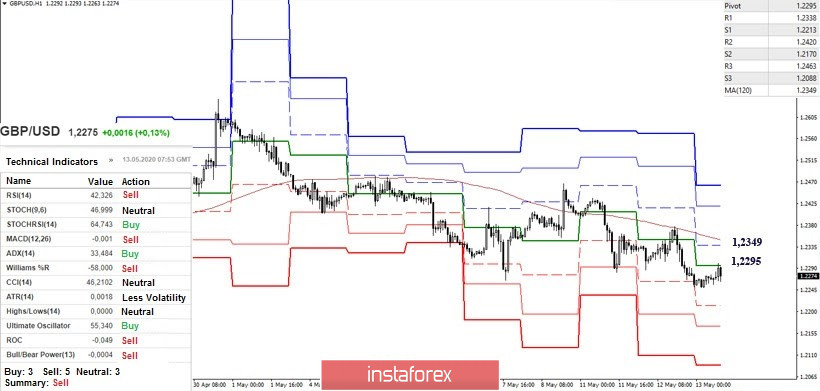

On H1, the key resistance yesterday retained the advantage for the players to decline. Thanks to this, the bears continued to decline. Currently, the pair is in the zone of upward correction and is testing for strength the first correctional reference point - the central Pivot level (1.2295). And while maintaining the bearish advantages and the continuation of the downward trend, intraday support may be S1 (1.2213) - S2 (1.2170) - S3 (1.2088). In case of consolidation above the central Pivot level of the day (1.2295), the weekly long-term trend (1.2349) will become the next pivot point of correction. Breaking through this level (1.2349) and reversing the moving can change the current balance of forces and open prospects for the further restoration of bullish positions.

Ichimoku Kinko Hyo (9.26.52), Pivot Points (classic), Moving Average (120)