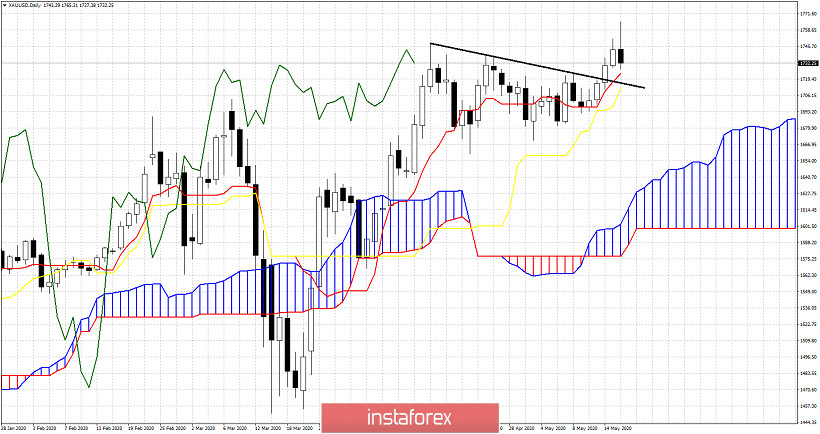

Gold price has reached very close to out target that we noted in previous posts after breaking above the key short-term resistance at $1,720-25 area. Gold price although pushed higher today towards $1,765, the end of the day found bulls on the defensive as sellers overpowered them.

Red line - bearish divergence

Green rectangle -target

As we explained in our previous analysis, although we are short-term bullish looking for a move towards $1,770, the weekly bearish divergence makes us turn bearish near the green rectangle target area. Gold price closed near the lows of the day and after a long upper tail in today's candlestick. The RSI remains below key trend line resistance with glaring weekly divergence.

Black line - resistance

Gold price is still in bullish mode despite the ugly daily candlestick. Price is still above both the tenkan-sen and kijun-sen indicators at $1,723-12. This is key short-term support. Gold price will most probably touch this area as a back test of the break out. Holding above $1,700 is key for the medium-term trend. Breaking again below $1,700 will open the way for a move towards $1,640.