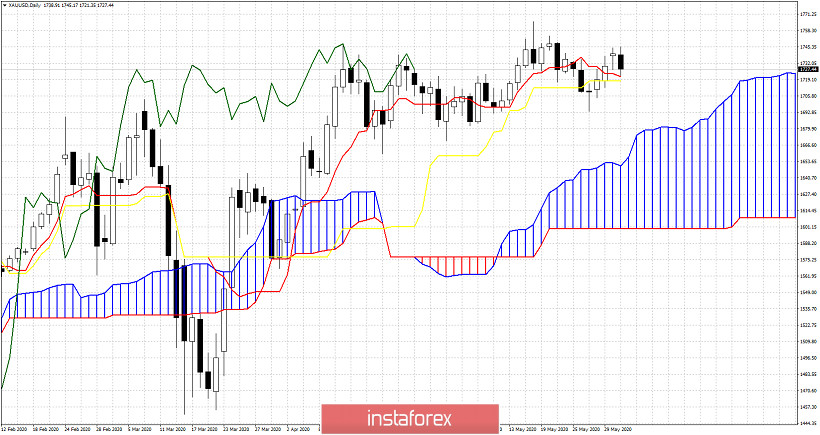

Gold reached $1,745 but price got rejected once again at recent highs and is now pulling back. Trend remains bullish as long as price is above $1,720-$1,710. This is very important support both horizontally and by using the tenkan-sen and kijun-sen indicators.

The tenkan-sen (red line indicator) has a negative slope. If this indicator crosses below the kijun-sen (yellow line indicator) we will have a weak sell signal. Key support to be tested afterwards. This support would be at the Cloud (Kumo) at $1,675. Inability to produce higher high is a sign of weakness.As we said many times before, trend might be bullish, but the weekly RSI provides us a with a bearish warning. This makes us be bearish Gold around $1,750 and higher.