4-hour timeframe

Average volatility over the past five days: 85p (average).

The EUR/USD currency pair continued to trade with an increase on Tuesday, June 2 as if nothing had happened. Traders have been waiting for a downward correction for several days in a row, but it still does not start. Just a few days ago, the euro/dollar was firmly "sitting" inside the side channel, and there was no fundamental reason for a new upward trend to begin. Market participants cheerfully ignored all macroeconomic reports. Now, even a macroeconomic background is not required. In principle, we cannot even say that the US dollar is falling in value in pairs with the euro and the pound solely due to riots and riots in the United States. Most likely, traders are getting rid of the US currency now for a combination of reasons. And among this aggregate, one can distinguish the impending threat of a new trade war with China, the threat of a cold war with China, the strongest collapse of the US economy, the high threat of the second wave of the epidemic (the likelihood of which has also increased over the past week thanks to all the same rallies and protests of the American people, during which, of course, no rules of social distance are respected), and, frankly, the political crisis. We talked about Donald Trump, his activities, his manner of conducting international and internal affairs a thousand times. In short, we believe that Donald Trump is an excellent businessman who managed to apply his business qualities in the first three years, which benefited America and its GDP, but a bad leader and a bad politician, because he managed to lose everything due to the lack of necessary qualities his merits for the next few months of his reign. Trump constantly underestimated China, underestimated the Democrats, believing that it is the smartest and most powerful. In practice, it turned out that it was intentionally or accidentally, but it was Beijing that dealt such a blow to America that it is now unknown when the "great country" will recover from it. And Trump himself with a high degree of probability will not be the next president of the country.

The events of recent weeks have affected Trump's political ratings not only because the country's president is always responsible for what is happening in this country. According to opinion polls, most Americans think Trump is a racist (52% according to YouGov). 45% of respondents said that, in their opinion, interracial relations in America have worsened in recent years. Agree, it is very disadvantageous when the majority of the population considers the president a racist in the midst of a racist scandal. As for the liking of potential voters, Trump lost 4% in popularity over the past week, and Joe Biden scored 4% and, thus, now the Democrat is leading by a margin of between 8% and 10%.

Meanwhile, Hong Kong Prime Minister Carrie Lam accused the US government of "double standards." At the end of last year, when riots took place in Hong Kong due to the adoption of several laws that contradict the autonomy of the district and the principle of "one state - two systems of government," Washington publicly condemned the actions of the Chinese police, which too harshly pacified the rebels. The White House even made a decision at the legislative level to restrict sales of certain categories of goods that were used by the Chinese police to suppress the riots. Now, when mass protests are taking place in the United States themselves, the American police do not limit themselves at all in the means of suppressing rebellions. "America is very concerned about its own national security, but they look at our national security through tinted glasses," said Lam. "We see how the authorities in the US" cope "with the riots and compare it with their position that they took when almost the same riots occurred in Hong Kong last year." Lam also recalled Trump's words about the "powerful blow", clearly hinting that America had run into what it was fighting for.

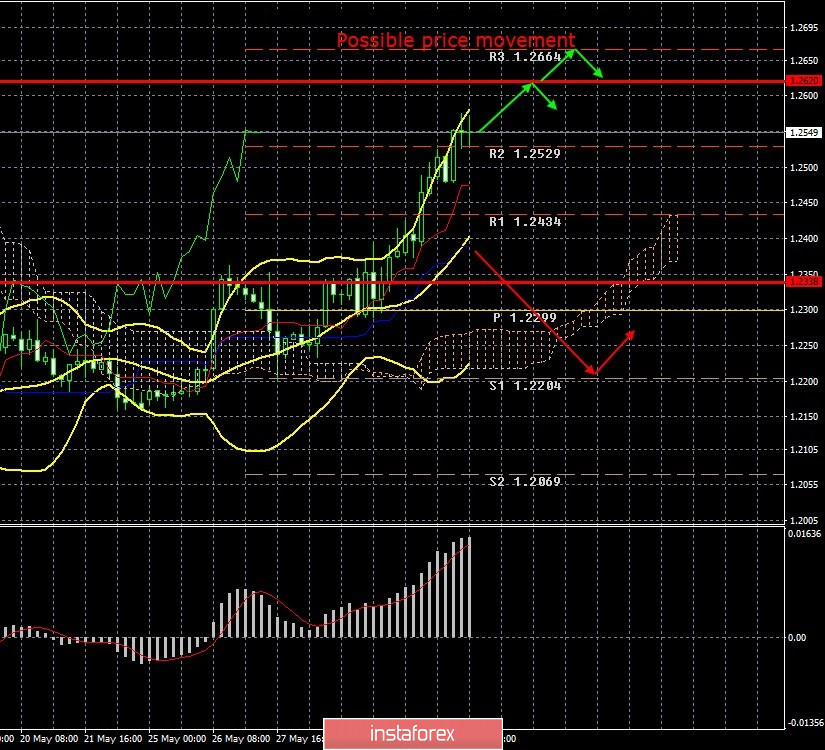

4-hour timeframe

Average volatility over the past five days: 141p (high).

The GBP/USD currency pair also continued its upward movement on June 2, which has clearly intensified in recent days. Thus, during the day the pound/dollar pair overcame the second resistance level for this week at 1.2529 and did not show a single sign of starting a correctional movement. The pair's volatility has significantly grown in recent days, and the reasons for strengthening the British currency are now similar to the reasons for the euro's growth. And they obviously do not lie in the European Union or Great Britain. From the UK, we have already forgotten when the last time came positive news or macroeconomic data. Which, in principle, is not surprising in times of global crisis and epidemic. However, even when the economies of all countries of the world are contracting, and the epidemic is affecting the inhabitants of these countries, for some reason, Britain is in first place in the number of COVID-19 related deaths in Europe, as well as the one with the most number of cases of diseases. A second wave of a pandemic is possible in Britain. Thus, even in a situation where all countries of the world are experiencing serious problems, Britain is even more serious. And if it were not for the unexpected and completely discouraging story in the United States, the pound would now fall back to the March 23 lows. However, instead, the British currency is growing and already approaching the highs of April 14 and April 30, which almost coincide at a price level of 1.2647. Actually, only about 100 points remain until this level is reached. We believe that it is around this level that the fate of the pound will be decided in the coming weeks. If traders show their strength and overcome this level, then the upward movement may continue with renewed vigor, but its duration will depend on the current circumstances on how quickly it will be possible to suppress rebellions and riots in America. In case the pair's quotes rebound from the 1.2647 level, bears can return to the market and recall that the economic situation in Britain (the most important and significant for traders) is no better than in the US, which means there are no particularly good reasons for long-term purchases of the British no pound. Well, if a new chunk of information about the failure of the next round of Brussels-London negotiations arrives in June, it can also significantly reduce the attractiveness of the pound in the eyes of traders.

Recommendations for EUR/USD:

For long positions:

The EUR/USD pair continues its upward movement on the 4-hour timeframe. Thus, the current targets for open buy orders are now levels 1.1205 and 1.1312. You are advised to manually close longs when the price rebounds from any target. The MACD indicator may now give false signals about the beginning of a correction, since the upward movement is practically recoilless.

For short positions:

Orders for sale can be opened no earlier than consolidating the price below the critical line with the first target support level of 1.0931. However, in this case, trading for a fall is recommended in small lots.

Recommendations for GBP/USD:

For long positions:

The pound/dollar is also continuing its upward movement. Thus, it is also advised to stay in purchases with targets of 1.2620 and 1.2664 until a rebound from any target occurs or the MACD indicator turns down when the price drops in parallel.

For short positions:

It is recommended that sales of the GBP/USD pair be considered with a target of 1.2299 and Senkou Span B line not before consolidating quotes under the Kijun-sen line, which is not expected in the near future.