Overview:

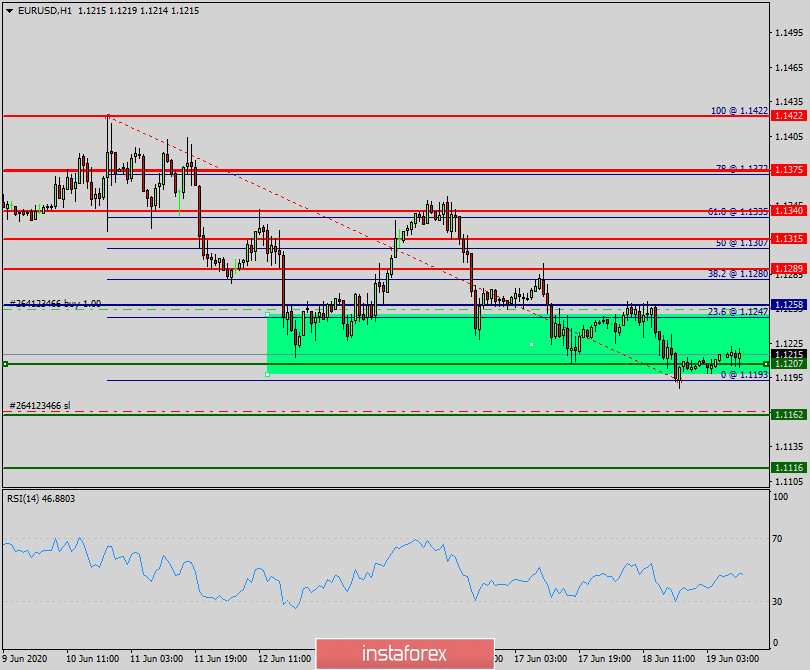

The price is still moving around the spot of 1.1190 / 1.1210. The EUR/USD pair didn't make any significant movements yesterday. There are no changes in our technical outlook. The bias remains bullish in the nearest term testing 1.1315 or higher. The EUR/USD pair continues to move upwards from the level of 1.1207. Right now, the first resistance level is seen at 1.1258 followed by 1.1315 and 1.1375, while daily support 1 is seen at 1.1207. According to the previous events, the EUR/USD pair is still moving between the levels of 1.1207 and 1.1375; so we expect a range of 168 pips. Furthermore, if the trend is able to break out through the first resistance level at 1.1258, we should see the pair climbing towards first resistance (1.1315). Therefore, buy above the level of 1.1258 with the first target at 1.1315 in order to test the daily resistance 1 and further to 1.1375. Also, it might be noted that the level of 1.1375is a good place to take profit because it will form a double top. This would suggest a bullish market because the RSI indicator is still in a positive spot and does not show any trend-reversal signs. Therefore, it will be advantageous to buy above 1.1207 with a first target 1.1258 in order to test the weekly pivot point. It may resume to .1375 if the price is able to break 1.1258. On the other hand, stop loss should always be in account, consequently, it will be of wholesome to set the stop loss below the support 1 at the price of 1.1175.