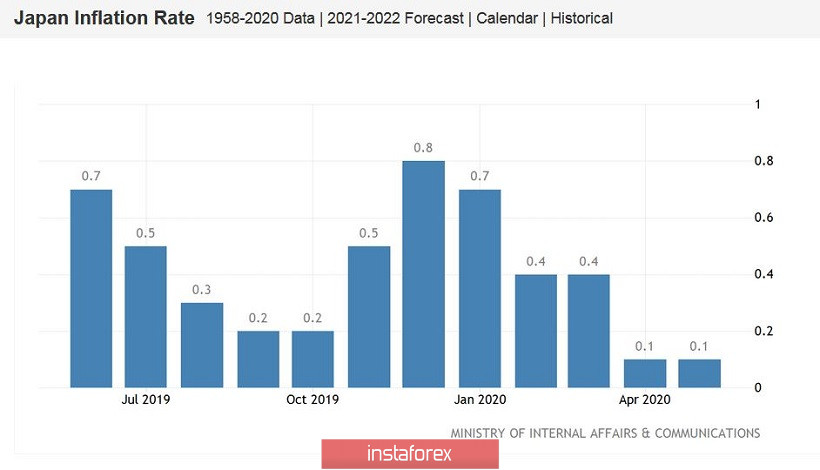

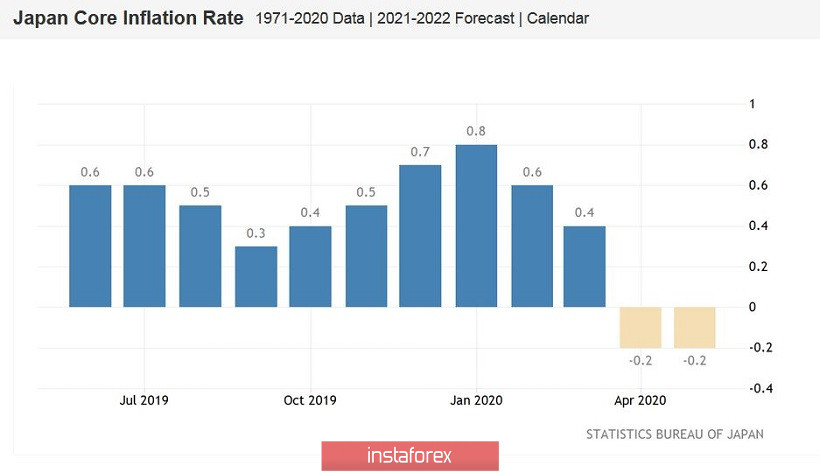

Today's publication on inflation in Japan is mixed. General consumer price index came out at a forecasted level, repeating the trajectory in April (the indicator also turned out to be around 0.1% in May), while the consumer price index excluding fresh food prices was in the "red zone", dropping to -0.2% (with a forecast decline to -0.1%). "Cleaned" inflation (CPI excluding food and energy prices), on the contrary, came out in the "green zone", exceeding experts' expectations by growing to 0.4%, higher than the expected 0.2%.

In other words, inflation exceeded forecast values and did not provoke volatility in the USD / JPY pair. Traders of this pair have not been active recently, even amid the meeting of the Bank of Japan in June. Only the escalation of geopolitical tensions in the Korean peninsula and on the border between India and China did the bears manage to shift the quotes one step downwards, thus, if at the beginning of the week, the quotes did not leave the limits of the 107th figure, the upper "border" now is 107.30, while the pair basically resides within 106 price levels.

Yesterday, the USD / JPY pair updated its weekly low after the publication of weak macroeconomic statistics from the US. According to the data, the number of applications for unemployment benefits increased by 1 million 508 thousand, slightly higher than the forecasted 1 million 300 thousand. The indicator, for 10 weeks, stably and consistently showed a downward trend (after nearly reaching 7 million), but this week came out almost at the level of earlier records. This suggests that the trend in the labor market is still unhealthy, so traders should remember the Fed's warning on the slower and longer recovery of the US economy. Such a factor became another anchor for the dollar.

Additional pressure was provided by the statements of the head of Cleveland Fed, Loretta Mester, who said that the regulator is ready to expand its balance "if necessary". She also noted that the issue of controlling the yield curve "remains under discussion", and the recovery of the US economy is estimated to take place at a much longer time. As for inflation, it will continue to decline which may lead to lower inflationary expectations, so the Fed will maintain a soft policy for a long period of time. Thus, interest rates will not change and remain at low levels in the future. By and large, Mester did not say anything new, but her rhetoric added to the negative background for the dollar. It allowed the bears to push the USD/JPY quotes to the middle of the 106th figure, but when it reached 106.68, the strength of the bulls intensified, which resulted to a slowdown and rebound of quotes.

Hence, the quotes did not leave the range of the 106th figure, and as soon as the pair touched one of the limits of the channel, the bears seized control of the market again. Nevertheless, the yen has a reason for growth again, as tensions in the Korean Peninsula are escalating, due to the decision of North Korea to send troops into the demilitarized zone on the border with South Korea. At the previously empty border posts, several military DPRKs were noticed. According to experts, Pyongyang may have approximately 150 posts, which ceased to function after the signing of the inter-Korean peace treaty in 2018. The demilitarized zone is not only the border between the DPRK and South Korea, but also the front line, since formally the countries have been at war since 1950.

The US also responded to such events, with the Assistant Secretary of Defense for Indo-Pacific Security Affairs saying that the United States is prepared to counter and defend North Korea's threats "if necessary."

Thus, further aggravation of the Korean conflict may provide additional support for the Japanese currency, which, together with the dollar, may strengthen to the base of the 106th figure. If the market sees signs of de-escalation (for example, if Pyongyang agrees to negotiations through the mediation of China), the USD/JPY pair will go to 107.30, the upper border of the price channel. In other words, the movement will depend not on macroeconomic news, but on news from the Korean Peninsula. Given the trends of recent days, it can be assumed that the next conflict between the DPRK and South Korea has not yet reached its peak, so the USD/JPY pair maintains a bearish potential.