"Eurozone factories reported a very positive start to the third quarter, with production growing at the fastest rate for over two years, fuelled by an encouraging surge in demand. Growth of new orders in fact outpaced production, hinting strongly that August should see further output gains. The order book improvement has also helped restore business confidence about the outlook in July to January's pre-pandemic peak. "The job numbers remain a major concern, however, especially as the labour market is likely to be key to determining the economy's recovery path

As I discussed in the previous review, the EUR managed to do downside rotation as I expected.

The level at 1,1700 seems like solid support for the price today and there is potential for the upside rotation and continuation of the upside trend.

Further Development

Analyzing the current trading chart, I found that the sellers got exhausted today and the upside roattion would be in the play later during the day and tomorrow.

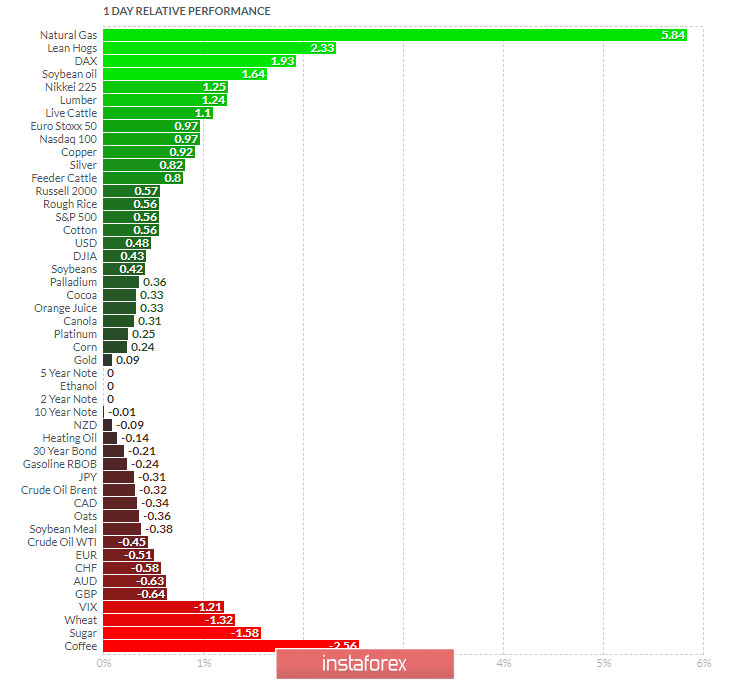

1-Day relative strength performance Finviz

Based on the graph above I found that on the top of the list we got Natural Gas and Lean Hogs today and on the bottom Coffee and Sugar.

In my opinion EUR and most of major currencies might start trend continuation to the upside tomorrow.

Key Lvels:

Support: 1,1700

Resistance levels: 1,1800 and 1,1850