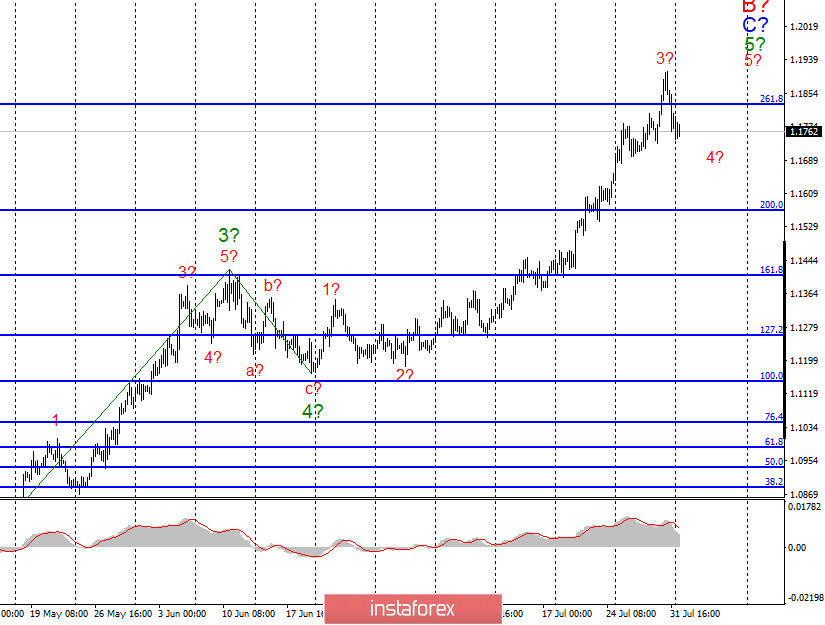

EUR/USD

On July 31, the EUR/USD pair lost about 70 basis points and presumably completed the construction of wave 3, 5, C, B. If this is true, then the decline in quotes will continue within the wave 4, 5, C, B, however, it is unlikely for long. As I said earlier, the tool still needs to build a wave 5, 5, C, B, after which it can complete the construction of the current set of waves and move to a new long-term downward section of the trend. So I'm waiting for another push of the tool up.

Fundamental component:

On Friday, there were many interesting events in the US and economic reports in the European Union. Let's start with retail sales in Germany for June, which increased by 5.9% y/y and decreased by 1.6% m/m. This was the least important report of the day. Further, the most powerful European countries reached the volume of GDP. In Italy, this indicator decreased by 12.4% q/q, in Spain - by 18.5% q/q, in France - by 13.8% q/q, in the European Union - by 12.1% q/q. It is difficult to make a clear conclusion whether these figures are good or not. Statistics show that these falls are a record for each country and for the European Union as a whole, but what else could you expect from GDP during such a serious crisis? American GDP in the second quarter lost a record 33%, which has never been recorded in the entire history of the country. Thus, Europe still got off lightly. After such important reports, inflation in the EU was no longer of interest to traders. And in any case, its slight acceleration does not play any role. It is still very far from the 2% target. The American reports were even less significant. But the American public spent the rest of last week discussing Donald Trump's "masterpiece" proposal to postpone the election. And at the same time, I wondered if this is an attempt by the US president to divert attention from the failed economic figures or the real proposal of the President? Members of the US Congress immediately criticized Trump, saying that the election has never been postponed. Thus, given that for the first time in the history of the United States, the postponement of elections will require the approval of the House of Representatives of the US Congress, which is controlled by Democrats, we can draw an almost unambiguous conclusion that nothing will work for Trump.

General conclusions and recommendations:

The euro/dollar pair presumably continues to build an upward wave C, B. Thus, I recommend continuing to buy the instrument with targets located near the estimated mark of 1.2084, which is equal to 323.6% for Fibonacci, for each new MACD signal "up", since the wave C, B does not yet look fully completed.

GBP/USD

The GBP/USD pair lost several base points on July 31, which was enough to also suggest the construction of wave 4, 5. If this is the case, then the decline in quotes here will also continue with targets located near the 100.0% Fibonacci level. However, another upward wave is also needed here, so that the instrument can complete the construction of wave 5.Thus, the British also need to make at least one more upward leap.

Fundamental component:

In the UK, there was not a single important economic report during the entire current week. There was little other news, however. Only this week the markets can expect interesting information. Today, UK and US trade representatives are due to hold the first stage of negotiations on a future free trade agreement between the countries. However, negotiations can last at least a year, and a maximum of several years. Today, the UK released the index of business activity in the manufacturing sector for July, which was 53.3, which was slightly worse than market expectations.

General conclusions and recommendations:

The pound/dollar instrument continues to build an upward wave 5, nothing changes. Therefore, I recommend that you continue buying the instrument at this time for each MACD signal "up" with the goals located around the 1.3183 mark, which is equal to 127.2% for Fibonacci.