Comments by BOE governor, Andrew Bailey

- We are not taking a strong signal from the recovery so far for what happens next

- We could do more QE, new forms of forward guidance

- Risks are skewed to the downside

- Further stimulus would depend on downside risks coming to fruition

- Faster economic data gives only a partial picture of the economy

- Brexit deal failure is part of downside risks, but virus is the biggest issue for now

Bailey is making a firm plea to markets not to price in the possibility for negative rates just yet but his remarks on the economy sort of says otherwise.

As I discussed in the previous review, the EUR managed to test and reject of my third upward target at the price of 1,1900

The level at 1,1900 seems like solid resistnace for the price today buy I still see that trend is bullish with potential for even fourth target to test at 1,2000.

Further Development

Analyzing the current trading chart, I found that the sellers became exhausted around the 1,1850, which might be the good area for buy for further re-test of 1,1900 or 1,2000.

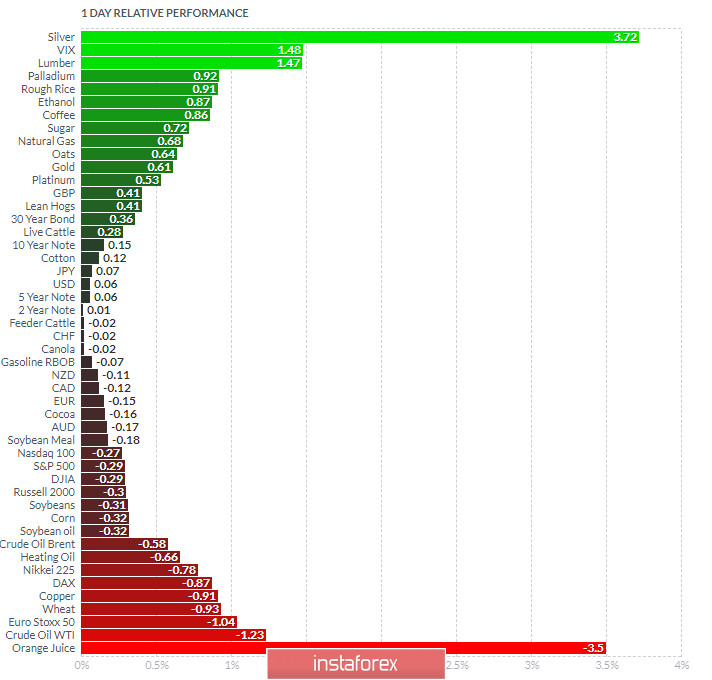

1-Day relative strength performance Finviz

Based on the graph above I found that on the top of the list we got Silver and Lumber second day in a row today and on the bottom Crude Oil and Orange Juice.

EUR is currently negative but with potential for the increase...

Key Lvels:

Resistance: 1,1900

Support levels: 1,1850, 1,1800