Protocols of the ECB had a positive impact on the prices of the euro and weak data on the US labor market led to a new wave of demand for risk assets.

According to published reports, the policymakers of the ECB agreed that monetary stimulus remains appropriate, but the June meeting also discussed that it considered abandoning its pledge to accelerate QE.

The minutes also reflects the motivation of leaders due to weak inflation and economic growth.

The market positively received the statement of ECB representative Peter Praet, who spoke on the risks of the diffusion, which in his opinion, has completely disappeared. Praet also drew attention to the fact that the recovery in the eurozone recently gained additional momentum, but the level of core inflation remains low.

The ECB representative also said that the current management of the Central Bank needs to show patience and persistence before making key decisions on monetary policy.

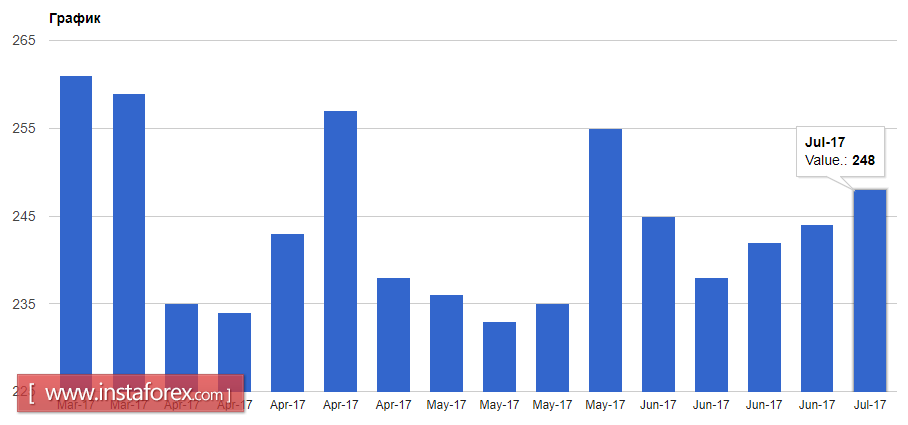

In the afternoon, data showed that the number of initial applications for unemployment benefits in the US for the week from June 25 until July 1 has increased. However, as noted in the report, the labor market remains strong.

According to the US Department of Labor, the number of initial claims for unemployment benefits rose by 4,000 and amounted to 248,000. Economists expected that the figure would be equal to 246,000.

The market was also not pleased with the data from ADP. It showed that the number of jobs creation in the US private sector in June grew by only 158,000 after a rise of 230,000 in May. Economists had expected a larger increase in the number of jobs by 180,000.

The US trade deficit declined in May. The growth of exports exceeded imports and reached its highest level in the last two years.

According to the US Department of Commerce, the deficit of foreign goods and services in May of this year narrowed by 2.3% compared with the previous month, which amounted to 46.51 billion US dollars. Economists had expected a deficit of 46.2 billion dollars. Imports fell 0.1% in May to 238.54 billion, while exports rose 0.4% from April. Total exports were 192.03 billion in May.