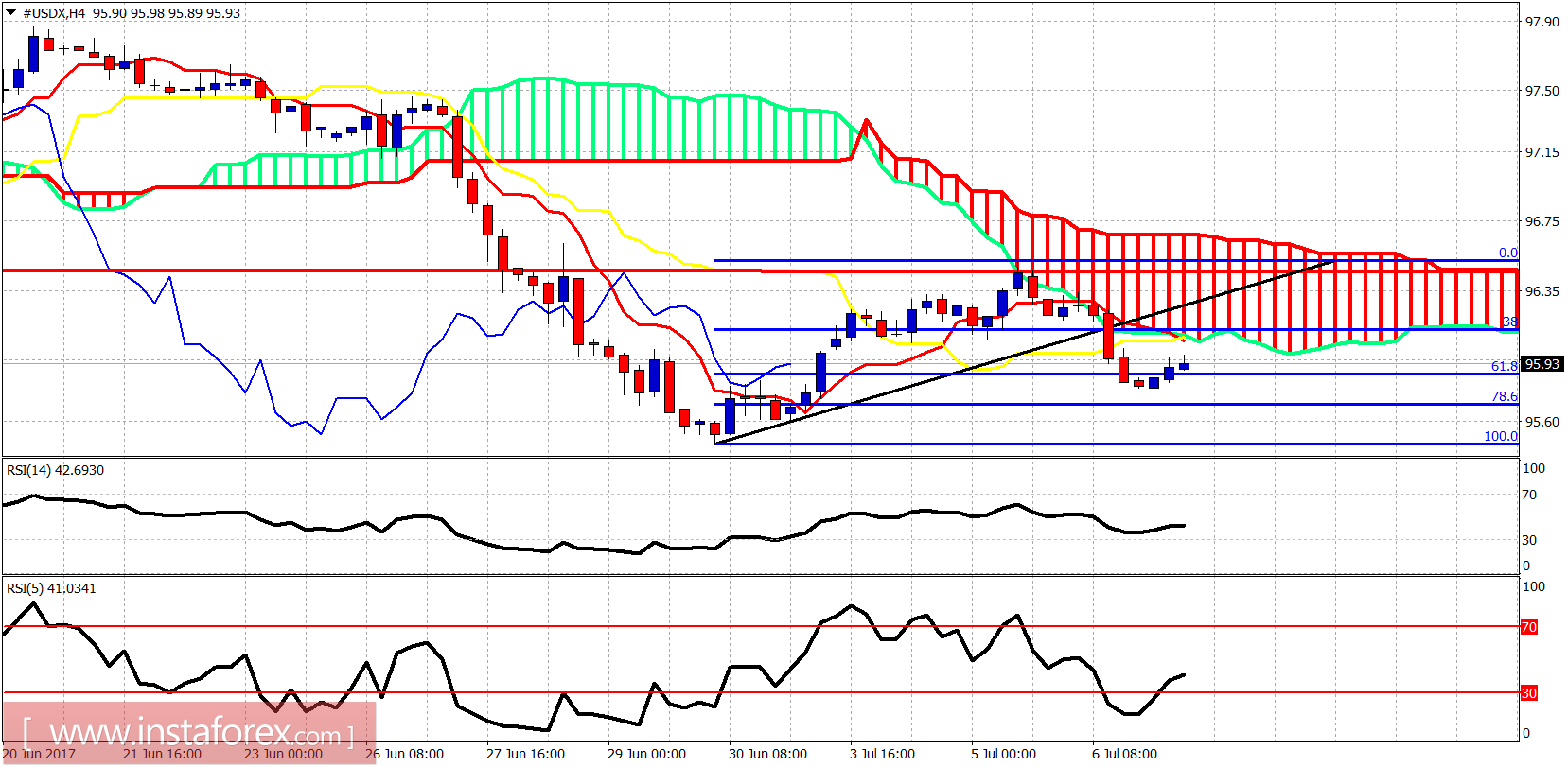

The Dollar index is making a higher low so far as the decline from the rejection at 96.50 has stopped around the 61.8% Fibonacci retracement. Trend remains bearish but I prefer to be on the lookout for a reversal.

Trading for so long on top of the lower channel boundary implies that an explosive upward move will come. Trend is bearish as price is below the tenkan- and kijun-sen indicators. Breaking above them (96.50-96.70) will be a very bullish sign and push price towards 98-98.50.