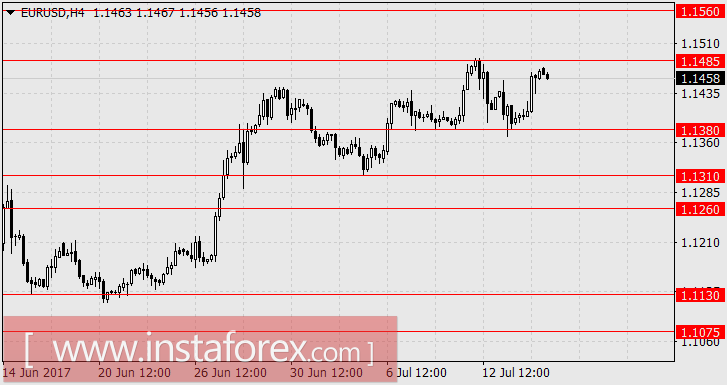

EUR / USD, GBP / USD

Friday's increase in the British pound was 160 points on information about the upcoming concessions of the UK to the EU in the Brexit negotiations this week.

Euro investors are worried regarding the upcoming speech of Mario Draghi after the ECAB meeting on Monetary policy on Thursday. https://www.mt5.com/en/WeeklyReviews/fullview/193 ).

In the US, the Secret Service did not confirm the fact that Donald Trump Jr.

The index of business activity in the manufacturing sector of New York for the current month, coming out today, is projected to decline from 19.8 to 15.2.

We expect the increase of the pound sterling in the range of 1.3160-1.3210 and the growth of the euro to 1.1560.

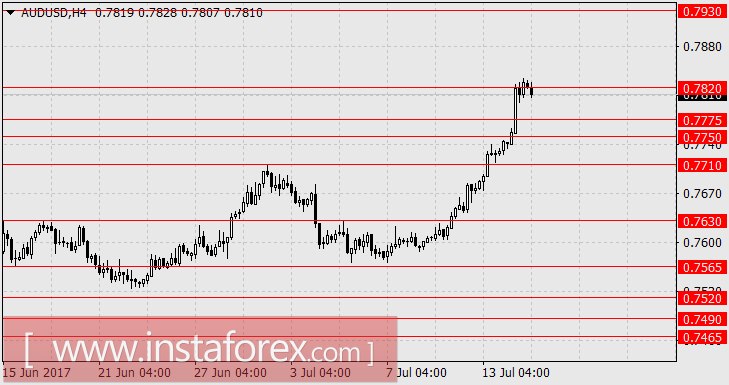

AUD/USD

The Australian dollar, which is rising ahead of the total market since the beginning of the summer, seems it is no longer threatened. Uncertainty over the euro and the pound reached a very confusing phase, oil and iron ore are rising for the third consecutive day (iron ore $65.17 per tonne), coking coal ads 1.1%. Today, excellent macroeconomic news came from China. GDP for the second quarter remained at the same level, 6.9% y/y against expectations of a decline to 6.8% y/y, quarterly growth was 1.7% against the 1.3% in the previous period. Investments in the main production in June also remained at the level of the previous period, 8.6% y/y against expectations of a drop to 8.5% y/y. Industrial production rose from 6.5% y/y to 7.6% y/y, retail sales showed an increase in June from 10.7% y/y to 11.0% y/y with the expectation of 10.6% y/y. In the Chinese stock index, China A50 is growing at 1.34%. The Australian S&P/ASX200 added just 0.08%, on which the AUD/USD for the Asian session loses 15 points.

Tomorrow the minutes of the last meeting of the RBA will be published. It is possible that central bank will follow the example of the European Central Bank (and especially the Bank of Canada, which raised its rate last week) and give a hint of tightening policy in the medium term, even if it does not have it in mind. The main obstacle for a rate hike is the extremely high crediting of the population with mortgage loans- more than $1 trillion with an annual increase of $2.4 billion.

We look forward to the continued increase of the "Aussie" to 0.7930.