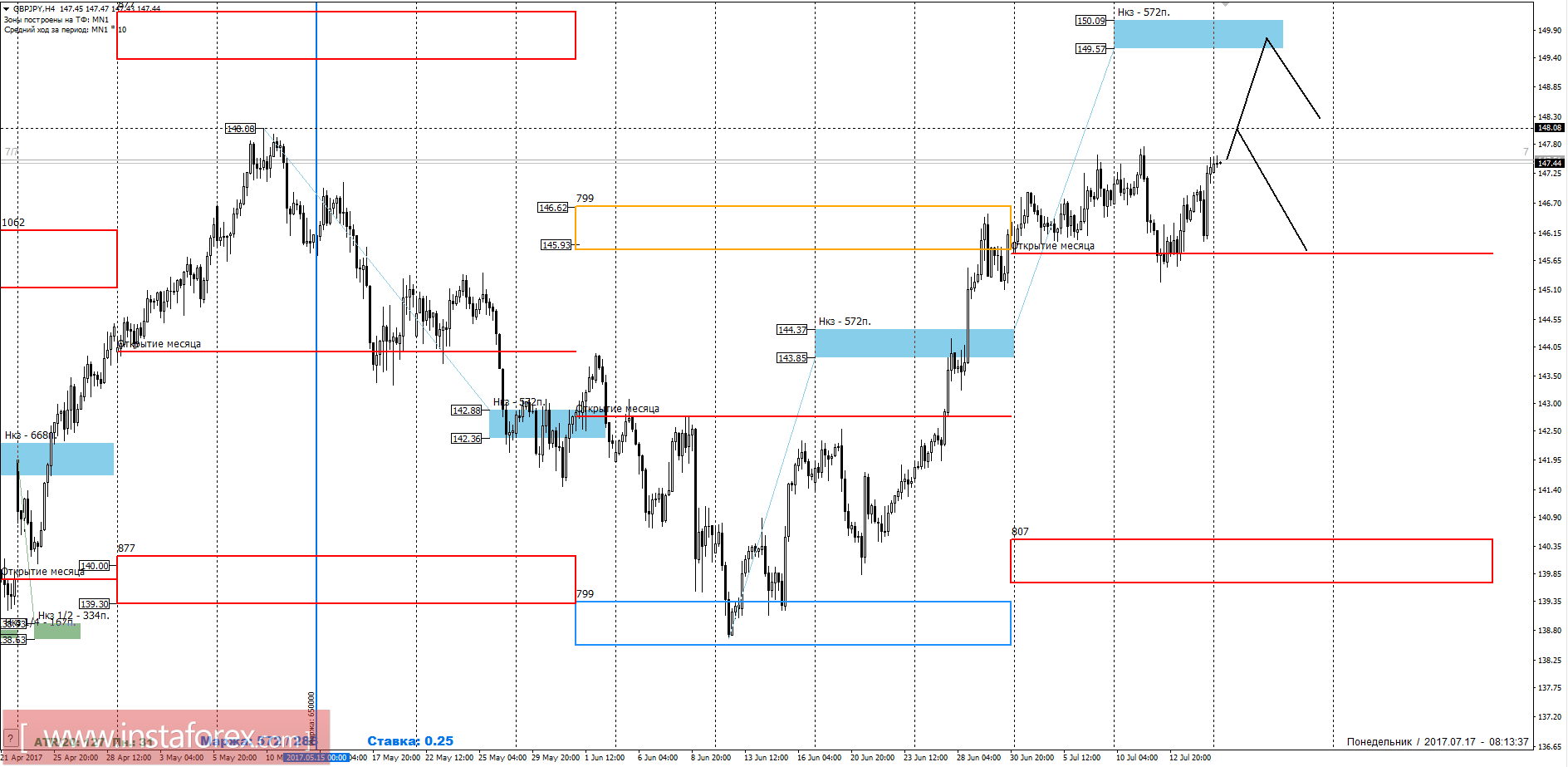

The upward movement remains a priority, as its violation last week did not happen. The main goal of growth is a weekly short-term rating of 150.09-149.57. Achieving this zone will close most of the purchases.

Medium-term plan.

The pair is in the process of forming a bullish medium-term impulse. This allows you to keep purchases opened last month, and look for new favorable prices in the direction of continued growth. In the middle of last week, such prices were received, so the main plan is to keep purchases when updating the monthly maximum. The second goal of growth is a weekly short-term rating of 150.09-149.57. It is important to note that there is an annual maximum at 148.08, so the probability of a large offer is increasing. This obliges to transfer to the breakeven purchase last week.

An alternative model will be the formation of an accumulation zone, in the event that growth stops when the annual maximum is updated. This may allow the pair to return to the opening level of trading this month.

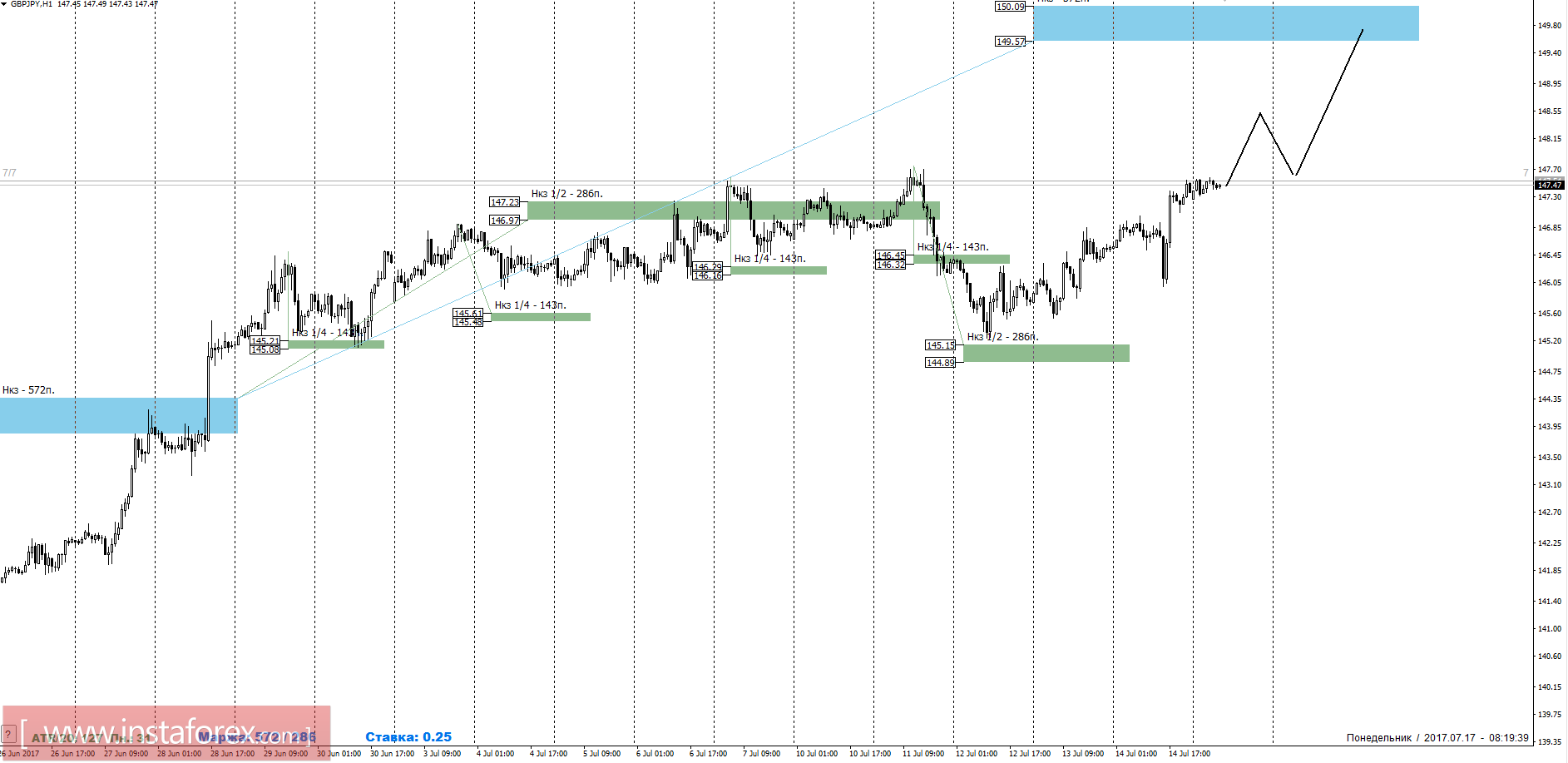

Intraday plan.

Last week, the pair formed a correction model and stayed above the NBK 1/2 145.15-144.89. This allows us to talk about the continuation of growth in both the junior and mid-term segments. The goal of growth is the weekly short-term 150.09-149.57, where the fate of the upward momentum will be determined. For those who trade in lower ranges, it is necessary to take into account the fact that the annual maximum is close. At the test of this level, you can partially fix purchases. In case of formation of the reversal model on the junior timeframe, intraday sales are possible to the nearest control zone.

Daytime fault is the daytime control zone. The zone formed by important data from the future market, which change several times a year.

Weekly fault is the weekly control zone. The zone formed by important future market marks, which change several times a year.

Monthly fault is the monthly control zone. The zone, which is a reflection of the average volatility over the past year.