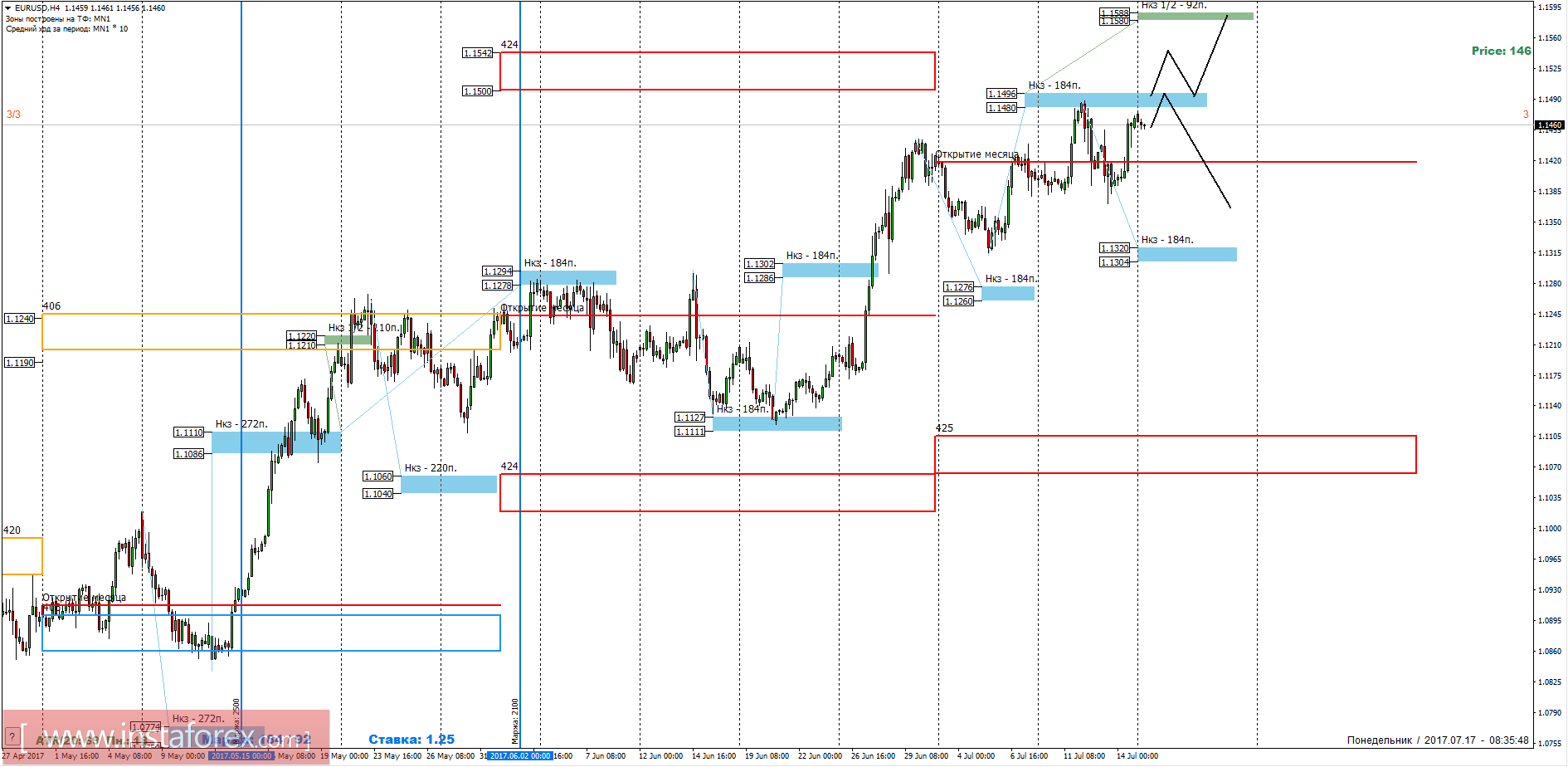

Last week, the pair formed a medium-term accumulation zone. A corrective pattern was formed, after which the pair continued its ascending movement. The main resistance is a weekly fault of 1.1496-1.1480.

Medium-term plan.

Last week, growth was stopped at a weekly short-term target of 1.1496-1.1480, which led to the formation of a correction model and obtaining favorable prices for the purchase. At the beginning of this week, the pair is once again trading near this resistance. This suggests the need for partial fixation of purchases and the transfer of the remaining part to the breakeven. To continue the growth, it will require a breakdown and consolidation above the level of 1.1496 in one of the American sessions. This will keep the purchases further and look for an opportunity to reopen long positions. It is important to note that the pair is approaching the monthly fault of June by 1.1542-1.1500, which can act as a strong medium-term resistance.

An alternative model will develop if the pair can not gain a foothold above the weekly short-term. This will entail the continuation of the formation of the medium-term accumulation zone.

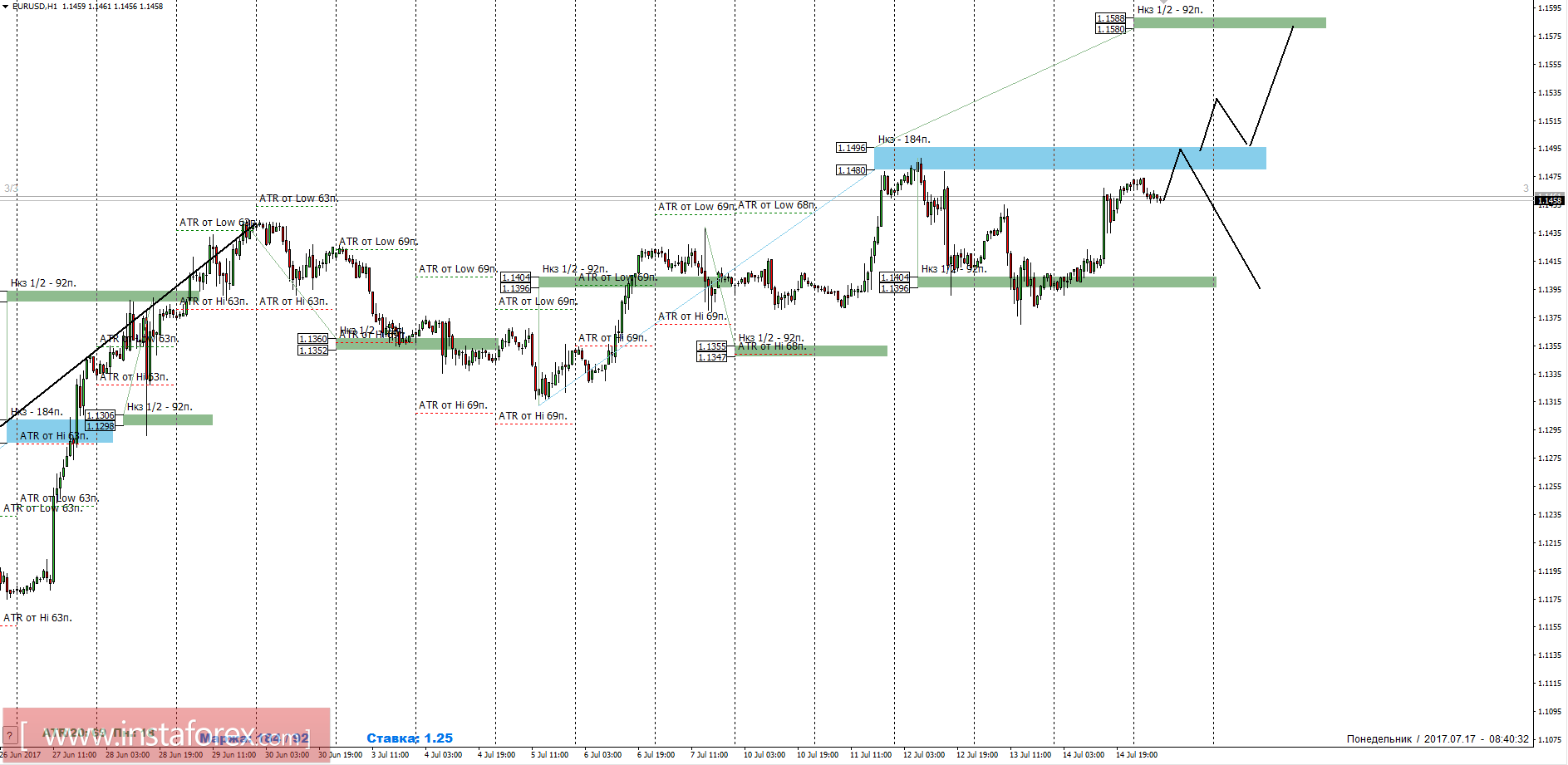

Intraday plan.

Last week, the pair traded between two control zones. The resistance is the weekly short-term fault of 1.1496-1.1480, and the support is NCZ 1/2 1.1404-1.1396. While the pair continues to be between the priority zones, growth remains in the medium term. To disrupt the upstream structure, a breakdown and consolidation below level 1.1396 at one of the American sessions will be required. This will allow talking about the formation of correction of the medium-term order or the reversal pattern.

Daytime fault is the daytime control zone. The zone formed by important data from the future market, which change several times a year.

Weekly fault is the weekly control zone. The zone formed by important future market marks, which change several times a year.

Monthly fault is the monthly control zone. The zone, which is a reflection of the average volatility over the past year.