Oil prices rose again after fears of the weakening global demand. Thus, November's futures for Brent crude advanced by 2.54% to trade at $40.79. October's futures for WTI crude grew by 3.51% to settle at $38.05 per barrel. The spread between these contracts is about $2.7.

Why did oil collapse so sharply? Firstly, the situation with the coronavirus is getting worse in the world. Several countries have re-imposed restrictions to stop the COVID-19 spread. The recovery in jet fuel demand has disappeared immediately. Secondly, the demand for oil in China fell, because the country has huge amounts of cheap oil bought in the spring.

According to the consulting company Oilx.co, oil imports to China in August fell by 382 thousand barrels per day. This was the reason for Saudi Arabia and the UAE to lower the official prices for the Asian market.

Patricia Hemsworth of Paragon Global Markets argues that the slow recovery in demand means an oversupply in the market.

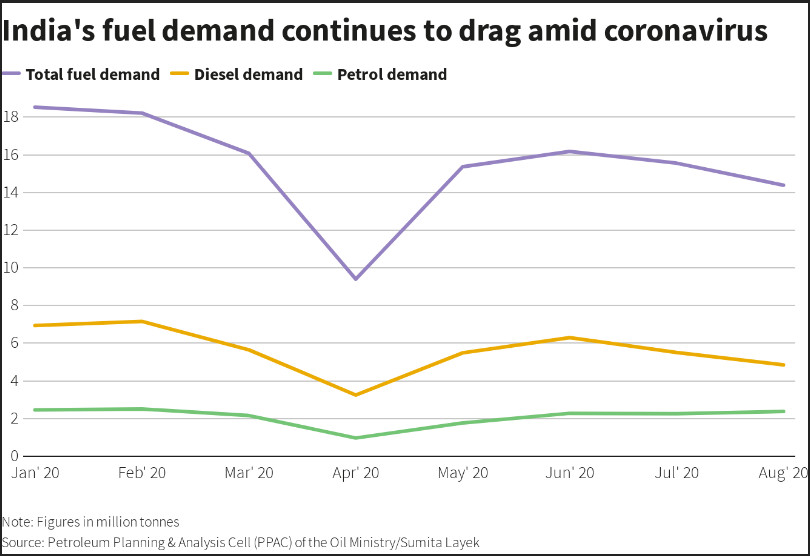

China is not the only major oil importer. In India, oil demand dropped by more than 16% from last year, according to the Ministry of Petroleum. By the way, in India, the situation with COVID-19 is critical. The number of coronavirus cases has exceeded 4.3 million. India ranks second place in the number of people suffering from the coronavirus infection in the world after the United States.

Despite the insignificant growth of quotations, the external background still remains quite alarming. The return to the levels of $43-45 will not happen in the near future. On the contrary, prices are expected to decline even deeper, to $36-37 per barrel.

Diesel consumption crushed by 20.8%. Gasoline demand fell by 7.4%.

Experts said that the more expensive oil is in the future, the greater the incentive to store it. Since the beginning of September, spreads in long-distance contracts have soared. Contango in contracts with the delivery after 6 months increased from $1.7 to $2.4, and in contracts with the delivery after 12 months - from $3 to $4.5 per barrel.

According to API data, the US oil reserves increased by 2.97 million barrels last week. This is well below forecasts. The reserves at the Cushing terminal increased by 2.6 million barrels. At the same time, the gasoline stocks collapsed by as much as 6.9 million barrels whereas distillate stocks rose by 2.3 million barrels. All this far exceeds expectations. Indeed, the statistics are negative.