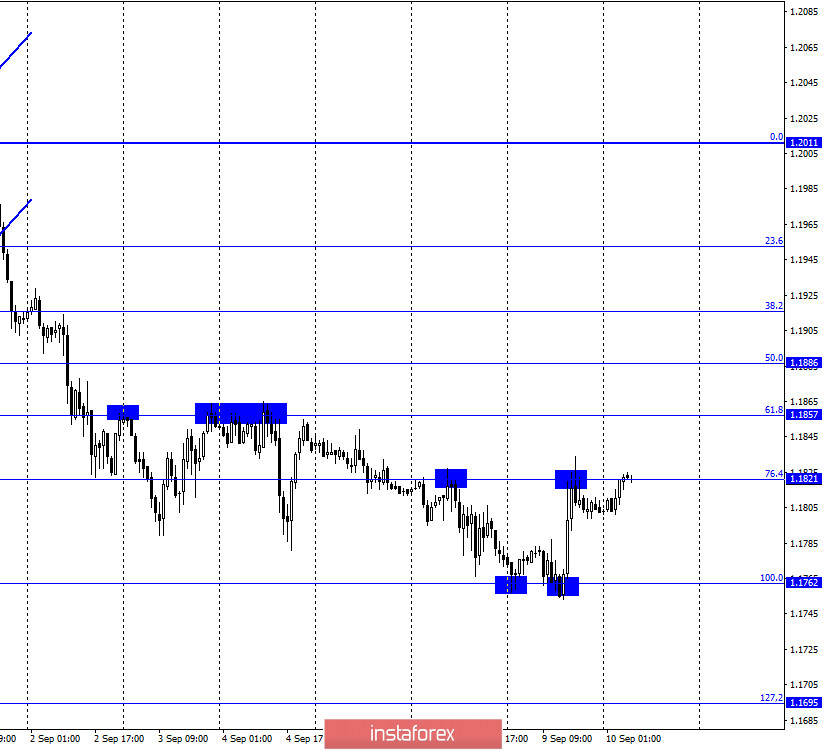

EUR/USD – 1H.

On September 9, the EUR/USD pair performed a new fall to the corrective level of 100.0% (1.1762), rebound from it and increase to the Fibo level of 76.4% (1.1821). Now the rebound from this level will allow traders to expect a reversal in favor of the US dollar and a resumption of the fall in the direction of the corrective level of 100.0%. During the past day, there was no important news from America or the European Union. But today in Europe, the ECB meeting will take place, which traders have been waiting since the beginning of the week. Experts agree that the parameters of monetary policy will remain unchanged. However, the nature of the ECB's accompanying communique, as well as the rhetoric of Christine Lagarde's speech, will be of great importance. Many economists also agree that the European economy will need more stimulus over the next few months. Therefore, today, we will be able to get a look at this problem from the Central Bank of the European Union. Let me also remind you that the main headache of the ECB is now inflation. The consumer price index indicator is important for any Central Bank, however, it is in Europe that inflation has now fallen to -0.2% y/y. This means that prices have decreased compared to the prices of a year ago. And the lack of price growth puts an end to economic growth, in our case, to the recovery of the economy after the pandemic.

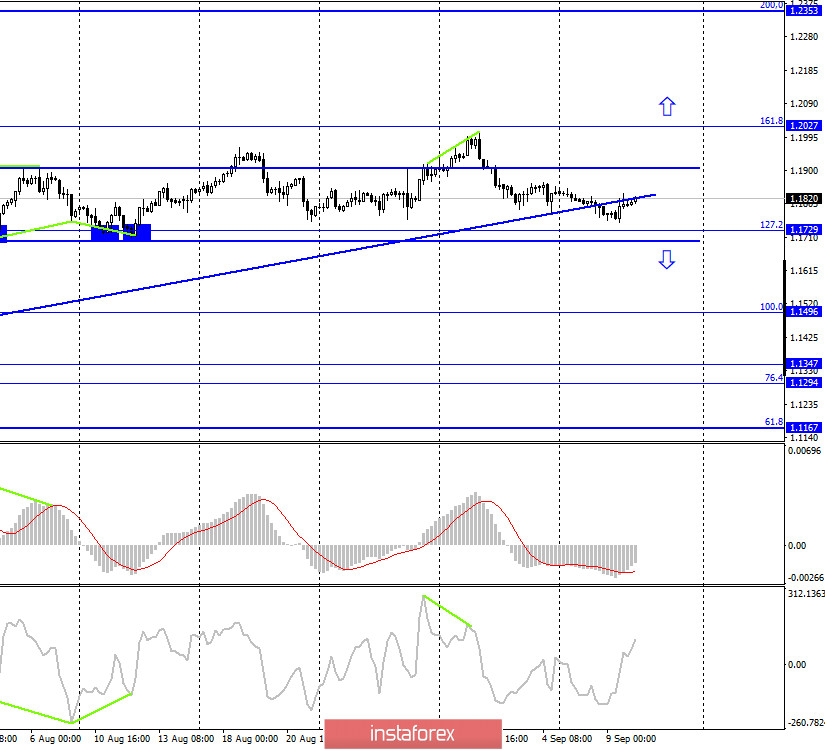

EUR/USD – 4H.

On the 4-hour chart, the quotes of the EUR/USD pair closed under the ascending trend line, which for a long time characterized the current mood of traders as "bullish". However, at this time, the pair's quotes do not continue to fall, however, it is moving along the trend line. Nevertheless, the current graphical picture suggests a drop in quotes to the Fibo level of 127.2% (1.1729). A further drop in prices will be possible only after closing under the side corridor.

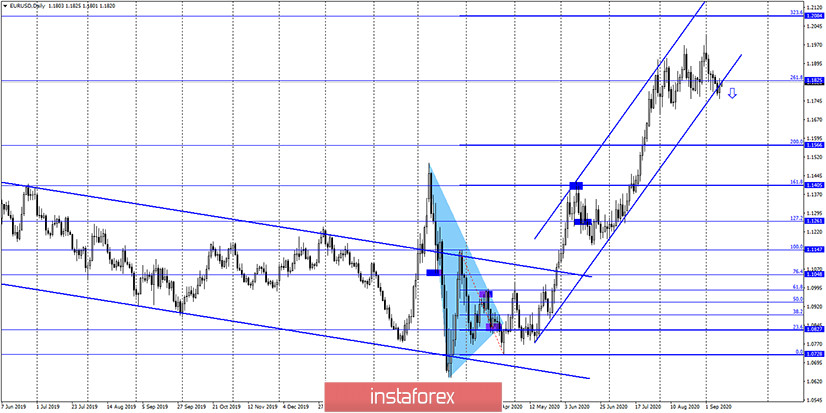

EUR/USD – Daily.

On the daily chart, the quotes of the EUR/USD pair performed another reversal in favor of the US dollar and fell to the lower border of the upward trend corridor, closing under which will allow traders to count on the continuation of the fall in quotes in the direction of the corrective level of 200.0% (1.1566).

EUR/USD – Weekly.

On the weekly chart, the EUR/USD pair has consolidated above the "narrowing triangle", which now allows us to count on further growth of the euro currency, which may be strong, but in the long term.

Overview of fundamentals:

On September 9, there were no economic reports or other economic events in the European Union and America. Thus, there was no information background, which did not prevent traders from trading quite actively this time.

News calendar for the United States and the European Union:

EU - publication of the ECB's decision on the main interest rate (11:45 GMT).

EU - monetary policy report (11:45 GMT).

EU - ECB press conference (12:30 GMT).

EU - ECB President Christine Lagarde will deliver a speech (17:00 GMT).

On September 10, all eyes are on Christine Lagarde's speech and the ECB meeting's summary.

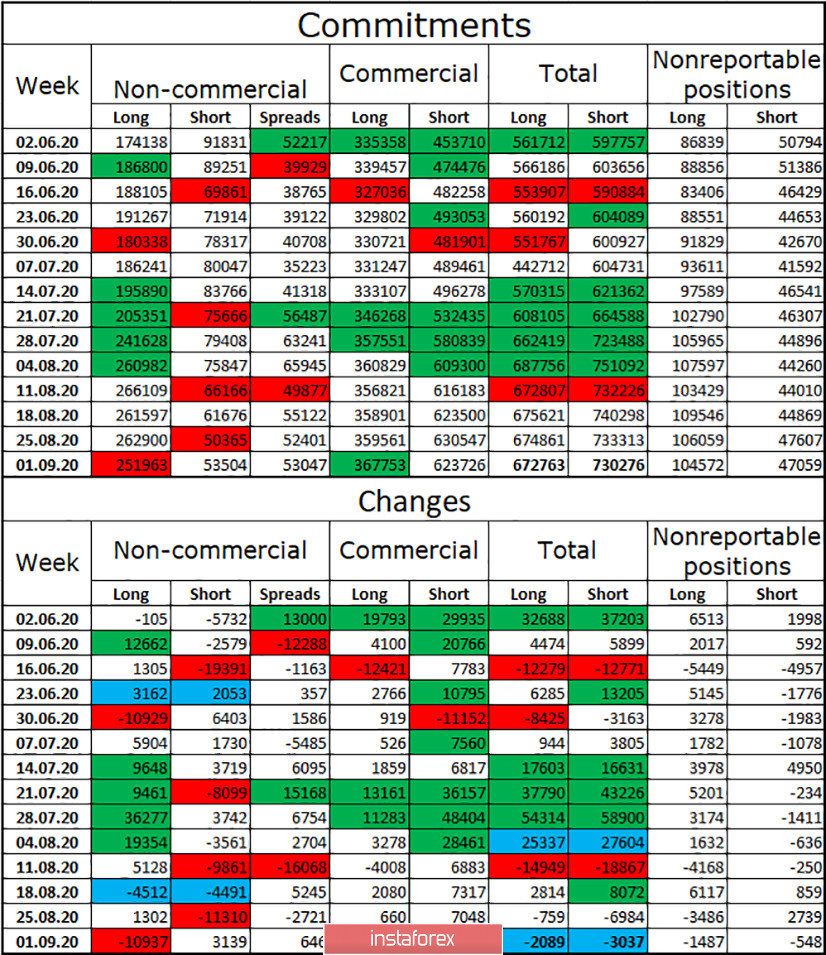

COT (Commitments of Traders) report:

The latest COT report was very interesting and informative. At the end of the reporting week, major traders of the "Non-commercial" group closed 10,937 long contracts and opened 3,139 short contracts. This means that during the reporting week, "bearish" sentiment prevailed among speculators. But does this mean that the general mood of speculators has changed to "bearish" and now the euro currency will be actively sold off? The "Non-commercial" group still has 5 times more long contracts than short. Over the past 10 weeks, speculators have been building up long contracts and getting rid of short ones. Thus, so far, only one COT report suggests that the upward trend in the euro is complete. However, this is a bad "bell" for the euro currency.

Forecast for EUR/USD and recommendations for traders:

Today, I recommend selling the euro with targets of 1.1762 and 1.1703, if the rebound from the level of 76.4% (1.1821) on the hourly chart is completed. I recommend buying the pair if there is a rebound from the lower border of the side corridor on the 4-hour chart of 1.1703 with goals of 1.1762-1.1821.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency, not for speculative profit, but for current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.