GBP/USD – 1H.

According to the hourly chart, the quotes of the GBP/USD pair fell to the corrective level of 127.2% (1.2937), however, a corrective pullback in the direction of the downward trend line followed, which now characterizes the mood of traders as "bearish". By and large, all the fall of the British dollar in the last week was caused by the news on Brexit, on the negotiations with Brussels, on the lack of progress in these negotiations, on the intransigent position of Boris Johnson. Finished off the British information that the British government is going to violate the agreement with the European Union, regarding the border of Northern Ireland. London cannot allow a border to appear between Ireland and Northern Ireland, which were at war for more than 30 years before 1998. This is fraught with an outbreak of separatist sentiments and outright civil unrest. However, without an agreement with the EU, Brexit could not be completed at all. Therefore, it seems that London first concluded an agreement on the border with the EU to continue the Brexit procedure, and now it will try to circumvent these agreements. One way or another, relations between the EU and the UK continue to deteriorate. Brussels may even appeal to the international court of justice, as well as impose sanctions against London for violating the Brexit Treaty.

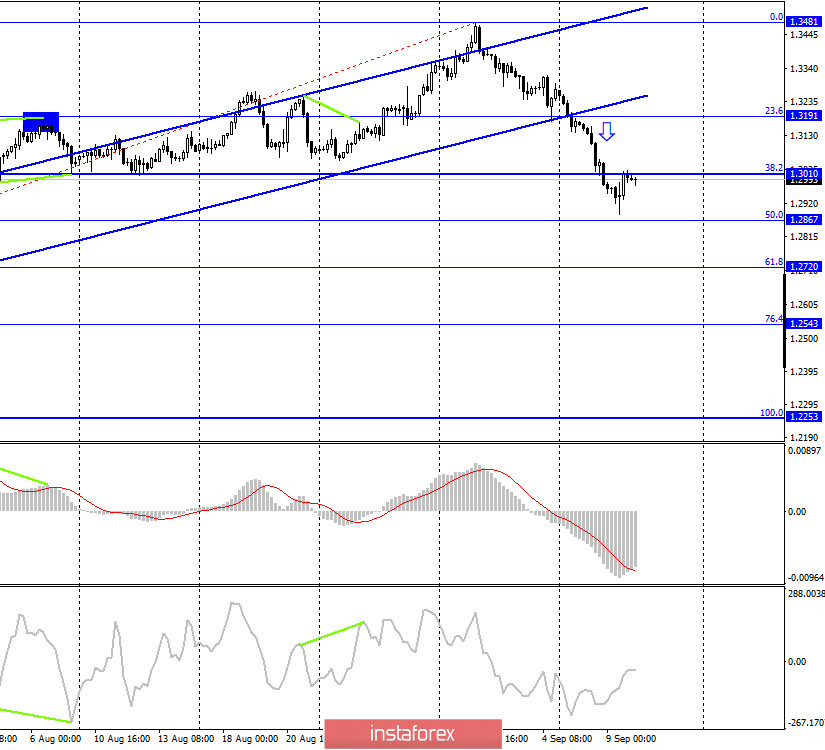

GBP/USD – 4H.

On the 4-hour chart, the GBP/USD pair performed a consolidation under the Fibo level of 38.2% (1.3010), however, it has returned to it. Thus, the rebound of quotes from this level will work in favor of the US dollar and the resumption of the fall in the direction of the corrective level of 50.0% (1.2867). Closing the pair's rate above the level of 38.2% will allow traders to expect continued growth in the direction of the corrective level of 23.6% (1.3191).

GBP/USD – Daily.

On the daily chart, the pair's quotes closed under the corrective level of 100.0% (1.3199), which allows traders to expect a continuation of the fall in the direction of the corrective level of 76.4% (1.2776).

GBP/USD – Weekly.

On the weekly chart, the pound/dollar pair closed above the lower downward trend line, however, it did not reach the upper trend line and may now return to the process of falling in the direction of 1.1600.

Overview of fundamentals:

There were no major economic reports in the UK or the US on Wednesday. However, for the British pound, there are now many more important events than economic reports.

News calendar for the US and UK:

On September 10, the UK and US news calendars again do not contain any interesting reports. However, there may be new information about the negotiations between Britain and the European Union on Brexit, as well as on a new bill that implies a violation of agreements with the EU on the Irish border.

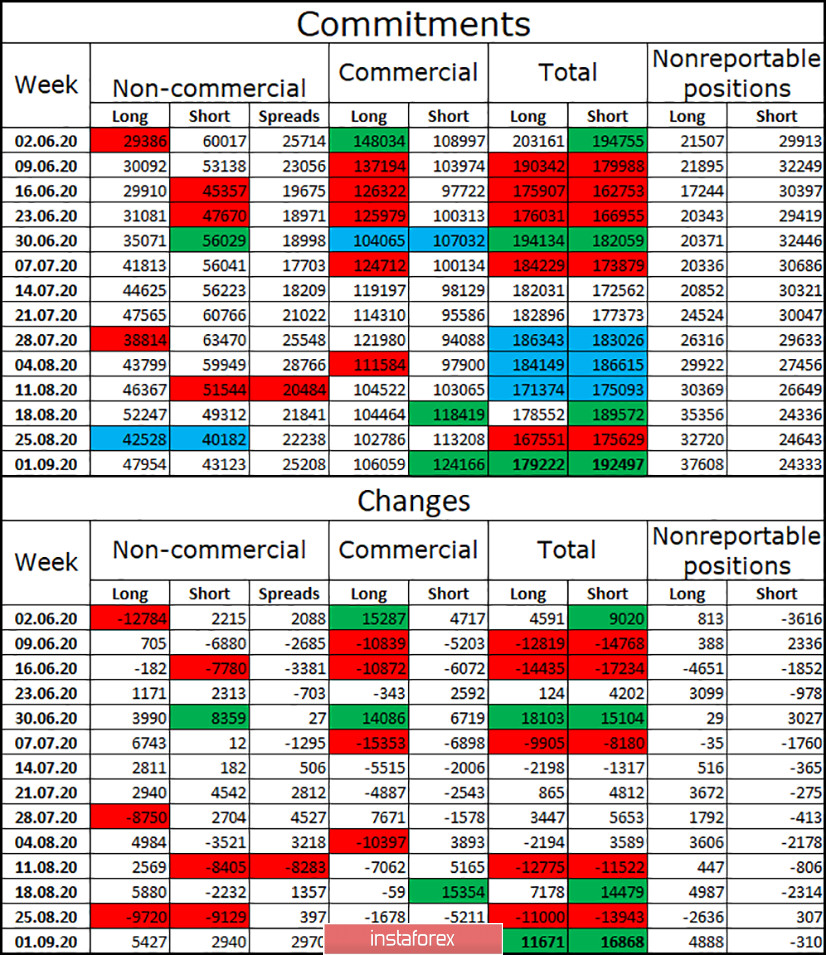

COT (Commitments of Traders) report:

Unlike the COT report on the euro currency, the latest COT report on the British was completely different. Major speculators during the reporting week again increased long-contracts, and also increased short-contracts. Thus, the mood of the "Non-commercial" group as a whole remained "bullish". Over the past 10 weeks, the total number of long contracts focused on the hands of speculators has also increased significantly, while the number of short contracts has decreased. So, according to the latest report, I can't conclude that major traders have already decided to get rid of the pound. However, graphical analysis shows that the British pound has a high chance of continuing to fall. Thus, the next COT report may show a weakening of the bullish mood of major traders. I remind you that COT reports should not be used as signals to open positions since they only show the mood of major traders.

Forecast for GBP/USD and recommendations for traders:

I recommend selling the British currency with targets of 1.2867 and 1.2720 if the rebound from the level of 38.2% (1.3010) on the 4-hour chart is completed. I recommend opening purchases of the British currency if it is fixed above the descending trend line on the hourly chart.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency, not for speculative profit, but current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.