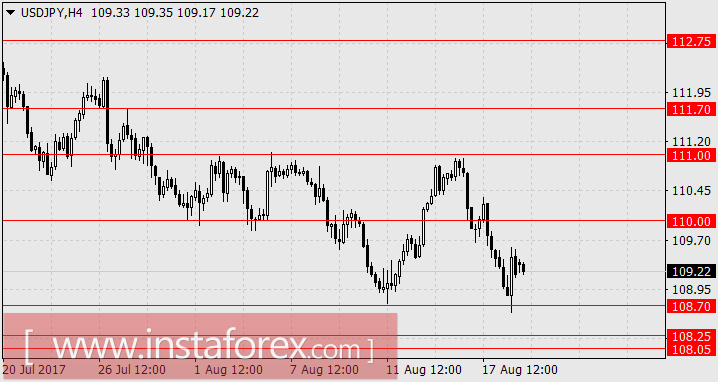

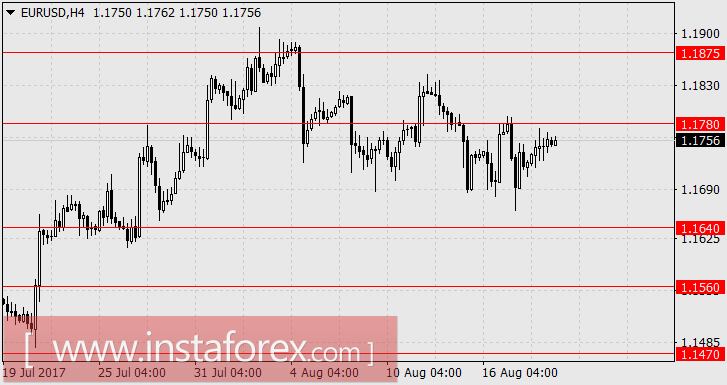

EUR / USD, GBP / USD

Last week's Friday was calm. The euro and the pound sterling traded in the range of the 16th. Despite the macroeconomic indicators that emerged in favor of the dollar, investors did not take any action and instead are waiting for the symposium in Jackson Hole. The first day of it will be on Thursday. The eurozone's balance of payments for June fell from 30.5 billion euros (revised from 30.1 billion) to 21.2 billion euros, with expectation of a smaller decline to 27.3 billion. In the US, the consumer confidence index from the University of Michigan in the preliminary assessment for August increased from 93.4 to 97.6 points. The head of the Federal Reserve Bank of Dallas, Robert Kaplan, suggested that GDP growth in the current year is above 2%. From the team of D. Trump, two more people exited: chief advisor S. Bannon and billionaire C. Icahn. Bannon is considered as a radical (he is the author of anti-immigration decrees of Trump). However, the general confusion surrounded by the president does not benefit the dollar.

Trump will make a statement on Afghanistan tonight. It is expected that the American military presence will be weakened in this country, as it has not yielded a tangible result since 2001. Important economic data will not be published today. Tomorrow, we can see a drop in business sentiment in the euro area for the ZEW assessment and a decline in manufacturing activity in Richmond County. Politics, therefore, comes to the forefront this week and preliminary information indicates a possible weakening of the dollar.

We are looking forward to the growth of the euro to 1.1875, the pound's growth to 1.2950 which is possible if, of course, the White House does not receive any new surprises.

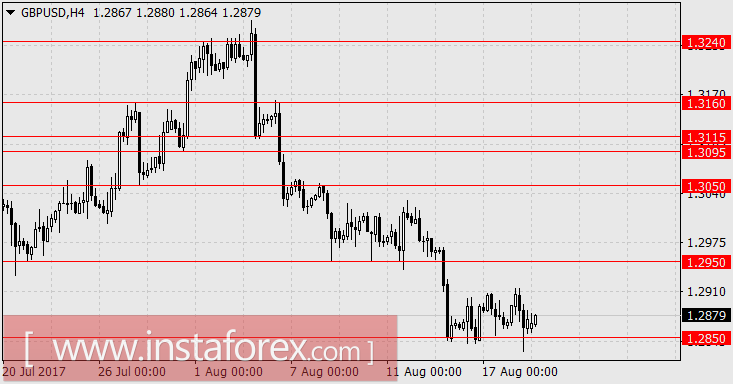

USD / JPY

Unfortunately, the yen never managed to gain a foothold over the 110th figure. The reason for this was the strong drop in the US stock market over the days by an estimated 1.55%. As a consequence, the Nikkei 225 is currently down by 0.35%. Joint military exercises of the United States and South Korea are beginning today which, naturally, does not contribute to market optimism. In Singapore, there was a collision of an American missile destroyer with a merchant ship where 10 people disappeared without a trace.

The index of business confidence in Japan increased from 12 in Q1 to 17 in Q2. The index of activity in all sectors of the economy (All Industries Activity) for July added 0.4% against the decline in June by 0.9% and the growth forecast of 0.5%. The data that will be released on Wednesday is the index of business activity in the manufacturing sector for the month of August which is expected to increase from 52.1 to 52.3.

Thus, the good beginnings for the growth of the yen were knocked down by political factors. In the current situation, it is easier for investors to buy the yen against the dollar under the self-soothing arguments of avoiding risk. We are waiting for the price in the range of 108.05 / 25.